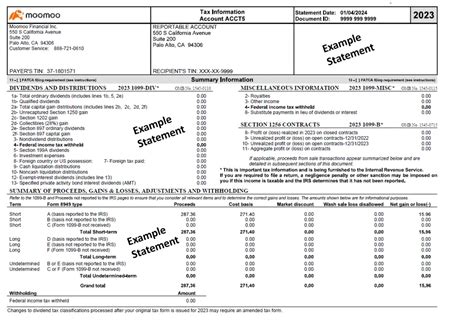

As a Moomoo investor, it's essential to understand the tax implications of your investments. Each year, Moomoo will provide you with a 1099 tax form, which reports the income you've earned from your investments. In this article, we'll break down the different sections of the Moomoo 1099 tax form, explaining what each part means and how to use the information to file your taxes.

What is a 1099 Tax Form?

A 1099 tax form is a document that reports various types of income to the Internal Revenue Service (IRS). There are several types of 1099 forms, but as a Moomoo investor, you'll receive a 1099-B, which reports proceeds from broker and barter exchange transactions. This form will show the income you've earned from selling stocks, options, and other securities through Moomoo.

Breaking Down the Moomoo 1099 Tax Form

The Moomoo 1099 tax form is divided into several sections, each reporting different types of income. Let's take a closer look at each section:

Box 1a: Description of Property

This section lists the description of the property sold, including the ticker symbol, number of shares, and type of security.

Box 1b: Date Sold

This section shows the date the property was sold.

Box 1c: Proceeds from Broker and Barter Exchange Transactions

This section reports the total proceeds from the sale of the property.

Box 1d: Adjustments

This section lists any adjustments made to the proceeds, such as fees or commissions.

Box 1e: Aggregate Profit or Loss

This section reports the aggregate profit or loss from the sale of the property.

How to Use the Moomoo 1099 Tax Form to File Your Taxes

When filing your taxes, you'll need to report the income shown on your Moomoo 1099 tax form. Here are the steps to follow:

Gather Your 1099 Forms

Collect all your 1099 forms, including the one from Moomoo.

Report Capital Gains and Losses

Use the information from your Moomoo 1099 tax form to report capital gains and losses on Schedule D of your tax return.

Report Ordinary Income

If you have any ordinary income reported on your Moomoo 1099 tax form, such as interest or dividends, report it on Schedule 1 of your tax return.

Tips for Filing Your Taxes

Here are some tips to keep in mind when filing your taxes:

- Make sure to report all income from your Moomoo 1099 tax form.

- Keep accurate records of your investments and tax documents.

- Consider consulting a tax professional if you're unsure about how to report your income.

Conclusion

Understanding your Moomoo 1099 tax form is crucial for accurately reporting your income and filing your taxes. By breaking down the different sections of the form and following the steps outlined in this article, you'll be able to confidently file your taxes and avoid any potential errors or penalties.

Get Involved!

If you have any questions or comments about understanding your Moomoo 1099 tax form, please leave them in the section below. Share this article with your friends and family who may also benefit from this information.

What is a 1099 tax form?

+A 1099 tax form is a document that reports various types of income to the Internal Revenue Service (IRS).

How do I use my Moomoo 1099 tax form to file my taxes?

+Use the information from your Moomoo 1099 tax form to report capital gains and losses on Schedule D of your tax return, and report ordinary income on Schedule 1 of your tax return.

What are some tips for filing my taxes?

+Make sure to report all income from your Moomoo 1099 tax form, keep accurate records of your investments and tax documents, and consider consulting a tax professional if you're unsure about how to report your income.