When it comes to managing your finances, having the right forms and documents is essential. One of the most important forms you may need to fill out is the M&T Bank beneficiary form. In this article, we will guide you through the process of filling out the form, provide a link to download it, and answer some frequently asked questions.

The M&T Bank beneficiary form is used to designate who will receive your assets in the event of your death. This form is typically used for retirement accounts, such as 401(k)s and IRAs, as well as for life insurance policies. By filling out the form, you can ensure that your assets are distributed according to your wishes.

What is a Beneficiary Form?

A beneficiary form is a document that allows you to designate who will receive your assets in the event of your death. This form is typically used for retirement accounts, such as 401(k)s and IRAs, as well as for life insurance policies. By filling out the form, you can ensure that your assets are distributed according to your wishes.

Why is a Beneficiary Form Important?

A beneficiary form is important because it allows you to control who will receive your assets in the event of your death. Without a beneficiary form, your assets may be distributed according to state law, which may not align with your wishes. By filling out the form, you can ensure that your assets are distributed according to your wishes, and avoid any potential disputes or conflicts.

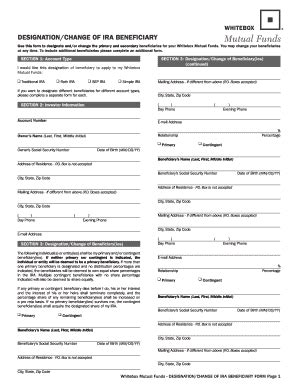

How to Fill Out the M&T Bank Beneficiary Form

Filling out the M&T Bank beneficiary form is a straightforward process. Here are the steps you need to follow:

- Download the form: You can download the M&T Bank beneficiary form from the M&T Bank website or by visiting a local branch.

- Gather required information: You will need to gather some information before filling out the form, including:

- Your name and account number

- The name and address of your beneficiary

- The beneficiary's Social Security number or tax ID number

- Fill out the form: Fill out the form by following the instructions provided. Make sure to sign and date the form.

- Submit the form: Submit the form to M&T Bank by mail or in person.

M&T Bank Beneficiary Form Download

You can download the M&T Bank beneficiary form from the M&T Bank website or by visiting a local branch. Here is a link to the form:

- M&T Bank Beneficiary Form (PDF)

FAQs

Here are some frequently asked questions about the M&T Bank beneficiary form:

Q: Who can I name as a beneficiary?

A: You can name anyone as a beneficiary, including family members, friends, or charitable organizations.

Q: Can I name multiple beneficiaries?

A: Yes, you can name multiple beneficiaries. You will need to specify the percentage of assets that each beneficiary will receive.

Q: Can I change my beneficiary?

A: Yes, you can change your beneficiary at any time by filling out a new beneficiary form.

Q: What happens if I don't fill out a beneficiary form?

A: If you don't fill out a beneficiary form, your assets may be distributed according to state law, which may not align with your wishes.

What is the purpose of a beneficiary form?

+The purpose of a beneficiary form is to designate who will receive your assets in the event of your death.

Can I name a minor as a beneficiary?

+Yes, you can name a minor as a beneficiary, but you will need to designate a guardian or trustee to manage the assets on their behalf.

How often should I review my beneficiary form?

+You should review your beneficiary form regularly, such as every 2-3 years, to ensure that it still aligns with your wishes.

We hope this article has provided you with a comprehensive guide to the M&T Bank beneficiary form. If you have any further questions or concerns, please don't hesitate to reach out to us.