North Carolina is a popular destination for individuals and businesses alike, with its thriving cities, beautiful mountains, and scenic coastline. However, navigating the state's tax laws can be a daunting task, especially when it comes to tax withholding. The NC state tax withholding form is a crucial document that helps employers and employees comply with the state's tax regulations. In this article, we will break down the NC state tax withholding form and provide a step-by-step guide on how to complete it.

Understanding NC State Tax Withholding

Before we dive into the NC state tax withholding form, it's essential to understand the basics of tax withholding in North Carolina. Tax withholding is the process by which employers deduct a portion of their employees' wages and pay them to the state as taxes. The amount of taxes withheld depends on the employee's income, filing status, and number of allowances claimed.

Why is Tax Withholding Important?

Tax withholding is crucial for several reasons:

- It helps employees avoid a large tax bill when filing their tax returns

- It ensures that employers comply with state tax regulations

- It enables the state to collect taxes throughout the year, rather than in one lump sum

The NC State Tax Withholding Form

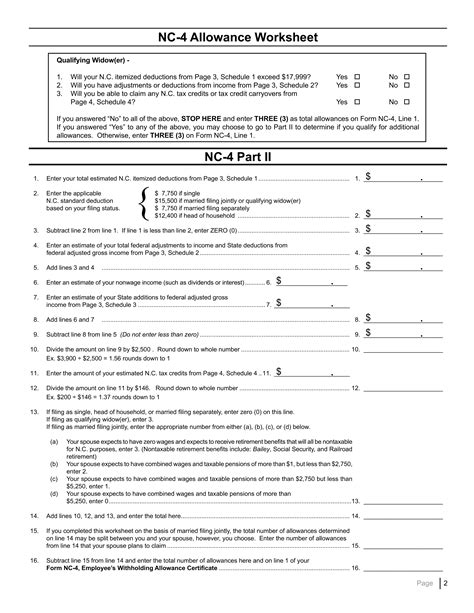

The NC state tax withholding form is also known as the NC-4 form. It's a simple, one-page document that employees complete to inform their employers of their tax withholding preferences. The form requires employees to provide basic personal and tax-related information.

Who Needs to Complete the NC-4 Form?

The following individuals need to complete the NC-4 form:

- New employees in North Carolina

- Existing employees who want to change their tax withholding status

- Employees who claim more than 10 allowances

Step-by-Step Guide to Completing the NC-4 Form

Completing the NC-4 form is a straightforward process. Here's a step-by-step guide to help you:

- Employee Information: Provide your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Filing Status: Choose your filing status from the following options:

- Single

- Married

- Head of Household

- Qualifying Widow(er)

- Number of Allowances: Claim the number of allowances you're eligible for. You can claim one allowance for yourself, your spouse, and each dependent.

- Additional Withholding: If you want to withhold additional taxes, specify the amount you want to withhold per pay period.

- Signature: Sign and date the form.

Tips and Reminders

Here are some tips and reminders to keep in mind:

- Review your tax withholding regularly to ensure you're not over- or under-withholding taxes.

- If you're married, you may want to consider filing a joint tax return to minimize taxes.

- If you have dependents, you may be eligible for additional tax credits and deductions.

Common Mistakes to Avoid

Here are some common mistakes to avoid when completing the NC-4 form:

- Failing to sign and date the form

- Claiming too many allowances

- Not accounting for additional income or deductions

Conclusion and Next Steps

Completing the NC state tax withholding form is a straightforward process that helps employees and employers comply with state tax regulations. By following the step-by-step guide outlined in this article, you can ensure that your tax withholding is accurate and efficient. Remember to review your tax withholding regularly and adjust as needed to avoid any tax-related issues.

What is the purpose of the NC-4 form?

+The NC-4 form is used to inform employers of an employee's tax withholding preferences.

Who needs to complete the NC-4 form?

+New employees in North Carolina, existing employees who want to change their tax withholding status, and employees who claim more than 10 allowances need to complete the NC-4 form.

How often should I review my tax withholding?

+You should review your tax withholding regularly, ideally every 6-12 months, to ensure you're not over- or under-withholding taxes.

We hope this article has provided you with a comprehensive guide to the NC state tax withholding form. If you have any further questions or concerns, please don't hesitate to comment below.