In the state of Minnesota, the M1M form is a crucial document required for various purposes, including tax compliance and identity verification. Completing this form accurately is essential to avoid any complications or delays. In this article, we will explore five ways to complete the Minnesota M1M form efficiently and effectively.

Understanding the M1M Form

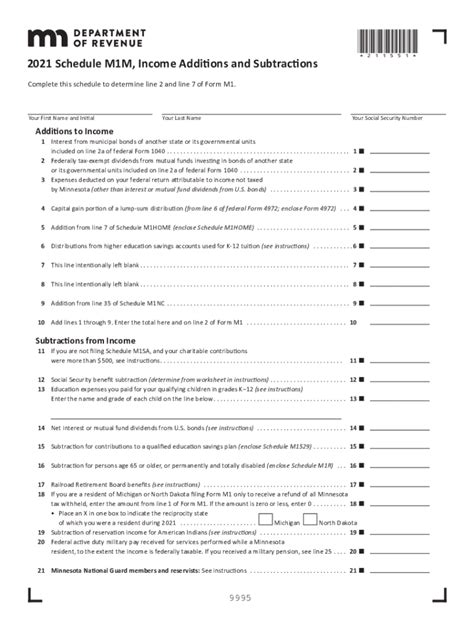

Before diving into the completion process, it's essential to understand the purpose and requirements of the M1M form. The M1M form is a Minnesota income tax return form used by individuals and businesses to report their income and claim credits and deductions. The form is typically filed annually, and its due date is usually April 15th.

Method 1: Manual Completion

One way to complete the M1M form is by manual completion. This involves downloading the form from the Minnesota Department of Revenue website, printing it, and filling it out by hand. This method is suitable for those who prefer a more traditional approach or have limited access to digital tools.

To complete the form manually:

- Download the M1M form from the Minnesota Department of Revenue website.

- Print the form and read the instructions carefully.

- Fill out the form using a black pen, making sure to write legibly.

- Attach any required supporting documents, such as W-2 forms and 1099 forms.

- Sign and date the form.

Benefits of Manual Completion

- Suitable for those who prefer a traditional approach.

- No need for digital tools or software.

- Allows for a paper trail and physical record-keeping.

Limitations of Manual Completion

- Time-consuming and prone to errors.

- Requires manual calculations and attention to detail.

- May require additional postage and mailing costs.

Method 2: Online Filing through the Minnesota Department of Revenue Website

Another way to complete the M1M form is by filing online through the Minnesota Department of Revenue website. This method is convenient, efficient, and reduces the risk of errors.

To file online:

- Visit the Minnesota Department of Revenue website and create an account or log in.

- Select the M1M form and follow the online instructions.

- Fill out the form, and the system will perform calculations and checks for errors.

- Attach required supporting documents electronically.

- Submit the form and receive a confirmation number.

Benefits of Online Filing

- Convenient and efficient.

- Reduces the risk of errors and calculations mistakes.

- Fast and secure submission.

Limitations of Online Filing

- Requires digital tools and internet access.

- May require additional software or browser updates.

- Technical issues may occur during the filing process.

Method 3: Tax Preparation Software

Tax preparation software, such as TurboTax or H&R Block, can also be used to complete the M1M form. These programs guide users through the completion process, perform calculations, and check for errors.

To use tax preparation software:

- Choose a reputable tax preparation software and create an account.

- Select the M1M form and follow the program's instructions.

- Fill out the form, and the software will perform calculations and checks.

- Attach required supporting documents electronically.

- Submit the form and receive a confirmation number.

Benefits of Tax Preparation Software

- Convenient and efficient.

- Reduces the risk of errors and calculations mistakes.

- Offers guidance and support throughout the completion process.

Limitations of Tax Preparation Software

- Requires digital tools and internet access.

- May require additional software or browser updates.

- Technical issues may occur during the filing process.

Method 4: Professional Tax Preparation Services

For those who prefer a more personalized approach or have complex tax situations, professional tax preparation services can be a viable option. Certified public accountants (CPAs) or enrolled agents (EAs) can assist with completing the M1M form and provide guidance on tax laws and regulations.

To use professional tax preparation services:

- Find a reputable tax preparation professional or firm.

- Schedule an appointment and provide necessary documentation.

- Discuss your tax situation and receive guidance on completion.

- Review and sign the completed form.

Benefits of Professional Tax Preparation Services

- Personalized approach and guidance.

- Expertise in tax laws and regulations.

- Reduced risk of errors and calculations mistakes.

Limitations of Professional Tax Preparation Services

- May be more expensive than other methods.

- Requires scheduling an appointment and meeting with a professional.

- May require additional documentation and information.

Method 5: Combination of Methods

Finally, some individuals may prefer to use a combination of methods to complete the M1M form. For example, they may use tax preparation software to complete the form and then have a professional review and sign it.

To use a combination of methods:

- Choose a primary method for completing the form (e.g., tax preparation software).

- Complete the form using the chosen method.

- Review the form and make any necessary corrections.

- Have a professional review and sign the form (if desired).

Benefits of Combination of Methods

- Flexibility and customization.

- Reduced risk of errors and calculations mistakes.

- Personalized approach and guidance (if desired).

Limitations of Combination of Methods

- May require additional time and effort.

- May be more expensive than using a single method.

- Requires coordination between methods and professionals (if applicable).

In conclusion, there are various ways to complete the Minnesota M1M form, each with its benefits and limitations. By understanding the different methods and choosing the one that best suits your needs, you can ensure accurate and efficient completion of the form.

We invite you to share your experiences and preferences for completing the M1M form in the comments section below. Have you used a particular method that worked well for you? Do you have any questions or concerns about the completion process? Let's start a conversation!

What is the due date for the M1M form?

+The due date for the M1M form is typically April 15th.

Can I file the M1M form electronically?

+Yes, you can file the M1M form electronically through the Minnesota Department of Revenue website or using tax preparation software.

What are the benefits of using tax preparation software to complete the M1M form?

+Using tax preparation software can reduce the risk of errors and calculations mistakes, provide guidance and support throughout the completion process, and offer a convenient and efficient way to file the form.