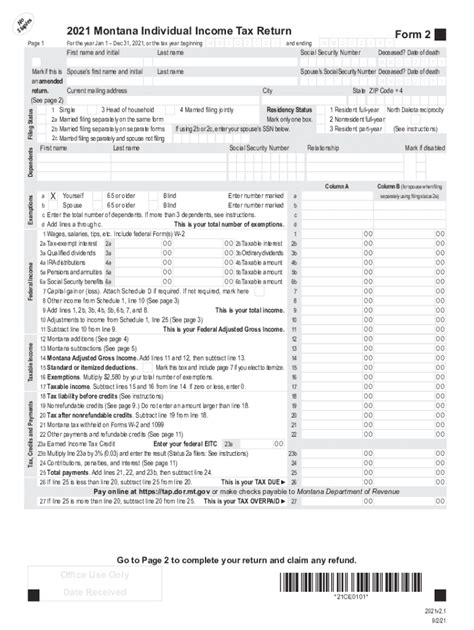

Filing tax returns can be a daunting task, especially for those who are new to the process. One of the most important forms for individuals to file is the Mt Form 2, also known as the Individual Income Tax Return form. This form is used to report an individual's income, deductions, and credits, and to calculate the amount of taxes owed to the government. In this article, we will provide a step-by-step guide on how to fill out the Mt Form 2, making it easier for you to navigate the process.

Understanding the Mt Form 2

Before we dive into the instructions, it's essential to understand the different sections of the Mt Form 2. The form is divided into several sections, including:

- Section 1: Personal Details - This section requires you to provide your personal details, such as your name, address, and tax identification number.

- Section 2: Income - This section requires you to report your income from various sources, such as employment, self-employment, and investments.

- Section 3: Deductions - This section allows you to claim deductions for expenses related to your income, such as charitable donations and medical expenses.

- Section 4: Credits - This section allows you to claim credits for taxes paid or for specific activities, such as education expenses.

Step 1: Gathering Required Documents

Before you start filling out the Mt Form 2, it's essential to gather all the required documents. These documents may include:

- W-2 forms - These forms show your income from employment and taxes withheld.

- 1099 forms - These forms show your income from self-employment and other sources.

- Receipts - These receipts show your expenses related to your income, such as charitable donations and medical expenses.

- Tax identification number - This is a unique number assigned to you by the government.

Step 2: Filling Out Section 1: Personal Details

To fill out Section 1, you will need to provide your personal details. This includes:

- Name - Your full name as it appears on your tax identification number.

- Address - Your current address.

- Tax identification number - Your unique tax identification number.

Example:

| Field | Example |

|---|---|

| Name | John Doe |

| Address | 123 Main Street, Anytown, USA |

| Tax identification number | 123-45-678 |

Step 3: Filling Out Section 2: Income

To fill out Section 2, you will need to report your income from various sources. This includes:

- Employment income - Income from employment, including tips and bonuses.

- Self-employment income - Income from self-employment, including freelance work and business income.

- Investment income - Income from investments, including interest and dividends.

Example:

| Field | Example |

|---|---|

| Employment income | $50,000 |

| Self-employment income | $20,000 |

| Investment income | $10,000 |

Step 4: Filling Out Section 3: Deductions

To fill out Section 3, you will need to claim deductions for expenses related to your income. This includes:

- Charitable donations - Donations to qualified charitable organizations.

- Medical expenses - Expenses related to medical care, including doctor visits and prescriptions.

- Business expenses - Expenses related to your business, including office supplies and travel expenses.

Example:

| Field | Example |

|---|---|

| Charitable donations | $5,000 |

| Medical expenses | $2,000 |

| Business expenses | $10,000 |

Step 5: Filling Out Section 4: Credits

To fill out Section 4, you will need to claim credits for taxes paid or for specific activities. This includes:

- Education credits - Credits for education expenses, including tuition and fees.

- Child tax credits - Credits for taxes paid on behalf of dependents.

- Earned income tax credits - Credits for taxes paid by low-income individuals.

Example:

| Field | Example |

|---|---|

| Education credits | $2,000 |

| Child tax credits | $1,000 |

| Earned income tax credits | $500 |

Step 6: Calculating Your Tax Liability

Once you have completed all the sections, you will need to calculate your tax liability. This includes:

- Total income - Your total income from all sources.

- Total deductions - Your total deductions for expenses related to your income.

- Total credits - Your total credits for taxes paid or for specific activities.

Example:

| Field | Example |

|---|---|

| Total income | $80,000 |

| Total deductions | $20,000 |

| Total credits | $3,500 |

Conclusion

Filing your Mt Form 2 can seem like a daunting task, but by following these steps, you can ensure that you are completing the form accurately and efficiently. Remember to gather all the required documents, fill out each section carefully, and calculate your tax liability accurately. If you have any questions or concerns, consider consulting a tax professional or seeking guidance from the IRS.

Final Thoughts

We hope this guide has been helpful in providing you with a step-by-step guide on how to fill out the Mt Form 2. Remember to stay organized, take your time, and seek help if you need it. Filing your tax return accurately and efficiently is crucial to avoiding any penalties or fines.

What is the Mt Form 2?

+The Mt Form 2 is the Individual Income Tax Return form, used to report an individual's income, deductions, and credits, and to calculate the amount of taxes owed to the government.

What documents do I need to gather before filling out the Mt Form 2?

+You will need to gather W-2 forms, 1099 forms, receipts for expenses related to your income, and your tax identification number.

How do I calculate my tax liability?

+You will need to calculate your total income, total deductions, and total credits, and then subtract your deductions and credits from your income to determine your tax liability.