The Mw507 form is an essential document for individuals who want to report their Maryland withholding tax exemptions. It's a crucial form that helps the state of Maryland track and verify the tax exemptions claimed by residents. In this article, we will provide a step-by-step guide on how to fill out the Mw507 form accurately and efficiently.

Importance of Accurate Filing

Accurate filing of the Mw507 form is crucial to avoid any delays or penalties. The form requires individuals to provide their personal and tax-related information, which is used to verify their tax exemptions. Failure to provide accurate information may result in delays or rejection of the form, leading to penalties and fines.

Who Needs to File the Mw507 Form?

The Mw507 form is required for individuals who want to claim Maryland withholding tax exemptions. This includes:

- Maryland residents who want to claim exemption from state income tax withholding

- Non-residents who want to claim exemption from state income tax withholding on Maryland-sourced income

- Individuals who want to claim exemption from local income tax withholding

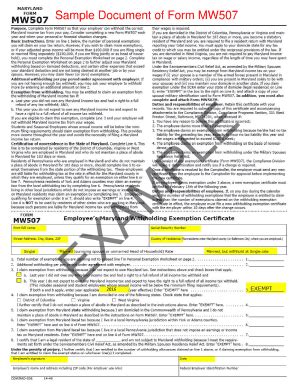

Step-by-Step Filling Guide

To fill out the Mw507 form accurately, follow these steps:

Step 1: Download and Print the Form

Download the Mw507 form from the official website of the Comptroller of Maryland or print it from the Maryland Tax Forms webpage.

Step 2: Fill Out the Header Section

The header section requires you to provide your personal and contact information. Fill out the following fields:

- Name

- Address

- City

- State

- ZIP code

- Date of birth

- Social Security number or Individual Taxpayer Identification Number (ITIN)

Step 3: Fill Out the Tax Exemption Section

The tax exemption section requires you to provide information about your tax exemptions. Fill out the following fields:

- Type of exemption (check one or more):

- Exemption from state income tax withholding

- Exemption from local income tax withholding

- Exemption from both state and local income tax withholding

- Reason for exemption (check one or more):

- I am a Maryland resident and have no taxable income

- I am a non-resident and have no Maryland-sourced income

- I am exempt from state and local income tax withholding due to a disability

- Other ( specify)

Step 4: Fill Out the Withholding Information Section

The withholding information section requires you to provide information about your withholding. Fill out the following fields:

- Current withholding status:

- I am currently having Maryland state income tax withheld

- I am currently having local income tax withheld

- I am not having any Maryland state or local income tax withheld

- Previous withholding status (if applicable):

- I previously had Maryland state income tax withheld

- I previously had local income tax withheld

Step 5: Sign and Date the Form

Sign and date the form in the presence of a notary public. The notary public must verify your identity and witness your signature.

Step 6: Submit the Form

Submit the completed form to the Comptroller of Maryland, either by mail or in person. Make sure to keep a copy of the form for your records.

Tips and Reminders

- Make sure to fill out the form accurately and completely to avoid delays or rejection.

- Use black ink and print clearly.

- Do not staple or attach any documents to the form.

- Keep a copy of the form for your records.

Common Mistakes to Avoid

- Failing to sign and date the form

- Failing to provide required information

- Failing to attach required documentation

- Submitting the form late or after the deadline

Benefits of Filing the Mw507 Form

- Avoid penalties and fines for late or inaccurate filing

- Ensure accurate tracking and verification of tax exemptions

- Avoid delays in processing tax refunds

- Maintain compliance with Maryland tax laws and regulations

Conclusion

Filing the Mw507 form is an essential step in reporting Maryland withholding tax exemptions. By following the step-by-step guide provided in this article, individuals can ensure accurate and efficient filing of the form. Remember to fill out the form carefully, sign and date it, and submit it to the Comptroller of Maryland. If you have any questions or concerns, consult with a tax professional or contact the Comptroller of Maryland.

Frequently Asked Questions

Who needs to file the Mw507 form?

+The Mw507 form is required for individuals who want to claim Maryland withholding tax exemptions, including Maryland residents and non-residents.

What is the deadline for filing the Mw507 form?

+The deadline for filing the Mw507 form varies depending on the type of exemption and the individual's circumstances. Consult with a tax professional or contact the Comptroller of Maryland for more information.

Can I file the Mw507 form electronically?

+No, the Mw507 form must be filed in paper format and submitted to the Comptroller of Maryland by mail or in person.