The NC-4 form is a crucial document for employees in North Carolina, serving as a means to report their state income tax withholding. For those seeking to manage their tax obligations effectively, accessing and filling out this form accurately is essential. In this article, we will delve into the details of the NC-4 form, its significance, and provide a step-by-step guide on how to download and print a template.

Understanding the Importance of NC-4 Form

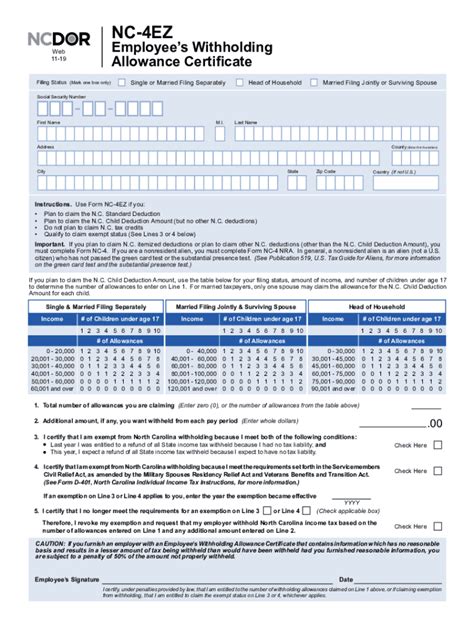

The NC-4 form, also known as the "Employee's Withholding Allowance Certificate," is used by employees to claim their state income tax withholding allowances. This form is crucial for ensuring that the correct amount of state income tax is withheld from an employee's wages. By accurately completing the NC-4 form, employees can avoid overpaying or underpaying their state income taxes.

Benefits of Using the NC-4 Form

The NC-4 form offers several benefits to employees, including:

- Accurate Tax Withholding: By completing the NC-4 form, employees can ensure that the correct amount of state income tax is withheld from their wages.

- Avoid Overpayment: Employees can avoid overpaying their state income taxes by claiming the correct number of allowances.

- Convenience: The NC-4 form is a straightforward document that can be easily completed and submitted to employers.

Step-by-Step Guide to Download and Print NC-4 Form Template

Downloading and printing an NC-4 form template is a straightforward process. Here's a step-by-step guide:

- Visit the North Carolina Department of Revenue Website: The official website of the North Carolina Department of Revenue provides access to various tax forms, including the NC-4 form.

- Search for NC-4 Form: Use the search function on the website to find the NC-4 form. You can also browse through the tax forms section to locate the document.

- Download the Form: Once you've located the NC-4 form, click on the download link to save the document to your computer.

- Print the Form: After downloading the form, print it on standard 8.5 x 11-inch paper.

Filling Out the NC-4 Form

Filling out the NC-4 form requires careful attention to detail. Here are some tips to help you complete the form accurately:

- Read the Instructions: Before filling out the form, read the instructions carefully to understand what information is required.

- Provide Accurate Information: Ensure that you provide accurate information, including your name, address, and Social Security number.

- Claim Allowances: Claim the correct number of allowances based on your filing status and number of dependents.

Common Mistakes to Avoid

When filling out the NC-4 form, there are several common mistakes to avoid:

- Incorrect Social Security Number: Ensure that you provide your correct Social Security number to avoid delays in processing your form.

- Inaccurate Allowances: Claiming incorrect allowances can result in overpayment or underpayment of state income taxes.

- Incomplete Form: Ensure that you complete all sections of the form to avoid delays in processing.

Conclusion

The NC-4 form is a vital document for employees in North Carolina, serving as a means to report their state income tax withholding. By understanding the importance of the form, downloading and printing a template, and filling it out accurately, employees can ensure that their state income taxes are withheld correctly. Remember to avoid common mistakes and provide accurate information to avoid delays in processing your form.

Additional Resources

For more information on the NC-4 form and state income tax withholding, visit the North Carolina Department of Revenue website. You can also consult with a tax professional or financial advisor to ensure that you're meeting your tax obligations effectively.

FAQs

What is the purpose of the NC-4 form?

+The NC-4 form is used by employees to claim their state income tax withholding allowances.

How do I download and print the NC-4 form template?

+Visit the North Carolina Department of Revenue website, search for the NC-4 form, download it, and print it on standard 8.5 x 11-inch paper.

What are the common mistakes to avoid when filling out the NC-4 form?

+Avoid incorrect Social Security number, inaccurate allowances, and incomplete form to avoid delays in processing.