As a resident of Missouri, you're likely aware of the state's gas tax, which is used to fund various transportation projects and infrastructure improvements. However, did you know that you might be eligible for a gas tax refund? That's right! If you've purchased gasoline for a non-highway use, such as for a boat, farm equipment, or generator, you may be able to claim a refund on the gas tax you paid. In this article, we'll explore the details of the gas tax refund in Missouri and provide a step-by-step guide on how to claim your refund using Form 4925.

What is the Gas Tax Refund in Missouri?

The gas tax refund in Missouri is a program designed to provide reimbursement to individuals and businesses that have paid gas tax on fuel used for non-highway purposes. The refund is available for gas tax paid on fuel used for activities such as:

- Boating

- Farming

- Construction

- Generators

- Other off-highway uses

The refund is based on the gas tax rate in effect at the time of the fuel purchase. In Missouri, the gas tax rate is currently 19.5 cents per gallon.

Who is Eligible for the Gas Tax Refund?

To be eligible for the gas tax refund, you must have purchased gasoline for a non-highway use in the state of Missouri. This includes:

- Individuals

- Businesses

- Farms

- Construction companies

- Government agencies

You must also have records of the fuel purchases, including receipts and invoices, to support your refund claim.

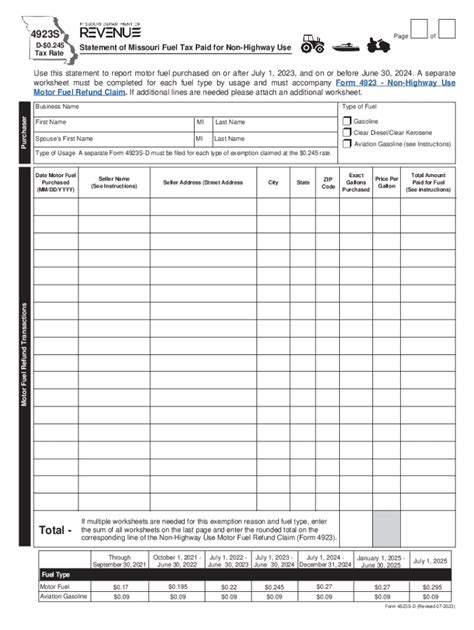

How to Claim Your Gas Tax Refund Using Form 4925

To claim your gas tax refund, you'll need to complete Form 4925, which is available on the Missouri Department of Revenue's website. Here's a step-by-step guide to help you through the process:

- Gather Required Documents: Collect all receipts and invoices for fuel purchases made during the calendar year. You'll need to provide documentation to support your refund claim.

- Determine Your Refund Amount: Calculate the amount of gas tax paid on your fuel purchases. You can use the gas tax rate in effect at the time of purchase to determine the amount of tax paid.

- Complete Form 4925: Fill out Form 4925, making sure to provide all required information, including:

- Your name and address

- Business name and address (if applicable)

- Type of fuel purchased

- Date of fuel purchase

- Gallons of fuel purchased

- Amount of gas tax paid

- Attach Supporting Documentation: Attach all receipts and invoices to Form 4925.

- Submit Your Claim: Mail your completed Form 4925 and supporting documentation to the Missouri Department of Revenue.

Deadlines and Filing Requirements

The deadline for filing Form 4925 is April 15th of each year. You can file electronically or by mail. If you're filing electronically, you can submit your claim through the Missouri Department of Revenue's online portal. If you're filing by mail, send your completed form and supporting documentation to:

Missouri Department of Revenue P.O. Box 146 Jefferson City, MO 65102

Additional Tips and Reminders

Here are some additional tips and reminders to keep in mind when claiming your gas tax refund:

- Keep Accurate Records: Keep detailed records of your fuel purchases, including receipts and invoices. This will help you accurately calculate your refund amount and provide supporting documentation.

- File Timely: Make sure to file your claim by the deadline to avoid any penalties or delays.

- Check for Updates: Check the Missouri Department of Revenue's website for any updates or changes to the gas tax refund program.

By following these steps and tips, you can claim your gas tax refund and receive reimbursement for the gas tax paid on your non-highway fuel purchases.

Conclusion

Claiming your gas tax refund in Missouri is a straightforward process that requires some documentation and calculation. By following the steps outlined in this article and using Form 4925, you can receive reimbursement for the gas tax paid on your non-highway fuel purchases. Don't miss out on this opportunity to recover some of your fuel costs. File your claim today!

We'd love to hear from you! Share your experiences or questions about the gas tax refund in Missouri in the comments below.

What is the current gas tax rate in Missouri?

+The current gas tax rate in Missouri is 19.5 cents per gallon.

What types of fuel purchases are eligible for the gas tax refund?

+Fuel purchases for non-highway uses, such as boating, farming, construction, and generators, are eligible for the gas tax refund.

What is the deadline for filing Form 4925?

+The deadline for filing Form 4925 is April 15th of each year.