Minnesota residents who are seeking to claim a refund for their property taxes or rent paid may need to fill out the Minnesota St19 form. This form, also known as the Minnesota Property Tax Refund Claim, can be a bit overwhelming for those who are not familiar with the process. However, by following the correct steps and providing accurate information, individuals can ensure that they receive the refund they are eligible for.

Understanding the Minnesota St19 Form

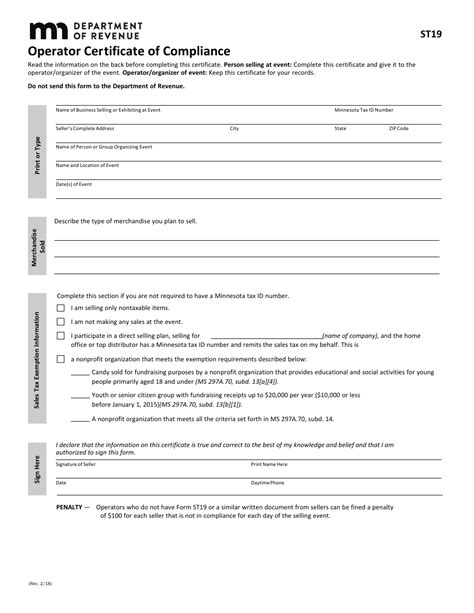

The Minnesota St19 form is used by the state to determine the amount of property tax refund or rent refund that an individual is eligible for. The form requires information about the individual's income, property taxes or rent paid, and other relevant details. It is essential to carefully review the form and provide accurate information to avoid any delays or discrepancies in the refund process.

5 Ways to Fill Out Minnesota St19 Form Correctly

To ensure that the Minnesota St19 form is filled out correctly, follow these five steps:

Step 1: Gather Required Documents and Information

Before starting to fill out the form, gather all the necessary documents and information, including:

- Property tax statements or rent receipts

- W-2 forms or 1099 forms

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Address and contact information

Having all the required documents and information readily available will make it easier to fill out the form accurately.

Step 2: Determine Eligibility and Choose the Correct Form

The Minnesota St19 form has different versions, including Form M1PR (Property Tax Refund) and Form M1RR (Renter's Property Tax Refund). Determine which form is applicable based on individual circumstances and ensure that the correct form is filled out.

Step 3: Fill Out the Form Accurately and Completely

Fill out the form carefully, making sure to provide accurate and complete information. Some essential sections to focus on include:

- Identification and address information

- Income and property tax or rent information

- Claim amount and refund information

Double-check the form for any errors or omissions before proceeding.

Step 4: Attach Required Supporting Documents

Attach all required supporting documents, such as property tax statements or rent receipts, to the form. Ensure that these documents are accurate and match the information provided on the form.

Step 5: Review and Submit the Form

Carefully review the form one last time to ensure accuracy and completeness. Make sure to sign and date the form before submitting it to the Minnesota Department of Revenue.

By following these steps and providing accurate information, individuals can ensure that their Minnesota St19 form is filled out correctly and that they receive the refund they are eligible for.

Common Mistakes to Avoid When Filling Out the Minnesota St19 Form

To avoid any delays or discrepancies in the refund process, it is essential to avoid common mistakes when filling out the Minnesota St19 form. Some of these mistakes include:

- Inaccurate or incomplete information

- Missing or incorrect supporting documents

- Failure to sign and date the form

- Submitting the wrong form or version

By being aware of these common mistakes, individuals can take steps to avoid them and ensure that their form is processed smoothly.

Additional Tips and Resources

For those who are still unsure about filling out the Minnesota St19 form or need additional assistance, there are several resources available:

- The Minnesota Department of Revenue website provides detailed instructions and FAQs on filling out the form.

- Tax professionals or accountants can offer guidance and assistance with the form.

- The Minnesota Taxpayer Assistance Center offers free assistance with tax-related issues, including filling out the Minnesota St19 form.

By taking advantage of these resources and following the steps outlined above, individuals can ensure that their Minnesota St19 form is filled out correctly and that they receive the refund they are eligible for.

We hope this article has been helpful in guiding you through the process of filling out the Minnesota St19 form. Remember to carefully review the form, provide accurate information, and attach required supporting documents to ensure a smooth refund process. If you have any further questions or concerns, please don't hesitate to comment below or share this article with others who may find it helpful.

What is the Minnesota St19 form used for?

+The Minnesota St19 form is used to claim a refund for property taxes or rent paid.

What documents do I need to fill out the Minnesota St19 form?

+You will need property tax statements or rent receipts, W-2 forms or 1099 forms, Social Security number or Individual Taxpayer Identification Number (ITIN), and address and contact information.

How do I know if I am eligible for a refund?

+You can determine your eligibility by reviewing the Minnesota Department of Revenue website or consulting with a tax professional.