Transferring property ownership can be a daunting task, especially when it comes to navigating the complex world of real estate law. However, with the right tools and resources, property owners in Minnesota can simplify the process and ensure a smooth transfer of ownership. One such tool is the Minnesota Quick Claim Deed Form, which provides a straightforward and efficient way to transfer property ownership. In this article, we will explore the benefits and workings of the Minnesota Quick Claim Deed Form, providing readers with a comprehensive guide to this valuable resource.

Understanding the Minnesota Quick Claim Deed Form

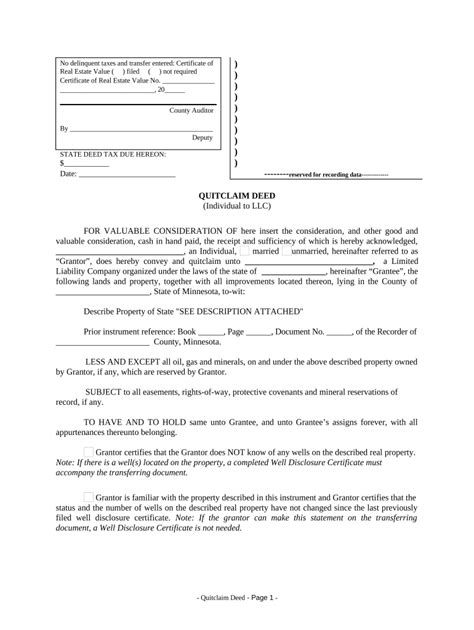

The Minnesota Quick Claim Deed Form is a document used to transfer property ownership from one party to another. It is commonly used in situations where the property owner wishes to transfer ownership to a family member, friend, or business partner. The form is designed to be simple and easy to use, making it an attractive option for those looking to avoid the complexity and expense of a traditional deed transfer.

Benefits of Using the Minnesota Quick Claim Deed Form

- Simplifies the transfer process: The Minnesota Quick Claim Deed Form provides a straightforward and efficient way to transfer property ownership, eliminating the need for complicated paperwork and bureaucratic red tape.

- Reduces costs: Unlike traditional deed transfers, which can involve significant fees and expenses, the Minnesota Quick Claim Deed Form is a cost-effective solution for property owners.

- Preserves ownership rights: The form ensures that the property owner's rights and interests are protected during the transfer process.

How to Use the Minnesota Quick Claim Deed Form

Using the Minnesota Quick Claim Deed Form is a relatively simple process that requires the following steps:

- Download and complete the form: The Minnesota Quick Claim Deed Form can be downloaded from the Minnesota Secretary of State's website or obtained from a local government office. The form should be completed in its entirety, including the names and addresses of the grantor and grantee, as well as a description of the property being transferred.

- Sign and notarize the form: The grantor must sign the form in the presence of a notary public, who will verify the grantor's identity and witness the signature.

- Record the form: The completed and signed form must be recorded with the county recorder's office in the county where the property is located.

Important Considerations When Using the Minnesota Quick Claim Deed Form

- Ensure accuracy: It is essential to ensure that the form is completed accurately and thoroughly, as errors or omissions can lead to delays or complications in the transfer process.

- Comply with state and local regulations: Property owners must comply with all applicable state and local regulations, including those related to taxes, assessments, and zoning.

- Consult with an attorney: While the Minnesota Quick Claim Deed Form is designed to be user-friendly, it is still a complex legal document. Property owners may wish to consult with an attorney to ensure that their rights and interests are protected.

Common Uses of the Minnesota Quick Claim Deed Form

The Minnesota Quick Claim Deed Form is commonly used in a variety of situations, including:

- Transfer of property to a family member: The form is often used to transfer property ownership to a family member, such as a spouse, child, or parent.

- Transfer of property to a business partner: The form can be used to transfer property ownership to a business partner or colleague.

- Transfer of property to a trust: The form is sometimes used to transfer property ownership to a trust, such as a living trust or irrevocable trust.

Alternatives to the Minnesota Quick Claim Deed Form

- Warranty Deed: A warranty deed provides greater protection for the grantee, as it includes a warranty that the grantor has good title to the property.

- Quitclaim Deed: A quitclaim deed is similar to the Minnesota Quick Claim Deed Form but may not provide the same level of protection for the grantee.

Conclusion

The Minnesota Quick Claim Deed Form provides a simple and efficient way to transfer property ownership in Minnesota. By following the steps outlined in this article and ensuring that the form is completed accurately and thoroughly, property owners can ensure a smooth transfer of ownership and avoid potential complications. Whether you are transferring property to a family member, business partner, or trust, the Minnesota Quick Claim Deed Form is a valuable resource that can help you achieve your goals.

We hope this article has provided you with a comprehensive guide to the Minnesota Quick Claim Deed Form. If you have any further questions or concerns, please don't hesitate to comment below or share your thoughts with us.

What is the difference between a Quick Claim Deed and a Warranty Deed?

+A Quick Claim Deed and a Warranty Deed are both used to transfer property ownership, but they differ in terms of the level of protection provided to the grantee. A Warranty Deed includes a warranty that the grantor has good title to the property, while a Quick Claim Deed does not provide this warranty.

Can I use the Minnesota Quick Claim Deed Form to transfer property to a minor?

+No, the Minnesota Quick Claim Deed Form should not be used to transfer property to a minor. Minors are not legally competent to own property, and any transfer of property to a minor may be subject to court approval or other restrictions.