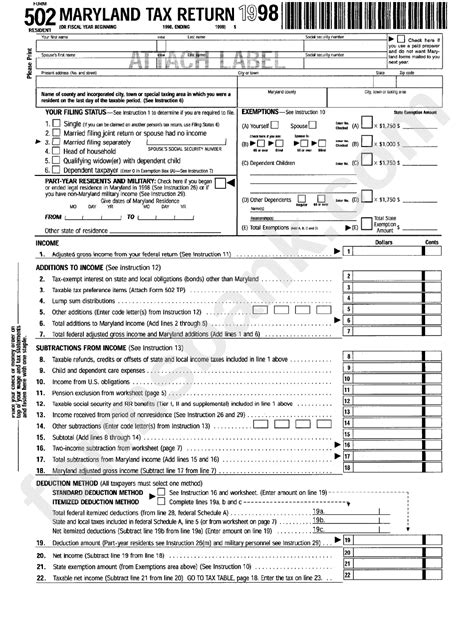

Completing the Maryland Form 502, also known as the Personal Property Tax Return, is a crucial step for businesses operating in the state of Maryland. The form is used to report and pay personal property taxes on business-owned assets, such as equipment, furniture, and vehicles. In this article, we will guide you through the 8 steps to complete the MD Form 502 successfully.

Understanding the MD Form 502

Before we dive into the steps, it's essential to understand the purpose and scope of the MD Form 502. The form is used to report the value of personal property owned or leased by a business, including tangible assets such as:

- Equipment

- Furniture

- Vehicles

- Computers and software

- Inventory

The form is typically filed annually with the Maryland State Department of Assessments and Taxation (SDAT).

Step 1: Gather Required Information

To complete the MD Form 502, you will need to gather the following information:

- Business name and address

- Federal Employer Identification Number (FEIN)

- Business type and classification

- List of personal property assets, including:

- Asset description

- Acquisition date

- Cost or value

- Depreciation method

Step 2: Determine the Filing Deadline

The filing deadline for the MD Form 502 is typically April 15th of each year. However, it's essential to check with the SDAT for any changes to the filing deadline.

Step 3: Complete the Form Header

The form header requires the following information:

- Business name and address

- FEIN

- Business type and classification

- Filing period ( calendar year or fiscal year)

Step 4: Report Personal Property Assets

In this section, you will report the personal property assets owned or leased by your business. You will need to provide the following information for each asset:

- Asset description

- Acquisition date

- Cost or value

- Depreciation method

Step 5: Calculate Depreciation

Depreciation is the decrease in value of an asset over time. You will need to calculate the depreciation for each asset using the depreciation method you selected. The SDAT provides a depreciation schedule to help you calculate the depreciation.

Step 6: Calculate the Tax

Once you have calculated the depreciation, you will need to calculate the tax due. The tax rate is typically 2.5% of the net assessed value of the personal property.

Step 7: Sign and Date the Form

The form must be signed and dated by an authorized representative of the business.

Step 8: Submit the Form

The completed form must be submitted to the SDAT by the filing deadline. You can submit the form online or by mail.

By following these 8 steps, you can ensure that you complete the MD Form 502 successfully and avoid any penalties or fines. Remember to keep accurate records and seek professional help if you need assistance with completing the form.

Common Mistakes to Avoid

When completing the MD Form 502, there are several common mistakes to avoid:

- Failing to report all personal property assets

- Incorrectly calculating depreciation

- Failing to sign and date the form

- Missing the filing deadline

By avoiding these common mistakes, you can ensure that your form is processed correctly and you avoid any penalties or fines.

Conclusion

Completing the MD Form 502 is a crucial step for businesses operating in the state of Maryland. By following the 8 steps outlined in this article, you can ensure that you complete the form successfully and avoid any penalties or fines. Remember to keep accurate records and seek professional help if you need assistance with completing the form.

What is the deadline for filing the MD Form 502?

+The filing deadline for the MD Form 502 is typically April 15th of each year. However, it's essential to check with the SDAT for any changes to the filing deadline.

What is the penalty for failing to file the MD Form 502?

+The penalty for failing to file the MD Form 502 is 10% of the tax due, plus interest at the rate of 1.5% per month or fraction of a month.

Can I file the MD Form 502 online?

+Yes, you can file the MD Form 502 online through the SDAT website.