The NC-4 form is a crucial document for businesses and individuals in North Carolina, serving as a vital tool for reporting and paying state income tax withholding. With the advent of digital technology, accessing and completing this form has become increasingly convenient. In this article, we will delve into the world of NC-4 forms, exploring the benefits of fillable online versions, the process of downloading and printing, and the importance of accurate completion.

Understanding the NC-4 Form

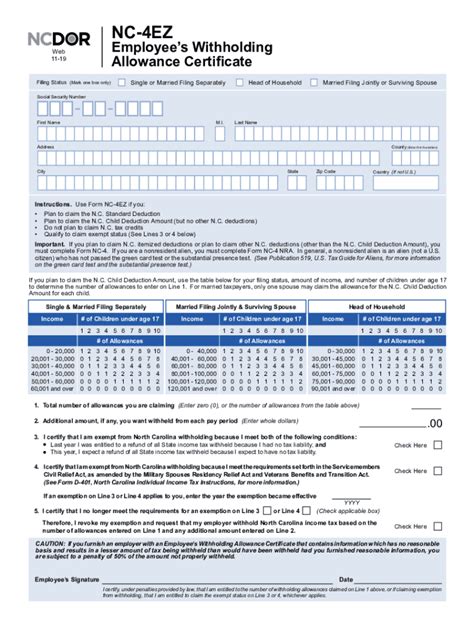

The NC-4 form, also known as the Employee's Withholding Certificate, is a mandatory document for all North Carolina employers. Its primary purpose is to determine the correct amount of state income tax to withhold from an employee's wages. The form requires employees to provide their withholding status, number of allowances, and any additional withholding amounts.

Benefits of Fillable Online NC-4 Forms

In today's digital age, accessing and completing forms online has become the norm. Fillable online NC-4 forms offer numerous benefits, including:

- Convenience: Employees can easily access and complete the form from anywhere, at any time, as long as they have a stable internet connection.

- Accuracy: Fillable online forms reduce the likelihood of errors, as they often include built-in calculations and validation checks.

- Time-saving: Employers can quickly and efficiently process the forms, saving time and resources.

- Environmentally friendly: Digital forms reduce the need for paper, minimizing waste and promoting sustainability.

Downloading and Printing NC-4 Forms

To download and print an NC-4 form, follow these steps:

- Visit the official North Carolina Department of Revenue website.

- Search for the NC-4 form and select the fillable online version.

- Complete the form electronically, ensuring accuracy and attention to detail.

- Save the completed form to your device or print it directly from the website.

- If printing, ensure you have a compatible printer and sufficient ink or toner.

Important Considerations When Downloading and Printing

When downloading and printing NC-4 forms, keep the following in mind:

- Ensure you are accessing the form from the official North Carolina Department of Revenue website to avoid any potential scams or inaccurate information.

- Verify that your device and printer are compatible with the form's file format.

- Double-check that the form is completed accurately and thoroughly to avoid any delays or issues.

Accurate Completion of NC-4 Forms

Accurate completion of the NC-4 form is crucial to ensure correct state income tax withholding. Here are some tips to help you complete the form accurately:

- Read the form carefully and understand the instructions before starting.

- Provide accurate and complete information, including your name, address, and Social Security number.

- Ensure you claim the correct number of allowances and provide any additional withholding amounts.

- Review the form for errors before submitting it to your employer.

Common Mistakes to Avoid

When completing the NC-4 form, avoid the following common mistakes:

- Inaccurate or incomplete information

- Incorrect number of allowances

- Failure to provide additional withholding amounts

- Not signing and dating the form

Submission and Record-Keeping

Once the NC-4 form is completed, submit it to your employer, who will then use the information to determine the correct state income tax withholding. As an employee, it's essential to keep a record of your submitted form, including:

- A copy of the completed form

- The date you submitted the form

- A confirmation from your employer that they received the form

Why Record-Keeping is Important

Record-keeping is crucial to ensure that you can:

- Verify the accuracy of your state income tax withholding

- Resolve any potential issues or discrepancies

- Provide proof of submission for tax purposes

What is the purpose of the NC-4 form?

+The NC-4 form is used to determine the correct amount of state income tax to withhold from an employee's wages.

How do I access a fillable online NC-4 form?

+Visit the official North Carolina Department of Revenue website and search for the NC-4 form.

What are the consequences of inaccurate completion of the NC-4 form?

+Inaccurate completion of the NC-4 form can lead to incorrect state income tax withholding, resulting in potential delays or issues.

In conclusion, the NC-4 form is a vital document for employees and employers in North Carolina. By understanding the benefits of fillable online forms, accurately completing the form, and maintaining proper record-keeping, individuals can ensure correct state income tax withholding and avoid any potential issues.