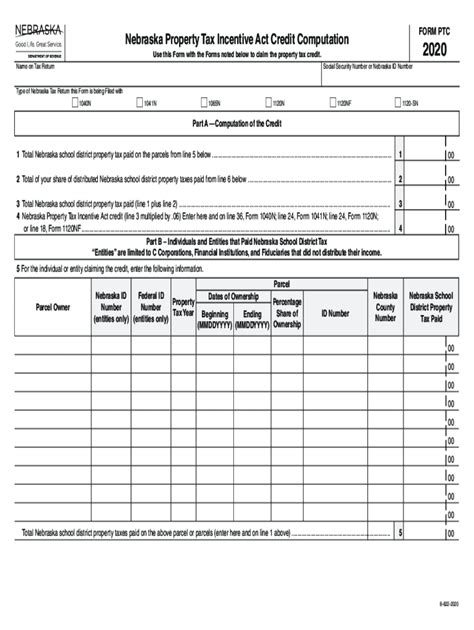

Completing Nebraska Form PTC, also known as the Nebraska Property Tax Incentive Act Application, is a crucial step for businesses and individuals looking to take advantage of the state's tax incentives. The form is designed to help applicants demonstrate their eligibility for the program, which offers refunds of a portion of the state's share of the sales and use taxes paid on qualified property. Here's a comprehensive guide to help you navigate the process and complete the form successfully.

Understanding the Nebraska Property Tax Incentive Act

Before diving into the form completion process, it's essential to understand the purpose and requirements of the Nebraska Property Tax Incentive Act. The program aims to encourage economic growth and job creation in the state by providing tax incentives to qualified businesses and individuals. To be eligible, applicants must meet specific criteria, such as investing in new or expanded facilities, creating new jobs, or making significant capital expenditures.

Method 1: Online Application

The Nebraska Department of Revenue provides an online portal for submitting Form PTC applications. This method is convenient and efficient, allowing applicants to upload required documents and track the status of their application.

- Visit the Nebraska Department of Revenue website and navigate to the Property Tax Incentive Act Application portal.

- Create an account or log in to an existing one to access the application.

- Fill out the online form, providing all required information and uploading supporting documents.

- Review and submit the application.

Method 2: Paper Application

While the online application is recommended, applicants can also submit a paper application. This method requires more time and effort, as applicants must print, complete, and mail the form along with supporting documents.

- Download and print Form PTC from the Nebraska Department of Revenue website.

- Complete the form, providing all required information and attaching supporting documents.

- Mail the application to the Nebraska Department of Revenue, PO Box 94759, Lincoln, NE 68509-4759.

Method 3: Certified Public Accountant (CPA) Assistance

Applicants can hire a certified public accountant (CPA) to assist with the Form PTC application process. A CPA can provide valuable expertise and ensure the application is accurate and complete.

- Find a qualified CPA with experience in Nebraska tax law and the Property Tax Incentive Act.

- Provide the CPA with all necessary information and supporting documents.

- Review and approve the completed application before submission.

Method 4: Tax Consultant Assistance

Tax consultants specializing in Nebraska tax law and the Property Tax Incentive Act can also assist with the Form PTC application process. They can provide guidance and support to ensure a successful application.

- Find a reputable tax consultant with experience in Nebraska tax law and the Property Tax Incentive Act.

- Provide the tax consultant with all necessary information and supporting documents.

- Review and approve the completed application before submission.

Method 5: Nebraska Department of Revenue Assistance

The Nebraska Department of Revenue offers assistance with the Form PTC application process. Applicants can contact the department directly to request guidance and support.

- Call the Nebraska Department of Revenue at (402) 471-5729 or toll-free at (800) 742-7474.

- Email the department at .

- Visit the department's website at for additional resources and information.

Common Mistakes to Avoid

When completing Form PTC, it's essential to avoid common mistakes that can delay or reject the application. Some common mistakes include:

- Incomplete or inaccurate information

- Missing or incomplete supporting documents

- Failure to sign and date the application

- Incorrect or incomplete calculations

Conclusion and Next Steps

Completing Nebraska Form PTC requires careful attention to detail and a thorough understanding of the Property Tax Incentive Act. By following these methods and avoiding common mistakes, applicants can ensure a successful application and take advantage of the state's tax incentives. Once the application is submitted, applicants can track the status of their application online or contact the Nebraska Department of Revenue for assistance.

Encourage Engagement

If you have any questions or need assistance with completing Form PTC, please comment below or share this article with others who may find it helpful. Don't forget to subscribe to our newsletter for more informative articles and updates on Nebraska tax law and the Property Tax Incentive Act.

FAQ Section

What is the purpose of the Nebraska Property Tax Incentive Act?

+The Nebraska Property Tax Incentive Act provides tax incentives to qualified businesses and individuals who invest in new or expanded facilities, create new jobs, or make significant capital expenditures.

Who is eligible to apply for the Nebraska Property Tax Incentive Act?

+Qualified businesses and individuals who meet specific criteria, such as investing in new or expanded facilities, creating new jobs, or making significant capital expenditures, are eligible to apply.

How do I submit Form PTC?

+Form PTC can be submitted online through the Nebraska Department of Revenue website, by mail, or with the assistance of a certified public accountant or tax consultant.