In the state of Maryland, a Limited Liability Company (LLC) is a popular business structure that offers personal liability protection, tax benefits, and flexibility in management. One of the essential documents required to establish an LLC in Maryland is the Operating Agreement. This document outlines the ownership, management, and operational structure of the LLC, ensuring that all members are on the same page.

Establishing a well-drafted Operating Agreement is crucial for the success and longevity of your Maryland LLC. In this article, we will provide a comprehensive guide to creating an LLC Operating Agreement in Maryland, including a free template to get you started.

Why Do You Need an LLC Operating Agreement in Maryland?

An LLC Operating Agreement serves several purposes:

- Defines ownership and management structure: The agreement outlines the roles and responsibilities of each member, including their ownership percentage, voting rights, and management duties.

- Establishes financial and operational procedures: The agreement outlines the financial management of the LLC, including accounting, budgeting, and distribution of profits and losses.

- Provides a framework for dispute resolution: The agreement establishes a process for resolving conflicts and disputes among members.

- Protects personal assets: By outlining the LLC's ownership and management structure, the agreement helps protect members' personal assets in case of business liabilities.

What to Include in Your Maryland LLC Operating Agreement

A comprehensive Maryland LLC Operating Agreement should include the following sections:

- Company Information: Include the LLC's name, address, and purpose.

- Membership Structure: Outline the ownership percentage, voting rights, and management duties of each member.

- Management and Operation: Describe the management structure, including the roles and responsibilities of each member.

- Capital Contributions: Outline the initial capital contributions of each member and any future contributions.

- Distributions: Describe how profits and losses will be distributed among members.

- Accounting and Record-Keeping: Establish the accounting and record-keeping procedures for the LLC.

- Dispute Resolution: Outline the process for resolving conflicts and disputes among members.

- Amendments and Termination: Describe the process for amending the agreement and terminating the LLC.

How to Create a Maryland LLC Operating Agreement

To create a Maryland LLC Operating Agreement, follow these steps:

- Consult with an attorney: Consider consulting with an attorney to ensure your agreement complies with Maryland state laws.

- Use a template: Use a template as a starting point, such as the one provided below.

- Customize the agreement: Tailor the agreement to your LLC's specific needs and circumstances.

- Review and revise: Review the agreement carefully and revise as necessary.

- Sign and date: Have all members sign and date the agreement.

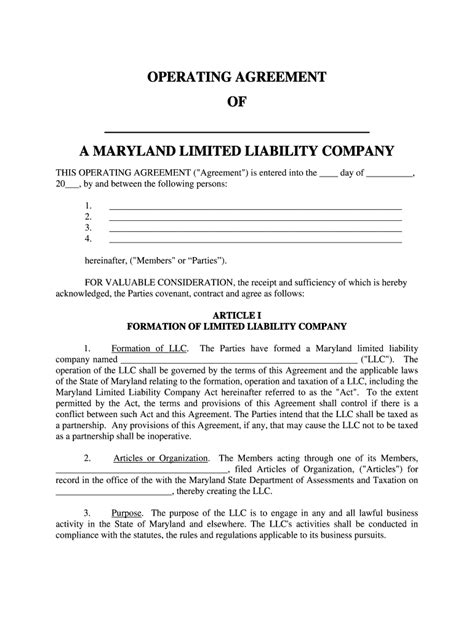

Free Maryland LLC Operating Agreement Template

Below is a free Maryland LLC Operating Agreement template to get you started:

[Company Name] LLC Operating Agreement

This Operating Agreement ("Agreement") is made and entered into on [Date] by and among the members of [Company Name], a Maryland limited liability company.

Article 1: Company Information

- Company Name: [Company Name]

- Address: [Address]

- Purpose: [Purpose]

Article 2: Membership Structure

- Ownership Percentage: [List members and their ownership percentage]

- Voting Rights: [List members and their voting rights]

- Management Duties: [List members and their management duties]

Article 3: Management and Operation

- Management Structure: [Describe the management structure]

- Roles and Responsibilities: [List members and their roles and responsibilities]

Article 4: Capital Contributions

- Initial Capital Contributions: [List members and their initial capital contributions]

- Future Contributions: [Describe the process for future contributions]

Article 5: Distributions

- Profit Distribution: [Describe the process for distributing profits]

- Loss Distribution: [Describe the process for distributing losses]

Article 6: Accounting and Record-Keeping

- Accounting Procedures: [Describe the accounting procedures]

- Record-Keeping Procedures: [Describe the record-keeping procedures]

Article 7: Dispute Resolution

- Dispute Resolution Process: [Describe the process for resolving conflicts and disputes]

Article 8: Amendments and Termination

- Amendment Process: [Describe the process for amending the agreement]

- Termination Process: [Describe the process for terminating the LLC]

IN WITNESS WHEREOF

The undersigned members have executed this Operating Agreement as of the date first above written.

[Member Signatures]

By following this guide and using the provided template, you can create a comprehensive Maryland LLC Operating Agreement that protects your business and its members.

We encourage you to share your thoughts and experiences with creating an LLC Operating Agreement in Maryland in the comments below. If you have any questions or need further guidance, please don't hesitate to ask.

What is the purpose of an LLC Operating Agreement in Maryland?

+The purpose of an LLC Operating Agreement in Maryland is to outline the ownership, management, and operational structure of the LLC, ensuring that all members are on the same page.

What should I include in my Maryland LLC Operating Agreement?

+A comprehensive Maryland LLC Operating Agreement should include sections on company information, membership structure, management and operation, capital contributions, distributions, accounting and record-keeping, dispute resolution, and amendments and termination.

How do I create a Maryland LLC Operating Agreement?

+To create a Maryland LLC Operating Agreement, consult with an attorney, use a template, customize the agreement, review and revise, and sign and date the agreement.