The MV-4ST form is a critical document for Pennsylvania residents who want to register their vehicles. Filling out the form correctly is essential to avoid any delays or issues with the registration process. In this article, we will provide a comprehensive guide on how to fill out the MV-4ST form in Pennsylvania.

Understanding the MV-4ST Form

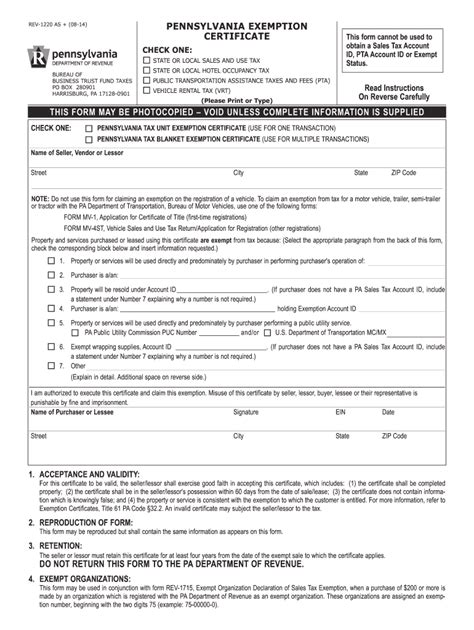

The MV-4ST form, also known as the "Vehicle Sales and Use Tax Return," is a document required by the Pennsylvania Department of Transportation (PennDOT) to register a vehicle in the state. The form is used to calculate and collect sales tax on the purchase or transfer of a vehicle. It's essential to fill out the form accurately to avoid any penalties or fines.

Who Needs to Fill Out the MV-4ST Form?

The MV-4ST form is required for anyone who wants to register a vehicle in Pennsylvania, including:

- Individuals purchasing a new or used vehicle from a dealership or private party

- Out-of-state residents who want to register their vehicle in Pennsylvania

- Pennsylvania residents who want to register a vehicle they purchased or inherited

Step 1: Gather Required Documents

Before filling out the MV-4ST form, you'll need to gather the following documents:

- Proof of vehicle ownership (title or pink slip)

- Proof of Pennsylvania residency (driver's license or state ID)

- Proof of vehicle insurance

- Sales contract or invoice

- odometer disclosure statement (if the vehicle is 10 years old or newer)

Step 2: Fill Out Section 1 - Vehicle Information

Section 1 of the MV-4ST form requires you to provide information about the vehicle, including:

- Vehicle make and model

- Vehicle identification number (VIN)

- Year of manufacture

- Vehicle type (passenger, truck, motorcycle, etc.)

Step 3: Fill Out Section 2 - Purchaser Information

Section 2 of the MV-4ST form requires you to provide information about the purchaser, including:

- Name and address

- Pennsylvania driver's license or state ID number

- Social Security number (optional)

Step 4: Fill Out Section 3 - Sales Information

Section 3 of the MV-4ST form requires you to provide information about the sale, including:

- Date of sale

- Sales price

- Trade-in allowance (if applicable)

- Sales tax exemption (if applicable)

Step 5: Fill Out Section 4 - Tax Calculation

Section 4 of the MV-4ST form requires you to calculate the sales tax owed on the vehicle purchase. You'll need to provide the following information:

- Sales tax rate (6% for Pennsylvania residents)

- Sales tax amount

- Total amount due

Additional Tips and Reminders

- Make sure to sign and date the form

- Use black ink to fill out the form

- Do not use correction fluid or tape

- Make a copy of the completed form for your records

By following these steps and tips, you'll be able to fill out the MV-4ST form accurately and efficiently. Remember to gather all required documents and information before starting the form, and don't hesitate to seek help if you have any questions or concerns.

Final Thoughts

Filling out the MV-4ST form is a critical step in registering your vehicle in Pennsylvania. By understanding the form and following the steps outlined in this article, you'll be able to navigate the process with ease. Remember to stay organized, take your time, and seek help if needed. With the right guidance, you'll be on the road to successful vehicle registration in no time.

We hope this article has provided you with the necessary information and guidance to fill out the MV-4ST form correctly. If you have any further questions or concerns, please don't hesitate to comment below. Share this article with friends and family who may be going through the same process.

What is the MV-4ST form used for?

+The MV-4ST form is used to calculate and collect sales tax on the purchase or transfer of a vehicle in Pennsylvania.

Who needs to fill out the MV-4ST form?

+The MV-4ST form is required for anyone who wants to register a vehicle in Pennsylvania, including individuals purchasing a new or used vehicle, out-of-state residents, and Pennsylvania residents who want to register a vehicle they purchased or inherited.

What documents do I need to gather before filling out the MV-4ST form?

+You'll need to gather proof of vehicle ownership, proof of Pennsylvania residency, proof of vehicle insurance, sales contract or invoice, and odometer disclosure statement (if the vehicle is 10 years old or newer).