Understanding the NC-3 Annual Withholding Reconciliation Form

As an employer in North Carolina, it's essential to understand the importance of the NC-3 Annual Withholding Reconciliation Form. This form is a crucial part of the state's tax reporting process, and it's used to reconcile the amount of state income tax withheld from employee wages. In this article, we'll delve into the details of the NC-3 form, its purpose, and how to complete it accurately.

Why is the NC-3 Form Important?

The NC-3 form is a critical component of North Carolina's tax compliance process. It's used to report the total amount of state income tax withheld from employee wages throughout the year. This information is essential for the state to determine the accuracy of the tax withheld and to identify any discrepancies. By completing the NC-3 form accurately, employers can ensure they're meeting their tax obligations and avoiding any potential penalties.

Who Needs to File the NC-3 Form?

All employers in North Carolina who withhold state income tax from employee wages are required to file the NC-3 form. This includes employers who have employees residing in North Carolina, as well as those who have employees working in the state but residing elsewhere.

When is the NC-3 Form Due?

The NC-3 form is typically due on January 31st of each year, covering the previous tax year. For example, the NC-3 form for the 2022 tax year would be due on January 31st, 2023. It's essential to file the form on time to avoid any penalties or fines.

How to Complete the NC-3 Form

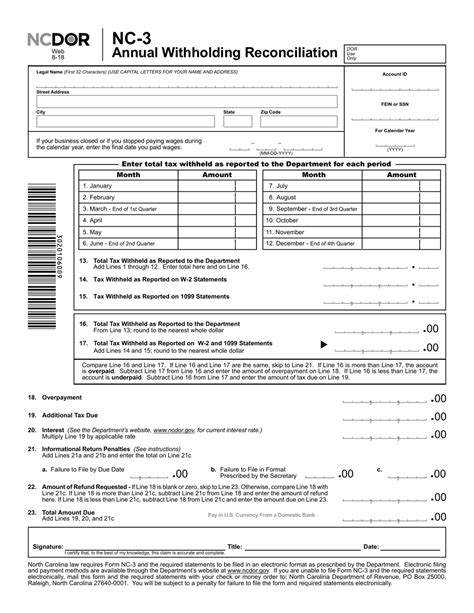

Completing the NC-3 form accurately requires attention to detail and a thorough understanding of the form's requirements. Here's a step-by-step guide to help you complete the form:

- Gather necessary information: Before starting the form, ensure you have all the necessary information, including:

- Total amount of state income tax withheld from employee wages

- Total amount of wages paid to employees

- Number of employees

- Federal Employer Identification Number (FEIN)

- Complete the form: Fill out the form with the required information, including:

- Employer's name and address

- FEIN

- Total amount of state income tax withheld

- Total amount of wages paid to employees

- Number of employees

- Reconcile the amounts: Reconcile the total amount of state income tax withheld with the total amount of wages paid to employees. This will help identify any discrepancies.

Common Mistakes to Avoid

When completing the NC-3 form, it's essential to avoid common mistakes that can lead to penalties or fines. Here are some common mistakes to watch out for:

- Inaccurate reporting: Ensure the information reported on the form is accurate and complete.

- Late filing: File the form on time to avoid penalties.

- Insufficient documentation: Keep accurate records of employee wages and tax withheld to support the information reported on the form.

Benefits of Filing the NC-3 Form Accurately

Filing the NC-3 form accurately has several benefits, including:

- Avoiding penalties: Accurate filing helps avoid penalties and fines associated with late or inaccurate reporting.

- Ensuring compliance: Filing the form accurately ensures compliance with North Carolina's tax laws and regulations.

- Streamlining audits: Accurate reporting can help streamline audits and reduce the risk of discrepancies.

Best Practices for Filing the NC-3 Form

To ensure accurate and timely filing of the NC-3 form, follow these best practices:

- Keep accurate records: Maintain accurate records of employee wages and tax withheld to support the information reported on the form.

- File electronically: Consider filing the form electronically to reduce errors and ensure timely submission.

- Seek professional help: If you're unsure about completing the form, consider seeking help from a tax professional or accountant.

Conclusion

The NC-3 Annual Withholding Reconciliation Form is a critical component of North Carolina's tax compliance process. By understanding the form's requirements and following the steps outlined in this article, employers can ensure accurate and timely filing. Remember to avoid common mistakes, keep accurate records, and seek professional help if needed. By following these best practices, employers can ensure compliance with North Carolina's tax laws and regulations.

Share Your Thoughts

Have you filed the NC-3 form before? What challenges have you faced, and how have you overcome them? Share your thoughts and experiences in the comments below. If you have any questions or concerns, feel free to ask, and we'll do our best to assist you.

FAQ Section

What is the NC-3 form used for?

+The NC-3 form is used to reconcile the amount of state income tax withheld from employee wages.

Who needs to file the NC-3 form?

+All employers in North Carolina who withhold state income tax from employee wages need to file the NC-3 form.

When is the NC-3 form due?

+The NC-3 form is typically due on January 31st of each year, covering the previous tax year.