Navigating the complexities of tax laws and regulations can be overwhelming, especially for businesses and individuals dealing with withholding tax exemptions. The NC Form E-500 is a crucial document for those seeking to claim exemption from withholding taxes in North Carolina. In this article, we will delve into the world of withholding tax exemptions, explaining the importance of the NC Form E-500, its benefits, and the steps to complete it accurately.

Understanding Withholding Tax Exemptions

Withholding taxes are amounts deducted from an employee's wages or other income and paid to the government on their behalf. These taxes are typically withheld by employers and are used to fund various public goods and services. However, certain individuals and businesses may be eligible for withholding tax exemptions, which can help reduce their tax burden.

Benefits of Withholding Tax Exemptions

Withholding tax exemptions can provide significant benefits to eligible individuals and businesses. Some of the most notable advantages include:

- Reduced tax liability: By claiming exemptions, individuals and businesses can reduce the amount of taxes withheld from their income, resulting in a lower tax liability.

- Increased cash flow: Withholding tax exemptions can help businesses and individuals retain more of their income, which can be used to fund operations, invest in growth, or cover expenses.

- Simplified tax compliance: Exemptions can simplify tax compliance by reducing the complexity of tax returns and minimizing the risk of errors or penalties.

NC Form E-500: A Guide to Withholding Tax Exemption

The NC Form E-500 is a critical document for individuals and businesses seeking to claim withholding tax exemptions in North Carolina. The form is used to certify exemption from withholding taxes and must be completed accurately to avoid delays or penalties.

Eligibility Criteria for NC Form E-500

To be eligible for withholding tax exemptions using the NC Form E-500, individuals and businesses must meet specific criteria. These include:

- Being a resident of North Carolina or having a business located in the state

- Having a valid Social Security number or Employer Identification Number (EIN)

- Meeting specific income or revenue thresholds

- Filing required tax returns and reports

Completing the NC Form E-500

Completing the NC Form E-500 requires careful attention to detail and accuracy. The form consists of several sections, including:

- Section 1: Exemption Certification

- Section 2: Business Information

- Section 3: Income and Revenue Information

- Section 4: Signature and Date

Step-by-Step Guide to Completing the NC Form E-500

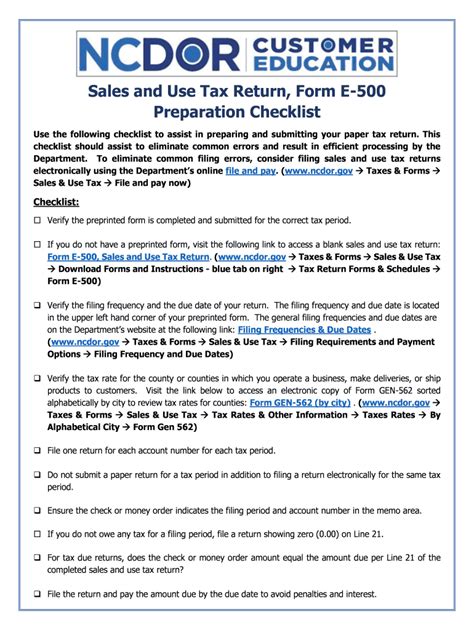

To complete the NC Form E-500 accurately, follow these steps:

- Gather required information and documentation, including Social Security numbers, EINs, and income statements.

- Complete Section 1: Exemption Certification, indicating the type of exemption being claimed.

- Provide business information in Section 2, including business name, address, and EIN.

- Report income and revenue information in Section 3, including total income and withholding taxes.

- Sign and date the form in Section 4, certifying the accuracy of the information provided.

Common Mistakes to Avoid When Completing the NC Form E-500

Common mistakes to avoid when completing the NC Form E-500 include:

- Inaccurate or incomplete information

- Failure to sign and date the form

- Not providing required documentation or attachments

- Submitting the form late or after the deadline

FAQs About the NC Form E-500

Who is eligible to claim withholding tax exemptions using the NC Form E-500?

+Individuals and businesses that meet specific eligibility criteria, including residency, income, and revenue thresholds, may claim withholding tax exemptions using the NC Form E-500.

What is the deadline for submitting the NC Form E-500?

+The deadline for submitting the NC Form E-500 varies depending on the specific exemption being claimed and the taxpayer's filing status. It is essential to check the North Carolina Department of Revenue's website for specific deadlines and requirements.

Can I file the NC Form E-500 electronically?

+Yes, the North Carolina Department of Revenue offers electronic filing options for the NC Form E-500. Taxpayers can submit the form through the department's website or use approved tax software.

By understanding the importance of withholding tax exemptions and following the steps outlined in this guide, individuals and businesses can accurately complete the NC Form E-500 and claim the exemptions they are eligible for. Remember to avoid common mistakes, and don't hesitate to reach out to the North Carolina Department of Revenue or a tax professional for assistance.