Understanding the Midflorida Credit Union Direct Deposit Form

Direct deposit is a convenient and efficient way to receive your paycheck, government benefits, or other recurring payments. Midflorida Credit Union, a not-for-profit financial cooperative, offers its members the option to set up direct deposit for easy and hassle-free transactions. In this article, we will guide you through the Midflorida Credit Union direct deposit form and provide you with essential information to get started.

Benefits of Direct Deposit with Midflorida Credit Union

Direct deposit offers numerous benefits, including:

- Convenience: No more waiting in line to deposit your paycheck or worrying about lost or stolen checks.

- Speed: Your funds are available immediately, so you can access your money as soon as it's deposited.

- Security: Direct deposit reduces the risk of lost or stolen checks, and your funds are insured by the National Credit Union Administration (NCUA).

- Flexibility: You can choose to deposit your funds into your checking or savings account.

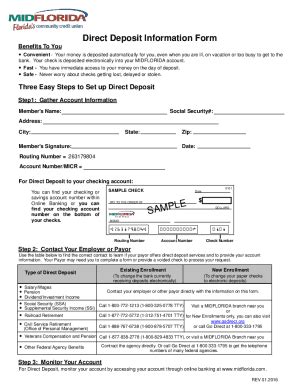

Midflorida Credit Union Direct Deposit Form Requirements

To set up direct deposit with Midflorida Credit Union, you will need to provide the following information:

- Your name and address

- Your account number and type (checking or savings)

- The routing number for Midflorida Credit Union (263178559)

- The name and address of your employer or the sender of the direct deposit

- The amount and frequency of the direct deposit

How to Complete the Midflorida Credit Union Direct Deposit Form

To complete the direct deposit form, follow these steps:

- Download the Midflorida Credit Union direct deposit form from their website or pick one up at a branch location.

- Fill out the form with the required information, making sure to sign and date it.

- Attach a voided check or deposit slip to the form to verify your account information.

- Submit the completed form to your employer or the sender of the direct deposit.

- Verify with your employer or sender that the direct deposit has been set up correctly.

Common Issues with Midflorida Credit Union Direct Deposit

While direct deposit is a convenient and efficient way to receive your payments, issues can arise. Here are some common problems and their solutions:

- Incorrect account information: Verify that your account number and routing number are accurate. Contact Midflorida Credit Union if you need assistance.

- Delayed deposits: Check with your employer or sender to ensure that the direct deposit was sent on time. Also, verify that your account information is correct.

- Missing deposits: Contact Midflorida Credit Union's customer service to investigate the issue.

Midflorida Credit Union Direct Deposit FAQs

- Q: How long does it take for direct deposit to be set up? A: Typically, direct deposit is set up within 1-2 pay cycles.

- Q: Can I split my direct deposit between multiple accounts? A: Yes, you can split your direct deposit between multiple accounts, including checking and savings accounts.

- Q: Is direct deposit secure? A: Yes, direct deposit is a secure way to receive your payments, as it reduces the risk of lost or stolen checks.

What is the routing number for Midflorida Credit Union?

+The routing number for Midflorida Credit Union is 263178559.

Can I set up direct deposit online?

+Yes, you can set up direct deposit online through Midflorida Credit Union's website or mobile app.

How do I verify that my direct deposit has been set up correctly?

+Contact your employer or sender to verify that the direct deposit has been set up correctly. You can also check your account online or through the mobile app to confirm that the deposit has been made.

In conclusion, setting up direct deposit with Midflorida Credit Union is a straightforward process that offers numerous benefits, including convenience, speed, and security. By following the steps outlined in this guide, you can easily complete the direct deposit form and start receiving your payments in a hassle-free way. If you have any questions or concerns, don't hesitate to reach out to Midflorida Credit Union's customer service team for assistance.