Idaho Form 41s is a crucial document for residents and non-residents who have earned income from sources within the state. The form is used to file state income tax, which is a vital part of Idaho's revenue collection. As a taxpayer, understanding the ins and outs of Idaho Form 41s is essential to ensure you are meeting your tax obligations.

In this comprehensive guide, we will delve into the details of Idaho Form 41s, including who needs to file, what information is required, and how to complete the form. We will also explore the benefits of e-filing and provide tips for a smooth filing process.

Who Needs to File Idaho Form 41s?

Idaho Form 41s is required for individuals who have earned income from Idaho sources, regardless of their residency status. This includes:

- Residents who have earned income from Idaho sources, such as wages, salaries, and tips

- Non-residents who have earned income from Idaho sources, such as rental income, royalties, and capital gains

- Part-year residents who have earned income from Idaho sources during their residency period

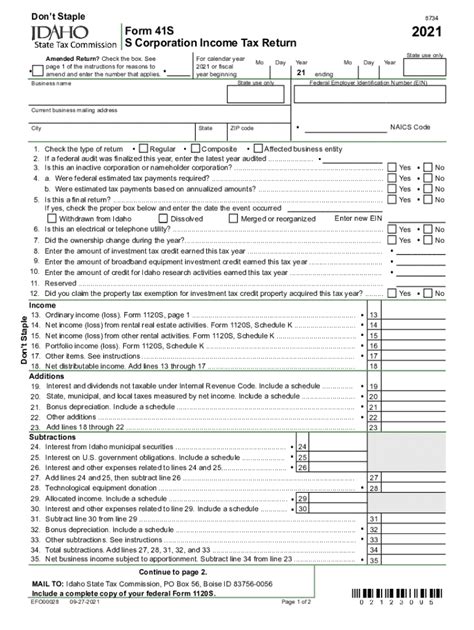

What Information is Required on Idaho Form 41s?

Idaho Form 41s requires a range of information, including:

- Personal details, such as name, address, and Social Security number

- Income information, including wages, salaries, tips, and other income from Idaho sources

- Deductions and credits, such as charitable donations, mortgage interest, and education credits

- Tax payments and withholding information

How to Complete Idaho Form 41s

Completing Idaho Form 41s can be a complex process, but breaking it down into smaller steps can make it more manageable. Here's a step-by-step guide to help you complete the form:

- Gather all necessary documents, including W-2 forms, 1099 forms, and receipts for deductions and credits.

- Complete the personal details section, including your name, address, and Social Security number.

- Report all income from Idaho sources, including wages, salaries, tips, and other income.

- Claim deductions and credits, such as charitable donations, mortgage interest, and education credits.

- Calculate your tax liability and report any tax payments or withholding.

Benefits of E-Filing Idaho Form 41s

E-filing Idaho Form 41s offers several benefits, including:

- Faster processing times

- Reduced error rates

- Increased security

- Convenience and flexibility

Tips for a Smooth Filing Process

To ensure a smooth filing process, follow these tips:

- Gather all necessary documents before starting the filing process.

- Use tax software or consult with a tax professional to ensure accuracy and completeness.

- Double-check your calculations and ensure all information is correct.

- E-file your return to take advantage of faster processing times and reduced error rates.

Idaho Form 41s Deadlines and Penalties

The deadline for filing Idaho Form 41s is typically April 15th, but this can vary depending on the tax year and any extensions. Failure to file or pay taxes on time can result in penalties and interest.

Idaho Form 41s Amended Returns

If you need to make changes to your original return, you can file an amended return using Idaho Form 41s-Amended. This form is used to correct errors or report changes to your original return.

Conclusion

Idaho Form 41s is a critical document for taxpayers who have earned income from Idaho sources. By understanding the requirements and process for filing this form, you can ensure you are meeting your tax obligations and taking advantage of available deductions and credits. Remember to e-file your return to take advantage of faster processing times and reduced error rates.

Take Action

If you are a taxpayer who needs to file Idaho Form 41s, take action today. Gather all necessary documents, complete the form accurately, and e-file your return to avoid penalties and interest. If you have any questions or concerns, consult with a tax professional or contact the Idaho State Tax Commission for assistance.

Frequently Asked Questions

What is Idaho Form 41s?

+Idaho Form 41s is a state income tax return form used by residents and non-residents who have earned income from Idaho sources.

Who needs to file Idaho Form 41s?

+Residents and non-residents who have earned income from Idaho sources need to file Idaho Form 41s.

What is the deadline for filing Idaho Form 41s?

+The deadline for filing Idaho Form 41s is typically April 15th, but this can vary depending on the tax year and any extensions.