Withdrawing from a Lincoln annuity can be a complex process, but having the right guidance can make all the difference. In this article, we will delve into the details of the Lincoln annuity withdrawal form, providing a step-by-step guide to help you navigate the process with ease.

Lincoln annuities are a popular choice for individuals seeking a steady income stream in retirement. However, circumstances may arise where you need to access your funds before the scheduled withdrawal period. This is where the Lincoln annuity withdrawal form comes into play. By understanding the process and requirements, you can ensure a smooth and hassle-free experience.

Understanding the Lincoln Annuity Withdrawal Process

Before we dive into the step-by-step guide, it's essential to understand the basics of the Lincoln annuity withdrawal process. When you purchase a Lincoln annuity, you enter into a contract with the insurance company, which outlines the terms and conditions of the policy. The contract specifies the withdrawal rules, including the amount you can withdraw, the frequency of withdrawals, and any applicable fees.

Step 1: Review Your Contract

The first step in the withdrawal process is to review your Lincoln annuity contract. This document outlines the specific rules and regulations governing withdrawals. Take note of the following:

- Withdrawal amount: Check the minimum and maximum withdrawal amounts allowed per year.

- Withdrawal frequency: Determine how often you can make withdrawals, whether it's monthly, quarterly, or annually.

- Fees and charges: Understand any fees associated with withdrawals, such as surrender charges or administrative fees.

Step 2: Determine Your Withdrawal Options

Lincoln annuities often offer various withdrawal options, including:

- Systematic withdrawals: Regular withdrawals made at set intervals, such as monthly or quarterly.

- Lump-sum withdrawals: One-time withdrawals of a specific amount.

- Required minimum distributions (RMDs): Mandatory withdrawals made after reaching age 72.

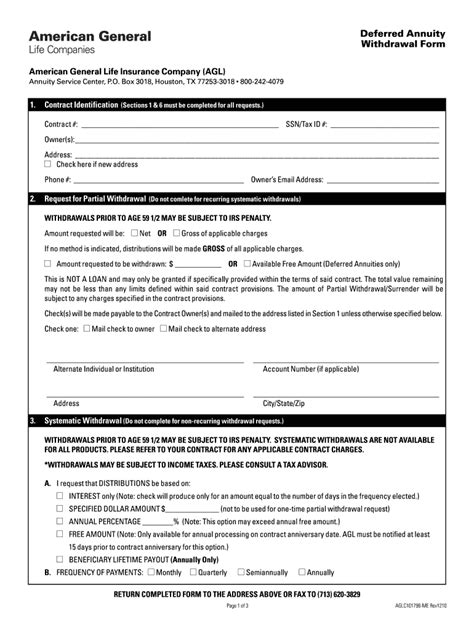

Step 3: Complete the Withdrawal Form

Once you've determined your withdrawal option, you'll need to complete the Lincoln annuity withdrawal form. This form typically requires the following information:

- Policy details: Your policy number, contract date, and annuitant information.

- Withdrawal details: The amount you wish to withdraw, the frequency of withdrawals, and the payment method.

- Beneficiary information: The name and contact information of your beneficiary, if applicable.

Step 4: Submit the Withdrawal Form

After completing the withdrawal form, submit it to Lincoln Financial Group for processing. You can typically do this by:

- Mailing the form to the address specified in your contract.

- Faxing the form to the designated fax number.

- Uploading the form through Lincoln's online portal, if available.

Step 5: Review and Verify Your Withdrawal

Once Lincoln Financial Group receives your withdrawal form, they will review and verify the information. This may take several days or weeks, depending on the complexity of your request. Once your withdrawal is processed, you'll receive a confirmation notification, and the funds will be disbursed according to your instructions.

Additional Tips and Considerations

When withdrawing from a Lincoln annuity, keep the following in mind:

- Tax implications: Withdrawals may be subject to income tax and potential penalties for early withdrawal.

- Fees and charges: Understand any fees associated with withdrawals, such as surrender charges or administrative fees.

- Impact on future benefits: Withdrawals may affect your future annuity benefits, so it's essential to carefully consider your decision.

Conclusion

Withdrawing from a Lincoln annuity requires careful consideration and attention to detail. By following this step-by-step guide, you'll be well-equipped to navigate the process and make informed decisions about your retirement funds. Remember to review your contract, determine your withdrawal options, complete the withdrawal form, submit it for processing, and review and verify your withdrawal. If you're unsure about any aspect of the process, consider consulting with a financial advisor or contacting Lincoln Financial Group directly.

What is the Lincoln annuity withdrawal form?

+The Lincoln annuity withdrawal form is a document used to request withdrawals from a Lincoln annuity policy.

How do I determine my withdrawal options?

+Review your Lincoln annuity contract to determine your withdrawal options, including systematic withdrawals, lump-sum withdrawals, and required minimum distributions (RMDs).

What information do I need to provide on the withdrawal form?

+The withdrawal form typically requires policy details, withdrawal details, and beneficiary information.