The Louisiana Form L-4 is a crucial document for individuals and businesses operating in the state of Louisiana. As a tax withholding form, it plays a vital role in ensuring compliance with state tax regulations. In this comprehensive guide, we will delve into the world of Louisiana Form L-4, exploring its purpose, benefits, and a step-by-step filing process.

Understanding the Importance of Louisiana Form L-4

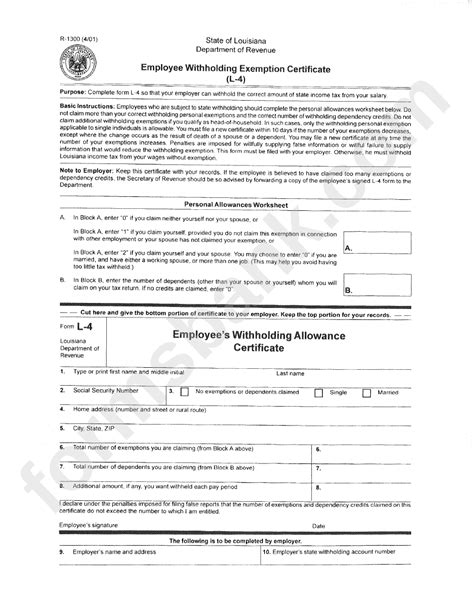

The Louisiana Form L-4, also known as the Employee's Withholding Exemption Certificate, is a vital document for both employees and employers in the state of Louisiana. Its primary purpose is to determine the correct amount of state income tax to withhold from an employee's wages. This form is essential for ensuring that employers comply with state tax regulations and avoid any potential penalties.

Benefits of Filing Louisiana Form L-4

Filing the Louisiana Form L-4 offers numerous benefits for both employees and employers. Some of the key advantages include:

- Accurate tax withholding: By completing the form, employees can ensure that the correct amount of state income tax is withheld from their wages, avoiding any potential underpayment or overpayment of taxes.

- Compliance with state tax regulations: Employers can ensure compliance with state tax regulations, avoiding any potential penalties or fines.

- Simplified tax filing process: The form provides a straightforward and easy-to-understand process for filing state income taxes, reducing the complexity and stress associated with tax season.

Step-By-Step Filing Guide for Louisiana Form L-4

Filing the Louisiana Form L-4 is a relatively straightforward process. Here's a step-by-step guide to help you through the process:

Step 1: Download and Print the Form

The first step is to download and print the Louisiana Form L-4 from the Louisiana Department of Revenue website or obtain a copy from your employer.

Step 2: Complete Section 1: Employee Information

Section 1 of the form requires employees to provide their personal and employment information, including:

- Name and address

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Employer's name and address

Step 3: Complete Section 2: Withholding Exemptions

In Section 2, employees must indicate their withholding exemptions, including:

- Number of allowances claimed

- Exemptions for dependents

- Other exemptions (if applicable)

Step 4: Complete Section 3: Additional Withholding

Section 3 allows employees to request additional withholding, if desired. This section is optional and should only be completed if the employee wishes to have additional state income tax withheld.

Step 5: Sign and Date the Form

Once the form is complete, employees must sign and date it. This step is crucial, as the form must be signed and dated to be considered valid.

Step 6: Submit the Form to Your Employer

The final step is to submit the completed and signed form to your employer. This will ensure that the correct amount of state income tax is withheld from your wages.

Common Mistakes to Avoid When Filing Louisiana Form L-4

When filing the Louisiana Form L-4, it's essential to avoid common mistakes that can lead to delays or penalties. Some of the most common mistakes include:

- Incomplete or inaccurate information

- Failure to sign and date the form

- Submitting the form late or not at all

Frequently Asked Questions About Louisiana Form L-4

Here are some frequently asked questions about the Louisiana Form L-4:

Who is required to file the Louisiana Form L-4?

+All employees working in the state of Louisiana are required to file the Form L-4.

How often do I need to file the Form L-4?

+The Form L-4 should be filed whenever there are changes to your withholding exemptions or additional withholding.

Can I file the Form L-4 electronically?

+No, the Form L-4 must be filed in paper format with your employer.

Conclusion

Filing the Louisiana Form L-4 is a crucial step in ensuring compliance with state tax regulations and avoiding any potential penalties. By following this step-by-step guide, you can ensure that the correct amount of state income tax is withheld from your wages. Remember to avoid common mistakes and submit the form to your employer in a timely manner. If you have any questions or concerns, don't hesitate to reach out to the Louisiana Department of Revenue or your employer for assistance.

We hope this comprehensive guide has been informative and helpful in understanding the Louisiana Form L-4. If you have any further questions or would like to share your experiences with filing the form, please leave a comment below.