As the tax season approaches, many individuals who have worked with Lowe's, the popular home improvement retailer, are eagerly awaiting their tax forms. Lowe's, like many other companies, is required to provide its employees and contractors with tax forms that detail their income and taxes withheld. In this article, we will delve into the world of tax forms, specifically focusing on the 1099 and W-2 forms that Lowe's issues to its workers.

What is a 1099 Form?

A 1099 form is a tax document that is used to report various types of income that are not subject to withholding, such as freelance work, self-employment income, and interest and dividends. Lowe's, as a payer, is required to issue a 1099 form to its independent contractors and freelancers who have earned more than $600 in a calendar year. The form will show the amount of money earned, as well as any taxes withheld.

Types of 1099 Forms

There are several types of 1099 forms that Lowe's may issue, depending on the type of income earned. Some of the most common types of 1099 forms include:

- 1099-MISC: This form is used to report miscellaneous income, such as freelance work and self-employment income.

- 1099-INT: This form is used to report interest income, such as interest earned on savings accounts and certificates of deposit.

- 1099-DIV: This form is used to report dividend income, such as dividends earned on stocks and mutual funds.

What is a W-2 Form?

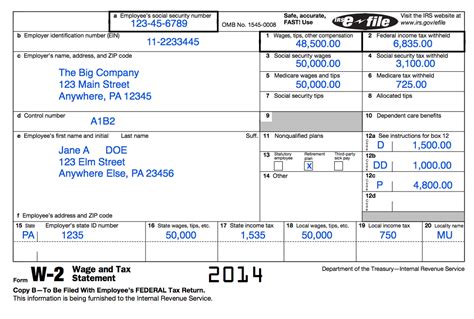

A W-2 form is a tax document that is used to report an employee's income and taxes withheld from their paycheck. Lowe's, as an employer, is required to issue a W-2 form to its employees at the end of each year, showing the amount of money earned, as well as any taxes withheld, including federal income taxes, Social Security taxes, and Medicare taxes.

Information on a W-2 Form

A W-2 form will typically show the following information:

- Employee's name and address

- Employer's name and address

- Employee's Social Security number

- Wages, tips, and other compensation

- Federal income tax withheld

- Social Security tax withheld

- Medicare tax withheld

How to Read Your Lowe's 1099 and W-2 Forms

Reading your Lowe's 1099 and W-2 forms can seem overwhelming, but it's essential to understand the information on these forms to ensure you're filing your taxes correctly. Here are some tips to help you read your forms:

- Check for accuracy: Make sure your name, address, and Social Security number are correct on both forms.

- Review your income: Check the amount of money earned on both forms to ensure it matches your records.

- Review your taxes withheld: Check the amount of taxes withheld on both forms to ensure it matches your records.

- Look for any errors: Check for any errors or discrepancies on both forms and contact Lowe's or the IRS if you find any.

What to Do with Your Lowe's 1099 and W-2 Forms

Once you receive your Lowe's 1099 and W-2 forms, it's essential to know what to do with them. Here are some steps to follow:

- File your taxes: Use the information on your 1099 and W-2 forms to file your taxes.

- Keep a copy: Keep a copy of both forms for your records.

- Contact Lowe's or the IRS: If you find any errors or discrepancies on either form, contact Lowe's or the IRS to resolve the issue.

Common Mistakes to Avoid

When dealing with your Lowe's 1099 and W-2 forms, it's essential to avoid common mistakes that can delay your tax refund or lead to penalties. Here are some mistakes to avoid:

- Not reporting all income: Make sure to report all income earned, including income from freelance work and self-employment.

- Not filing on time: File your taxes on time to avoid penalties and interest.

- Not keeping accurate records: Keep accurate records of your income and taxes withheld to ensure you're filing your taxes correctly.

We hope this article has helped you understand your Lowe's 1099 and W-2 forms. Remember to always review your forms carefully, file your taxes on time, and keep accurate records to avoid any mistakes. If you have any questions or concerns, don't hesitate to contact Lowe's or the IRS for assistance.

Share your thoughts and experiences with us in the comments below! Have you received your Lowe's 1099 and W-2 forms? Do you have any questions or concerns about filing your taxes?

What is the deadline for filing my taxes?

+The deadline for filing your taxes is typically April 15th of each year. However, this deadline may vary if you file for an extension or if you're a victim of identity theft.

What if I find an error on my Lowe's 1099 or W-2 form?

+If you find an error on your Lowe's 1099 or W-2 form, contact Lowe's or the IRS immediately to resolve the issue. You may need to provide documentation to support your claim.

Can I file my taxes electronically?

+Yes, you can file your taxes electronically using tax preparation software or the IRS's e-file system. Electronic filing is faster and more secure than paper filing.