The world of taxes can be a complex and intimidating place, especially for those who are self-employed or have other sources of income that aren't subject to traditional payroll withholding. One of the most important tax forms for these individuals is the NC 40 Estimated Tax Form. In this article, we'll take a closer look at what the NC 40 is, why it's necessary, and provide a step-by-step guide on how to file it.

The NC 40 Estimated Tax Form is a quarterly tax payment form used by the North Carolina Department of Revenue to collect estimated tax payments from individuals who expect to owe more than $500 in taxes for the year. This includes self-employed individuals, freelancers, and those with income from sources such as investments, rental properties, or royalties. The form is used to make quarterly payments towards your annual tax liability, helping to avoid penalties and interest on unpaid taxes.

Using the NC 40 Estimated Tax Form can seem daunting, but it's a relatively straightforward process. By following these five steps, you'll be able to accurately complete and file your form.

Step 1: Determine Your Estimated Tax Liability

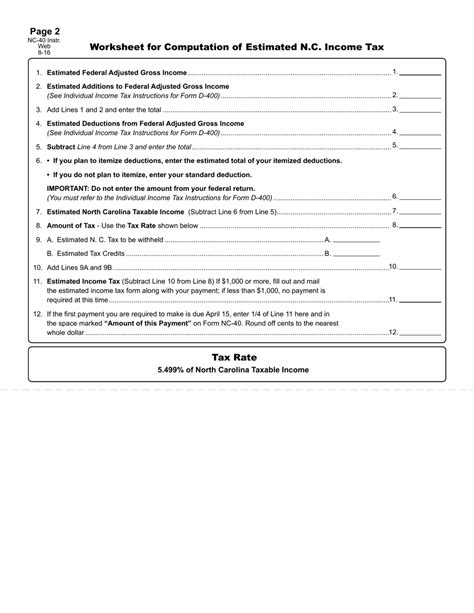

Before you can file your NC 40, you need to determine your estimated tax liability for the year. This involves calculating your total tax liability based on your income, deductions, and credits. You can use Form NC-40, Line 1, to estimate your tax liability. You'll need to consider your income from all sources, including self-employment income, interest, dividends, and capital gains.

Step 2: Choose Your Payment Option

You have several options for making your estimated tax payments, including:

- Electronic Funds Withdrawal (EFW): You can make a payment online or by phone using the Electronic Federal Tax Payment System (EFTPS).

- Check or Money Order: You can mail a check or money order with your payment voucher (Form NC-40V).

- Credit or Debit Card: You can make a payment online or by phone using a credit or debit card.

Choose the option that works best for you and make sure to keep a record of your payment.

Step 3: Complete Form NC-40

Once you've determined your estimated tax liability and chosen your payment option, you can complete Form NC-40. You'll need to provide your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN). You'll also need to report your estimated tax liability and calculate your payment.

Step 4: File Your Form

After you've completed Form NC-40, you'll need to file it with the North Carolina Department of Revenue. You can file online or by mail. If you're filing online, you'll need to create an account with the North Carolina Department of Revenue. If you're filing by mail, make sure to send your form to the correct address.

Step 5: Keep Records

Finally, make sure to keep records of your estimated tax payments. You'll need to report these payments on your annual tax return (Form D-400). You'll also need to keep a record of your payment vouchers (Form NC-40V) in case you need to prove you made a payment.

Benefits of Filing NC 40 Estimated Tax Form

Filing your NC 40 Estimated Tax Form on time can provide several benefits, including:

- Avoiding Penalties: By making estimated tax payments, you can avoid penalties and interest on unpaid taxes.

- Reducing Tax Liability: By making payments throughout the year, you can reduce your tax liability and avoid a large tax bill at the end of the year.

- Simplifying Tax Time: By keeping track of your estimated tax payments, you can simplify your tax preparation and avoid last-minute scrambling.

Common Mistakes to Avoid

When filing your NC 40 Estimated Tax Form, there are several common mistakes to avoid, including:

- Missing Deadlines: Make sure to file your form on time to avoid penalties and interest.

- Underreporting Income: Make sure to report all of your income, including self-employment income, interest, dividends, and capital gains.

- Not Keeping Records: Make sure to keep records of your estimated tax payments in case you need to prove you made a payment.

By following these steps and avoiding common mistakes, you can ensure that you're in compliance with North Carolina tax laws and avoid any potential penalties.

NC 40 Estimated Tax Form Due Dates

The due dates for the NC 40 Estimated Tax Form are as follows:

- April 15th: First quarter payment due

- June 15th: Second quarter payment due

- September 15th: Third quarter payment due

- January 15th: Fourth quarter payment due

Make sure to mark these dates on your calendar to ensure you don't miss a payment.

In conclusion, filing your NC 40 Estimated Tax Form is an important part of managing your tax liability. By following these five steps and avoiding common mistakes, you can ensure that you're in compliance with North Carolina tax laws and avoid any potential penalties. Don't wait until the last minute – take control of your taxes today.

What is the NC 40 Estimated Tax Form?

+The NC 40 Estimated Tax Form is a quarterly tax payment form used by the North Carolina Department of Revenue to collect estimated tax payments from individuals who expect to owe more than $500 in taxes for the year.

Who needs to file the NC 40 Estimated Tax Form?

+The NC 40 Estimated Tax Form is required for individuals who expect to owe more than $500 in taxes for the year, including self-employed individuals, freelancers, and those with income from sources such as investments, rental properties, or royalties.

What are the due dates for the NC 40 Estimated Tax Form?

+The due dates for the NC 40 Estimated Tax Form are April 15th, June 15th, September 15th, and January 15th.