Maryland residents, it's that time of the year again - tax season! Filing your taxes can be a daunting task, but with the right guidance, you'll be done in no time. In this article, we'll break down the steps to fill out the MD Tax Form 502, making it easier for you to navigate the process.

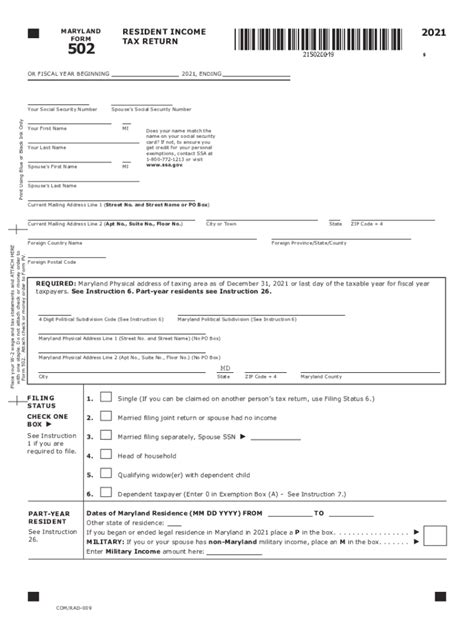

As a Maryland resident, you're required to file your state taxes using Form 502, which is the individual income tax return form. The form is used to report your income, claim deductions and credits, and calculate your tax liability. Before we dive into the steps, let's cover some essential information about the MD Tax Form 502.

What is the MD Tax Form 502?

The MD Tax Form 502 is the standard form used by Maryland residents to file their individual income tax returns. The form is used to report your income from all sources, including wages, salaries, tips, and self-employment income. You'll also use the form to claim deductions and credits, such as the standard deduction, personal exemption, and tax credits for education expenses.

Who Needs to File the MD Tax Form 502?

If you're a Maryland resident, you're required to file the MD Tax Form 502 if you meet certain income requirements. For the 2022 tax year, you'll need to file if your gross income exceeds the following amounts:

- $10,000 or more for single filers

- $20,000 or more for joint filers

- $10,000 or more for head of household filers

- $5,000 or more for estates and trusts

Step 1: Gather Required Documents and Information

Before you start filling out the MD Tax Form 502, make sure you have all the necessary documents and information. You'll need:

- Your W-2 forms from your employer(s)

- Your 1099 forms for freelance work, interest, and dividends

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if filing jointly)

- Information about your dependents, including their Social Security numbers or ITINs

- Records of your business expenses (if self-employed)

- Records of your education expenses (if claiming the education credit)

Step 2: Complete the Residency Section

In this section, you'll need to indicate whether you're a resident, non-resident, or part-year resident of Maryland. You'll also need to provide your Maryland driver's license number or Maryland ID number.

Step 3: Report Your Income

In this section, you'll report your income from all sources, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains and losses

- Rent and royalty income

Make sure to report all your income, even if it's not subject to Maryland tax.

Step 4: Claim Deductions and Credits

In this section, you'll claim your deductions and credits, including:

- Standard deduction

- Personal exemption

- Tax credits for education expenses

- Tax credits for child and dependent care expenses

- Tax credits for retirement savings contributions

Make sure to review the instructions carefully and claim only the deductions and credits you're eligible for.

Step 5: Calculate Your Tax Liability

In this final section, you'll calculate your tax liability based on your income, deductions, and credits. You'll also need to indicate whether you're due a refund or owe additional tax.

Tips and Reminders

- Make sure to review the instructions carefully and follow the steps in order.

- Use black ink to fill out the form, and avoid using white-out or correction fluid.

- If you're filing jointly, both spouses must sign the form.

- Keep a copy of your return and supporting documents for your records.

- If you're due a refund, consider direct deposit to receive your refund faster.

By following these steps and tips, you'll be able to fill out the MD Tax Form 502 with ease. Remember to review the instructions carefully and seek help if you need it. Good luck with your taxes!

What is the deadline for filing the MD Tax Form 502?

+The deadline for filing the MD Tax Form 502 is April 15th of each year.

Can I file my MD Tax Form 502 electronically?

+Yes, you can file your MD Tax Form 502 electronically through the Maryland Comptroller's website.

What if I need help filling out the MD Tax Form 502?

+You can contact the Maryland Comptroller's office for assistance or seek help from a tax professional.