If you're a New York State employee or retiree, you may be eligible to withdraw funds from your Deferred Compensation Plan account. To initiate the withdrawal process, you'll need to fill out the NYS Deferred Comp Withdrawal Form. In this article, we'll walk you through the process and provide guidance on how to complete the form accurately.

The NYS Deferred Comp Withdrawal Form is a straightforward document, but it's essential to understand the rules and regulations surrounding withdrawals to avoid any potential penalties or taxes. We'll cover the eligibility criteria, withdrawal options, and step-by-step instructions on how to fill out the form.

Understanding Your Eligibility

Before we dive into the form-filling process, let's quickly review the eligibility criteria for withdrawals:

- You must be a current or former New York State employee.

- You must have a minimum account balance of $1,000.

- You must be at least 59 1/2 years old (or meet other exceptions, such as separation from service or disability).

Step 1: Gathering Required Information

To fill out the NYS Deferred Comp Withdrawal Form, you'll need the following information:

- Your account number

- Your name and address

- Your date of birth

- Your Social Security number

- The amount you wish to withdraw (or the percentage of your account balance)

Step 2: Choosing Your Withdrawal Option

You can choose from several withdrawal options, including:

- Lump Sum: A one-time withdrawal of a specific amount.

- Periodic Payments: Regular payments over a set period (e.g., monthly, quarterly).

- Systematic Withdrawals: Regular withdrawals based on a percentage of your account balance.

Step 3: Completing the Form

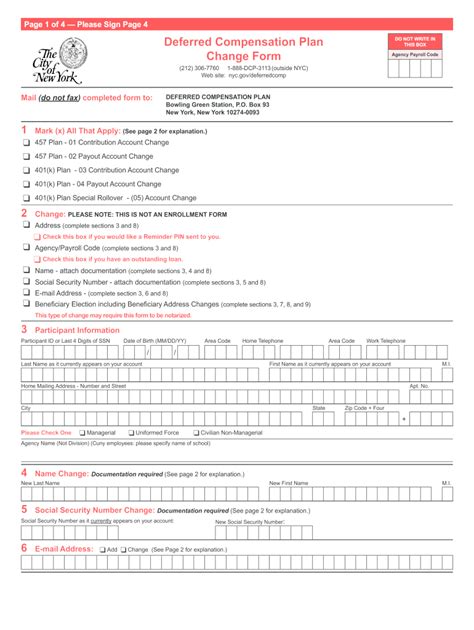

Here's a step-by-step guide to filling out the NYS Deferred Comp Withdrawal Form:

- Section 1: Account Information

- Enter your account number, name, and address.

- Provide your date of birth and Social Security number.

- Section 2: Withdrawal Information

- Choose your withdrawal option (lump sum, periodic payments, or systematic withdrawals).

- Enter the amount you wish to withdraw (or the percentage of your account balance).

- Section 3: Tax Withholding

- You can choose to have federal and state taxes withheld from your withdrawal.

- Enter the percentage of taxes you wish to withhold (or select the default rate).

- Section 4: Certifications and Signatures

- Read and certify that you understand the rules and regulations surrounding withdrawals.

- Sign and date the form.

Step 4: Submitting the Form

Once you've completed the form, submit it to the NYS Deferred Compensation Plan office. You can mail or fax the form, or submit it online through the plan's website.

Additional Tips and Reminders

- Be sure to review the plan's rules and regulations before submitting your withdrawal request.

- Consider consulting with a financial advisor to determine the best withdrawal strategy for your individual circumstances.

- Keep in mind that withdrawals may be subject to taxes and penalties, so it's essential to plan carefully.

Conclusion

Withdrawing funds from your NYS Deferred Compensation Plan account can be a straightforward process if you understand the rules and regulations. By following the steps outlined in this article, you'll be able to complete the NYS Deferred Comp Withdrawal Form accurately and efficiently. Remember to review the plan's rules, consider consulting with a financial advisor, and plan carefully to minimize taxes and penalties.

Frequently Asked Questions

What is the minimum account balance required for a withdrawal?

+The minimum account balance required for a withdrawal is $1,000.

Can I withdraw funds from my account if I'm under 59 1/2 years old?

+Yes, but you may be subject to penalties and taxes. Exceptions include separation from service, disability, or other qualifying events.

How do I submit my withdrawal request?

+You can mail or fax the completed form to the NYS Deferred Compensation Plan office, or submit it online through the plan's website.