As a consumer, managing your finances efficiently is crucial in today's fast-paced world. One of the most convenient ways to receive funds directly into your account is through direct deposit. Wells Fargo, one of the largest banks in the United States, offers a direct deposit service that allows you to receive payments directly into your account. In this article, we will delve into the details of the Wells Fargo direct deposit form with name required, exploring its benefits, working mechanism, and steps to enroll.

What is Direct Deposit?

Direct deposit is a payment method that allows funds to be transferred electronically from one account to another. It eliminates the need for paper checks, making it a more efficient and secure way to receive payments. Direct deposit can be used for various types of payments, including payroll, tax refunds, and government benefits.

Benefits of Direct Deposit

- Convenience: Direct deposit saves you time and effort by eliminating the need to visit a bank branch or ATM to deposit a check.

- Security: Direct deposit reduces the risk of lost or stolen checks, ensuring that your funds are safe and secure.

- Speed: Funds are typically available in your account on the same day they are deposited, allowing you to access your money quickly.

- Environmentally Friendly: Direct deposit reduces paper waste, making it a more sustainable option.

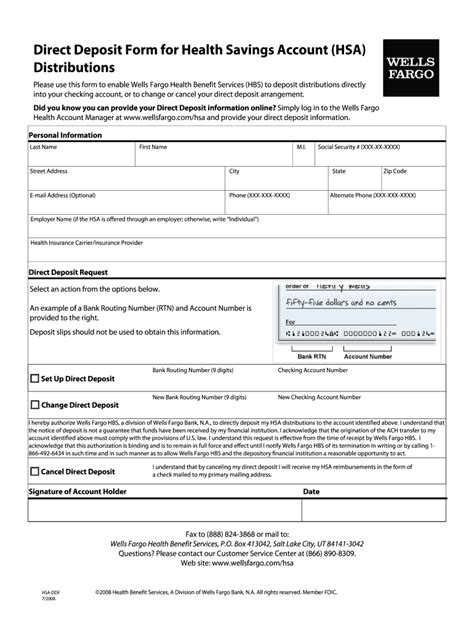

Wells Fargo Direct Deposit Form With Name Required

To enroll in Wells Fargo's direct deposit service, you will need to provide a direct deposit form with your name and account information. The form typically requires the following information:

- Your name and address

- Your Wells Fargo account number and routing number

- The type of deposit you want to receive (e.g., payroll, tax refund, government benefits)

- The frequency of the deposit (e.g., weekly, biweekly, monthly)

How to Enroll in Wells Fargo Direct Deposit

- Download the Direct Deposit Form: You can download the direct deposit form from Wells Fargo's website or pick one up at a local branch.

- Fill Out the Form: Complete the form with your name, account information, and deposit details.

- Submit the Form: Return the completed form to your employer or the relevant party responsible for making the deposit.

- Verify Your Account: Ensure that your account is eligible for direct deposit and that your information is accurate.

Common Issues with Direct Deposit

While direct deposit is a convenient and secure way to receive payments, there are some common issues that may arise:

- Incorrect Account Information: Ensure that your account information is accurate to avoid delays or rejected deposits.

- Insufficient Funds: Make sure you have sufficient funds in your account to cover any fees or overdrafts.

- Technical Issues: Technical issues may cause delays or errors in processing direct deposits.

Troubleshooting Direct Deposit Issues

- Contact Your Employer: If you experience issues with your direct deposit, contact your employer or the relevant party responsible for making the deposit.

- Contact Wells Fargo: Reach out to Wells Fargo's customer service to report any issues or concerns with your direct deposit.

- Verify Your Account: Ensure that your account is eligible for direct deposit and that your information is accurate.

Conclusion

In conclusion, Wells Fargo's direct deposit service provides a convenient and secure way to receive payments directly into your account. By understanding the benefits and working mechanism of direct deposit, you can take advantage of this service to manage your finances efficiently. Remember to carefully review the direct deposit form and ensure that your account information is accurate to avoid any issues.

We hope this article has provided you with valuable insights into Wells Fargo's direct deposit service. If you have any questions or concerns, please feel free to comment below. Don't forget to share this article with your friends and family to help them manage their finances more efficiently.

What is the Wells Fargo direct deposit form?

+The Wells Fargo direct deposit form is a document that requires your name and account information to enroll in the bank's direct deposit service.

How do I enroll in Wells Fargo direct deposit?

+To enroll in Wells Fargo direct deposit, download the direct deposit form, fill it out with your name and account information, and submit it to your employer or the relevant party responsible for making the deposit.

What are some common issues with direct deposit?

+Common issues with direct deposit include incorrect account information, insufficient funds, and technical issues.