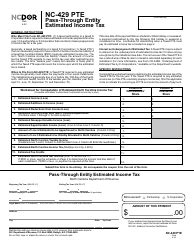

The NC-429 PTE Fillable Form is a crucial document for individuals who need to report their pass-through entity (PTE) information to the North Carolina Department of Revenue. In this article, we will provide a comprehensive, step-by-step guide on how to complete the NC-429 PTE Fillable Form.

Understanding the Importance of Accurate Reporting

As a pass-through entity, it is essential to accurately report your information to the North Carolina Department of Revenue. Failure to do so may result in penalties, fines, or even loss of tax benefits. The NC-429 PTE Fillable Form is designed to help you report your PTE information correctly and efficiently.

Who Needs to File the NC-429 PTE Fillable Form?

The NC-429 PTE Fillable Form is required for pass-through entities that have North Carolina source income and are required to file a federal income tax return. This includes:

- Partnerships (Form 1065)

- S corporations (Form 1120S)

- Limited liability companies (LLCs) that are treated as partnerships or S corporations for federal tax purposes

Gathering Necessary Information

Before starting to fill out the NC-429 PTE Fillable Form, make sure you have the following information readily available:

- Federal Employer Identification Number (FEIN)

- Business name and address

- Type of pass-through entity (partnership, S corporation, LLC)

- North Carolina source income

- Apportionment factor (if applicable)

Step-by-Step Guide to Completing the NC-429 PTE Fillable Form

Section 1: Entity Information

- Enter your FEIN, business name, and address in the designated fields.

- Select the type of pass-through entity from the drop-down menu.

- Check the box if you are a publicly traded partnership (PTP).

Section 2: North Carolina Source Income

- Enter your total North Carolina source income from all sources.

- If you have multiple sources of income, use the additional sheets provided to report each source separately.

Section 3: Apportionment Factor (If Applicable)

- If you have apportionable income, calculate your apportionment factor using the provided formula.

- Enter the resulting apportionment factor in the designated field.

Section 4: Tax Credits and Incentives

- List any tax credits or incentives you are claiming.

- Provide the credit or incentive amount and the corresponding code.

Section 5: Signatures and Verification

- Sign and date the form in the designated fields.

- Verify that the information provided is accurate and complete.

Tips and Reminders

- Make sure to keep a copy of the completed form for your records.

- If you are filing electronically, ensure that you have the required software and follow the instructions provided.

- If you need help or have questions, contact the North Carolina Department of Revenue or consult a tax professional.

Common Mistakes to Avoid

- Inaccurate or incomplete information

- Failure to sign and date the form

- Not keeping a copy of the completed form for your records

- Not filing electronically or by mail on time

Conclusion

Filing the NC-429 PTE Fillable Form accurately and on time is crucial for pass-through entities with North Carolina source income. By following this step-by-step guide, you can ensure that you are in compliance with the North Carolina Department of Revenue's requirements. Remember to keep a copy of the completed form for your records and seek help if you need it.

What is the deadline for filing the NC-429 PTE Fillable Form?

+The deadline for filing the NC-429 PTE Fillable Form is typically April 15th of each year. However, if you need an extension, you can file Form NC-429EXT.

Can I file the NC-429 PTE Fillable Form electronically?

+What happens if I make a mistake on the NC-429 PTE Fillable Form?

+If you make a mistake on the NC-429 PTE Fillable Form, you may be subject to penalties and fines. It is essential to double-check your information before submitting the form.