Filling out forms can be a daunting task, especially when it comes to official documents like the NC 5 form. This form is used by the North Carolina Department of Revenue to report income tax withholding and is typically submitted by employers. However, for individuals who need to file this form, it's essential to understand the correct way to fill it out to avoid any errors or penalties.

In this article, we will guide you through the process of filling out the NC 5 form correctly. We'll break down the sections, explain the required information, and provide tips to ensure you get it right the first time.

Understanding the NC 5 Form

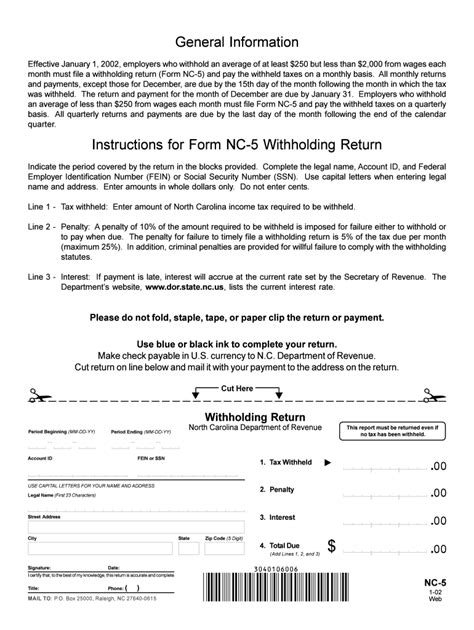

Before we dive into the instructions, let's quickly review what the NC 5 form is and why it's necessary. The NC 5 form is used to report North Carolina income tax withholding, which includes salaries, wages, tips, and other compensation. Employers are required to file this form quarterly, but individuals may also need to file it in certain situations.

Section 1: Employer Information

The first section of the NC 5 form requires employer information. You'll need to provide the following details:

- Employer name and address

- Federal Employer Identification Number (FEIN)

- North Carolina withholding identification number

- Business type (e.g., corporation, partnership, sole proprietorship)

Make sure to double-check your information for accuracy, as incorrect data can lead to processing delays or even penalties.

Section 2: Tax Withholding Information

Tax Withholding Information

In this section, you'll report the total amount of North Carolina income tax withheld from employee wages during the quarter. You'll need to provide the following information:

- Total wages paid

- Total North Carolina income tax withheld

- Total withholding tax reported on Form NC-5A (if applicable)

Be sure to calculate the total withholding tax correctly, as this will affect the amount of tax due or the refund amount.

Section 3: Payment Information

Payment Information

If you're required to make a payment with your NC 5 form, you'll need to provide payment information in this section. You can choose to pay by check or electronic funds transfer (EFT). Make sure to follow the instructions carefully to avoid any payment errors.

Section 4: Certification

Certification

The final section of the NC 5 form requires certification from the employer or authorized representative. You'll need to sign and date the form, acknowledging that the information provided is accurate and complete.

Tips for Filling Out the NC 5 Form Correctly

To ensure you fill out the NC 5 form correctly, follow these tips:

- Use black ink and print clearly

- Make sure to sign and date the form

- Double-check your calculations for accuracy

- Use the correct withholding tax rates and tables

- File the form on time to avoid penalties and interest

Common Mistakes to Avoid

When filling out the NC 5 form, be sure to avoid these common mistakes:

- Incorrect employer information

- Inaccurate tax withholding calculations

- Failure to sign and date the form

- Late filing or payment

- Incorrect payment method or amount

By following the instructions and tips outlined in this article, you'll be able to fill out the NC 5 form correctly and avoid any potential errors or penalties. Remember to take your time, double-check your information, and seek help if you need it.

Still Have Questions?

If you're still unsure about filling out the NC 5 form or have questions about the process, don't hesitate to reach out to the North Carolina Department of Revenue or a tax professional for assistance.

We hope this article has helped you understand how to fill out the NC 5 form correctly. If you have any further questions or concerns, please don't hesitate to ask.

What is the deadline for filing the NC 5 form?

+The deadline for filing the NC 5 form is typically the last day of the month following the end of the quarter. For example, the deadline for the first quarter (January 1 - March 31) is April 30th.

Can I file the NC 5 form electronically?

+What happens if I file the NC 5 form late?

+If you file the NC 5 form late, you may be subject to penalties and interest. The North Carolina Department of Revenue may also send you a notice requesting additional information or payment.