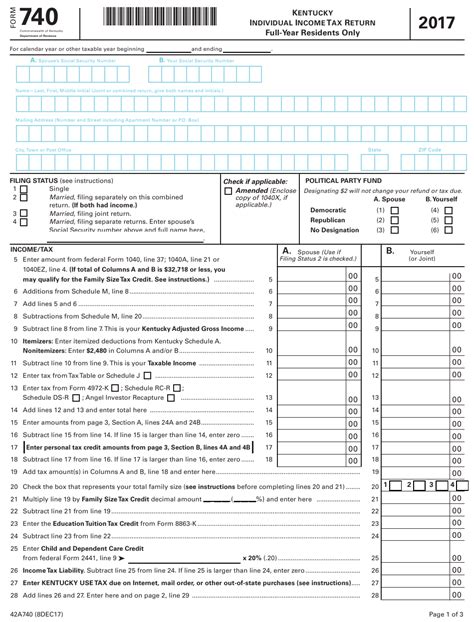

Filing taxes can be a daunting task, but with the right guidance, it can be a breeze. If you're a resident of Kentucky, you'll need to fill out the Ky Tax Form 740 to report your income and claim any deductions and credits you're eligible for. In this article, we'll break down the process into six easy steps, making it simpler for you to complete your tax return.

Step 1: Gather All Necessary Documents

Before you start filling out the Ky Tax Form 740, make sure you have all the necessary documents. This includes:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if filing jointly)

- Your dependents' Social Security numbers or ITINs (if claiming)

- Your W-2 forms from all employers

- Your 1099 forms for freelance work, interest, dividends, and capital gains

- Your receipts for deductions and credits

Having all these documents in one place will save you time and reduce the likelihood of errors.

Step 2: Choose Your Filing Status

Your filing status affects your tax rates and deductions. You can choose from the following:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Make sure to choose the correct filing status, as it will impact your tax liability.

What's the Difference Between Filing Jointly and Separately?

Filing jointly means you and your spouse will report your combined income and claim deductions and credits together. Filing separately means you'll report your income and claim deductions and credits individually.

Step 3: Report Your Income

Report all your income from various sources, including:

- W-2 income from employers

- 1099 income from freelance work, interest, dividends, and capital gains

- Self-employment income

- Rental income

- Royalty income

Make sure to report all income, as failing to do so can lead to penalties and fines.

Step 4: Claim Deductions and Credits

Deductions and credits can reduce your tax liability. Common deductions include:

- Standard deduction

- Itemized deductions (medical expenses, mortgage interest, charitable donations)

- Business expenses

Common credits include:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

Make sure to claim all the deductions and credits you're eligible for to minimize your tax liability.

Step 5: Complete the Tax Computation

Once you've reported your income and claimed deductions and credits, you'll need to compute your tax liability. This involves:

- Calculating your total tax liability

- Applying any tax credits

- Determining your net tax due or refund

Make sure to double-check your calculations to avoid errors.

Step 6: Submit Your Return

Once you've completed the Ky Tax Form 740, you can submit it to the Kentucky Department of Revenue. You can:

- E-file your return through the Kentucky Department of Revenue's website

- Mail your return to the Kentucky Department of Revenue

- Use a tax professional to submit your return

Make sure to submit your return by the deadline to avoid penalties and fines.

What's the Deadline for Filing the Ky Tax Form 740?

The deadline for filing the Ky Tax Form 740 is typically April 15th of each year. However, if you need an extension, you can file Form 740EXT to request a six-month extension.

By following these six steps, you'll be able to fill out the Ky Tax Form 740 easily and accurately. Remember to gather all necessary documents, choose your filing status, report your income, claim deductions and credits, complete the tax computation, and submit your return. If you have any questions or concerns, consider consulting a tax professional or contacting the Kentucky Department of Revenue.

Now that you've completed your tax return, take a moment to relax and enjoy the feeling of accomplishment. Share your experience with friends and family, and don't hesitate to ask for help if you need it.

What is the Ky Tax Form 740?

+The Ky Tax Form 740 is the Kentucky individual income tax return. It's used to report income, claim deductions and credits, and calculate tax liability.

Who needs to file the Ky Tax Form 740?

+Anyone who is a resident of Kentucky and has income must file the Ky Tax Form 740. This includes individuals, married couples, and dependents.

What is the deadline for filing the Ky Tax Form 740?

+The deadline for filing the Ky Tax Form 740 is typically April 15th of each year. However, if you need an extension, you can file Form 740EXT to request a six-month extension.