Maryland businesses and individuals are required to comply with various state regulations and filing requirements. One of the essential forms for Maryland taxpayers is the Form 502, which is used to report personal income tax. In this article, we will provide a comprehensive guide on how to file Form 502, including the necessary steps, requirements, and tips to ensure a smooth filing process.

Understanding Form 502

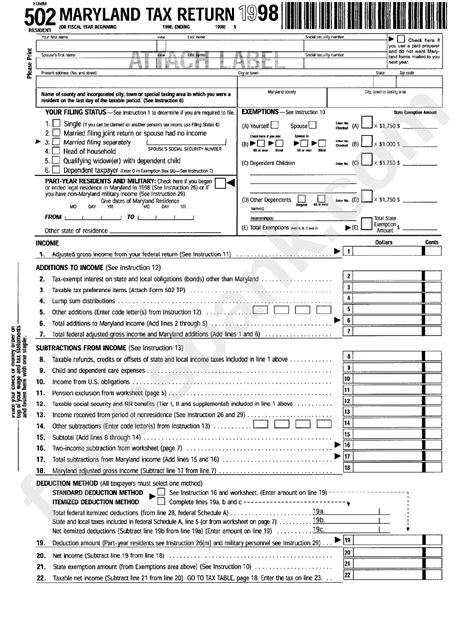

Before we dive into the filing process, it's essential to understand what Form 502 is and why it's required. Form 502 is the Maryland Personal Income Tax Return form, which is used by individuals and businesses to report their income and claim tax credits and deductions. The form is used to calculate the taxpayer's state income tax liability and to determine if they are eligible for a refund.

Who Needs to File Form 502?

Not everyone is required to file Form 502. The following individuals and businesses are required to file:

- Maryland residents who have a federal filing requirement

- Non-residents who have income from Maryland sources

- Businesses that have a Maryland tax liability

- Individuals who want to claim a refund

Preparing to File Form 502

Before you start filing Form 502, make sure you have the necessary documents and information. Here's a checklist of what you'll need:

- Federal income tax return (Form 1040)

- W-2 forms from employers

- 1099 forms for freelance work or self-employment income

- Interest statements from banks and financial institutions

- Dividend statements from investments

- Charitable donation receipts

- Medical expense receipts

- Business expense records (if self-employed)

Gathering Supporting Documents

In addition to the documents listed above, you may need to gather other supporting documents to claim tax credits and deductions. Some examples include:

- Child care expenses

- Education expenses

- Home mortgage interest

- Property taxes

- Charitable donations

Filing Form 502

Now that you have all the necessary documents and information, it's time to start filing Form 502. Here are the steps to follow:

- Download and print Form 502 from the Maryland Comptroller's website or pick one up from a local library or taxpayer service center.

- Fill out the form carefully and accurately, using black ink and a pen.

- Start by entering your personal and business information, including your name, address, and Social Security number.

- Report your income from all sources, including wages, salaries, tips, and self-employment income.

- Claim tax credits and deductions, such as the earned income tax credit, child tax credit, and mortgage interest deduction.

- Calculate your tax liability and determine if you owe taxes or are eligible for a refund.

- Sign and date the form, and attach all supporting documents.

E-Filing Options

Maryland also offers e-filing options for Form 502. You can file electronically through the Maryland Comptroller's website or through a tax preparation software. E-filing is faster and more convenient than paper filing, and you'll receive your refund faster.

Common Mistakes to Avoid

When filing Form 502, there are several common mistakes to avoid. Here are some tips to help you avoid errors:

- Make sure to sign and date the form

- Use the correct address and Social Security number

- Report all income from all sources

- Claim only eligible tax credits and deductions

- Calculate your tax liability accurately

- Attach all supporting documents

Avoiding Penalties and Interest

If you fail to file Form 502 or pay your taxes on time, you may be subject to penalties and interest. Here are some tips to avoid penalties and interest:

- File Form 502 on time, by the April 15th deadline

- Pay your taxes in full, or make a payment plan

- Respond to any notices or letters from the Maryland Comptroller's office

- Keep accurate records and supporting documents

Amending Form 502

If you need to make changes to your Form 502, you'll need to file an amended return. Here's how:

- Download and print Form 502X from the Maryland Comptroller's website.

- Fill out the form carefully and accurately, using black ink and a pen.

- Explain the changes you're making and why.

- Attach supporting documents, such as corrected W-2 forms or 1099 forms.

- Sign and date the form, and mail it to the Maryland Comptroller's office.

Refund Options

If you're eligible for a refund, you can choose from several options:

- Direct deposit: Have your refund deposited directly into your bank account.

- Check: Receive a paper check in the mail.

- Prepaid debit card: Receive a prepaid debit card with your refund amount.

What is the deadline for filing Form 502?

+The deadline for filing Form 502 is April 15th of each year.

Can I e-file Form 502?

+Yes, you can e-file Form 502 through the Maryland Comptroller's website or through a tax preparation software.

What if I need to amend my Form 502?

+If you need to make changes to your Form 502, you'll need to file an amended return using Form 502X.

We hope this guide has been helpful in navigating the process of filing Form 502. If you have any further questions or concerns, please don't hesitate to reach out to the Maryland Comptroller's office or a tax professional. Remember to file on time, report all income, and claim only eligible tax credits and deductions to avoid penalties and interest.