Nc 4-Ez Fillable Form Download And Instructions

The NC 4-EZ form is a simplified version of the North Carolina individual income tax return, designed for residents with straightforward tax situations. Filing taxes can be a daunting task, especially for those who are new to the process or have never had to file before. However, with the NC 4-EZ form, the process becomes more manageable, saving you time and effort. In this article, we will guide you through the process of downloading and completing the NC 4-EZ fillable form, as well as provide you with valuable instructions to ensure you get it right the first time.

Why Choose the NC 4-EZ Form?

The NC 4-EZ form is perfect for individuals who meet certain criteria, such as those who only have one source of income, have no dependents, and do not claim any deductions or credits. This form is shorter and more straightforward than the standard NC-40 form, making it easier to complete and submit. Additionally, using the NC 4-EZ form can help you avoid errors and delays in processing your tax return.Downloading the NC 4-EZ Fillable Form

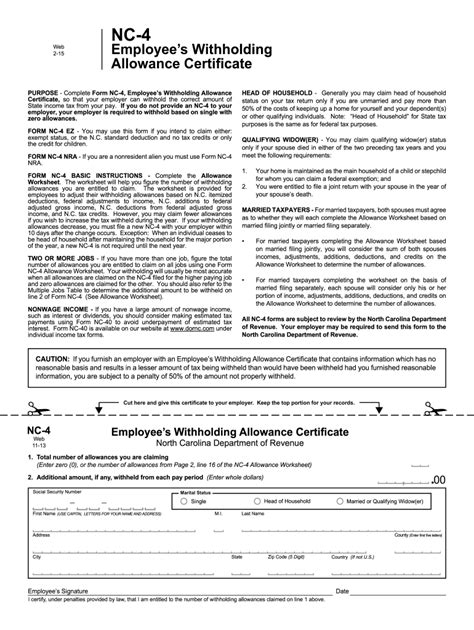

To download the NC 4-EZ fillable form, follow these steps:

- Visit the official website of the North Carolina Department of Revenue ()

- Click on the "Individuals" tab and select "Forms and Publications"

- Scroll down to the "NC 4-EZ" section and click on the "Fillable Form" link

- Save the form to your computer or print it out

Instructions for Completing the NC 4-EZ Form

To complete the NC 4-EZ form, follow these step-by-step instructions:- Enter Your Personal Information: Fill in your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Report Your Income: Enter your total income from all sources, including wages, salaries, tips, and any other income you received during the tax year.

- Claim Your Refund: If you have a refund due, enter the amount you want to receive and how you would like to receive it (direct deposit or check).

- Sign and Date the Form: Sign and date the form to certify that the information is accurate and complete.

NC 4-EZ Form Requirements and Eligibility

To be eligible to use the NC 4-EZ form, you must meet the following requirements:

- You are a resident of North Carolina

- You only have one source of income (W-2 or 1099)

- You do not claim any deductions or credits

- You do not have any dependents

- You are not required to file a Schedule C (Form 1040) or Schedule E (Form 1040)

NC 4-EZ Form Due Date and Filing Options

The NC 4-EZ form is due on April 15th of each year. You can file your tax return electronically or by mail. If you choose to file electronically, you can use the North Carolina Department of Revenue's online filing system or hire a tax professional to file on your behalf.Tips and Reminders for Filing the NC 4-EZ Form

- Make sure to keep a copy of your completed tax return and supporting documents for at least three years.

- If you have any questions or concerns, contact the North Carolina Department of Revenue or a tax professional for assistance.

- If you are due a refund, consider using direct deposit to receive your refund faster.

Common Errors to Avoid When Filing the NC 4-EZ Form

To avoid delays in processing your tax return, make sure to avoid the following common errors:- Incomplete or inaccurate information

- Failure to sign and date the form

- Incorrect calculation of tax due or refund

- Failure to include supporting documentation

Conclusion

The NC 4-EZ form is a simplified and easy-to-use tax return form designed for North Carolina residents with straightforward tax situations. By following the instructions and guidelines outlined in this article, you can ensure a smooth and hassle-free tax filing experience. Remember to double-check your information, avoid common errors, and consider seeking assistance if needed.What is the deadline for filing the NC 4-EZ form?

+The deadline for filing the NC 4-EZ form is April 15th of each year.

Can I file the NC 4-EZ form electronically?

+Yes, you can file the NC 4-EZ form electronically using the North Carolina Department of Revenue's online filing system or by hiring a tax professional to file on your behalf.

What are the eligibility requirements for using the NC 4-EZ form?

+To be eligible to use the NC 4-EZ form, you must be a resident of North Carolina, have only one source of income, not claim any deductions or credits, not have any dependents, and not be required to file a Schedule C (Form 1040) or Schedule E (Form 1040).