As the COVID-19 pandemic continues to affect communities worldwide, frontline workers have been instrumental in keeping essential services running, putting their lives at risk to care for the sick, maintain order, and keep critical infrastructure operational. In recognition of their sacrifices, many governments have introduced special tax relief measures, including the Mn Frontline Worker Pay Tax Form. In this article, we will delve into the details of this tax form, exploring what it entails, who is eligible, and how to claim this benefit.

What is the Mn Frontline Worker Pay Tax Form?

The Mn Frontline Worker Pay Tax Form is a tax relief initiative designed to provide financial assistance to frontline workers who have been working during the COVID-19 pandemic. This tax form allows eligible workers to claim a refund of a portion of their earnings, which can help alleviate some of the financial burdens associated with their critical work.

Eligibility Criteria

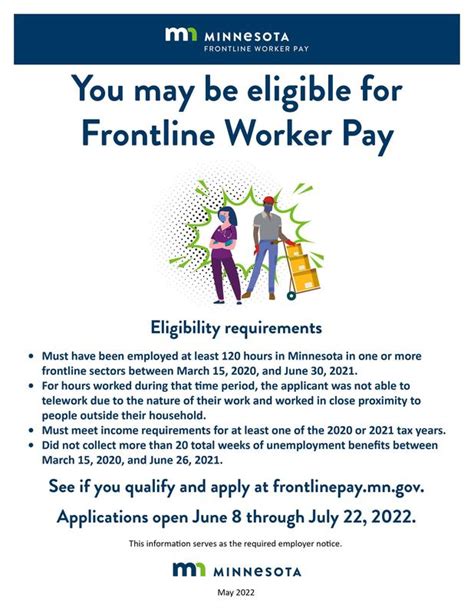

To be eligible for the Mn Frontline Worker Pay Tax Form, individuals must meet specific criteria, including:

- Working in a frontline position, such as healthcare, emergency services, or critical infrastructure

- Having worked at least 120 hours in a frontline position between March 2020 and December 2021

- Earning less than $175,000 per year

- Being a resident of Minnesota

- Filing a 2021 tax return

Benefits of the Mn Frontline Worker Pay Tax Form

The Mn Frontline Worker Pay Tax Form offers several benefits to eligible workers, including:

- A refund of up to $1,500, depending on the individual's earnings and work hours

- A reduction in tax liability, which can result in a larger refund or smaller tax bill

- The opportunity to claim this benefit in addition to other tax credits and deductions

How to Claim the Mn Frontline Worker Pay Tax Form

To claim the Mn Frontline Worker Pay Tax Form, eligible workers must follow these steps:

- Gather required documentation, including proof of employment, work hours, and earnings

- Complete the Mn Frontline Worker Pay Tax Form (available on the Minnesota Department of Revenue website)

- Attach the completed form to their 2021 tax return

- Submit the tax return and supporting documentation to the Minnesota Department of Revenue

Additional Resources

For more information on the Mn Frontline Worker Pay Tax Form, including eligibility criteria, benefits, and filing instructions, visit the Minnesota Department of Revenue website. Additionally, taxpayers can contact the department's customer service team for assistance with filing their tax return and claiming this benefit.

Tips for Filing the Mn Frontline Worker Pay Tax Form

- Ensure accurate and complete documentation to avoid delays or rejection of the claim

- Consult with a tax professional or seek guidance from the Minnesota Department of Revenue if unsure about eligibility or filing requirements

- Claim this benefit in addition to other tax credits and deductions to maximize refund potential

FAQs

What is the deadline for filing the Mn Frontline Worker Pay Tax Form?

+The deadline for filing the Mn Frontline Worker Pay Tax Form is the same as the deadline for filing the 2021 tax return (April 18, 2022).

Can I claim the Mn Frontline Worker Pay Tax Form if I am self-employed?

+No, the Mn Frontline Worker Pay Tax Form is only available to employees who have worked in a frontline position.

How will I receive my refund if I claim the Mn Frontline Worker Pay Tax Form?

+Refunds will be issued via direct deposit or paper check, depending on the taxpayer's preference.

In conclusion, the Mn Frontline Worker Pay Tax Form is a valuable resource for frontline workers who have been instrumental in keeping communities safe and operational during the COVID-19 pandemic. By understanding the eligibility criteria, benefits, and filing requirements, eligible workers can claim this tax relief and receive a well-deserved refund. We encourage you to share your thoughts and experiences with claiming this benefit in the comments below.