As an employee, receiving accurate and timely pay is essential. However, mistakes can happen, and payroll adjustments may be necessary. The University of New Mexico (UNM) payroll adjustment form is a crucial document that helps facilitate corrections to employee pay. In this article, we will provide a step-by-step guide on how to complete the UNM payroll adjustment form, ensuring that you receive the correct pay.

The importance of accurate payroll cannot be overstated. Errors in payroll can lead to financial stress, decreased morale, and even legal issues. The UNM payroll adjustment form is designed to help mitigate these issues by providing a standardized process for correcting payroll mistakes.

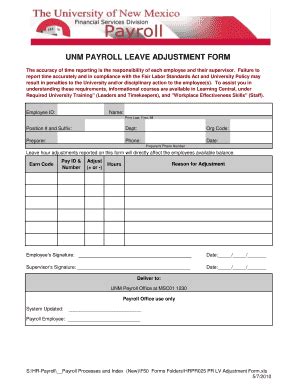

Understanding the UNM Payroll Adjustment Form

The UNM payroll adjustment form is a multi-page document that requires various pieces of information to process payroll corrections. The form is typically used to correct errors in pay, such as overpayments, underpayments, or incorrect benefits deductions.

Benefits of Using the UNM Payroll Adjustment Form

Using the UNM payroll adjustment form provides several benefits, including:

- Accurate payroll corrections: The form ensures that all necessary information is collected to process payroll corrections accurately.

- Standardized process: The form provides a standardized process for correcting payroll mistakes, reducing errors and increasing efficiency.

- Compliance with regulations: The form helps ensure compliance with relevant laws and regulations, such as the Fair Labor Standards Act (FLSA).

Step-by-Step Guide to Completing the UNM Payroll Adjustment Form

Completing the UNM payroll adjustment form requires attention to detail and accurate information. Here is a step-by-step guide to help you complete the form:

- Section 1: Employee Information

- Provide your name, employee ID number, and department.

- Ensure that your information is accurate and up-to-date.

- Section 2: Payroll Adjustment Type

- Select the type of payroll adjustment needed (e.g., overpayment, underpayment, benefits correction).

- Provide a detailed explanation of the reason for the adjustment.

- Section 3: Pay Period Information

- Identify the pay period(s) affected by the error.

- Provide the dates of the pay period(s).

- Section 4: Payroll Error Details

- Describe the error in detail, including the amount of the error.

- Provide supporting documentation, such as pay stubs or timesheets.

- Section 5: Corrected Pay Information

- Provide the corrected pay information, including the correct pay rate and hours worked.

- Ensure that the corrected information is accurate and complete.

- Section 6: Certification and Authorization

- Certify that the information provided is accurate and complete.

- Authorize the payroll adjustment.

Tips for Completing the UNM Payroll Adjustment Form

- Ensure that all sections are completed accurately and thoroughly.

- Provide supporting documentation to substantiate the payroll adjustment.

- Review the form carefully before submitting it.

Common Mistakes to Avoid When Completing the UNM Payroll Adjustment Form

Common mistakes to avoid when completing the UNM payroll adjustment form include:

- Incomplete or inaccurate information

- Failure to provide supporting documentation

- Incorrect or missing employee information

- Failure to certify and authorize the payroll adjustment

Consequences of Not Completing the UNM Payroll Adjustment Form Correctly

Failure to complete the UNM payroll adjustment form correctly can result in:

- Delayed or incorrect payroll corrections

- Additional errors or complications

- Increased risk of non-compliance with regulations

Best Practices for Managing Payroll Adjustments

Best practices for managing payroll adjustments include:

- Regularly reviewing payroll information for accuracy

- Implementing a standardized process for correcting payroll errors

- Providing training and support for employees and payroll staff

- Maintaining accurate and complete payroll records

Benefits of Implementing Best Practices for Payroll Adjustments

Implementing best practices for payroll adjustments provides several benefits, including:

- Improved accuracy and efficiency

- Reduced errors and complications

- Increased compliance with regulations

- Enhanced employee satisfaction and trust

We hope this guide has provided you with a comprehensive understanding of the UNM payroll adjustment form and the importance of accurate payroll management. By following the steps outlined in this article, you can ensure that your payroll adjustments are processed correctly and efficiently.

If you have any questions or concerns about the UNM payroll adjustment form, please don't hesitate to reach out to your HR or payroll representative. We encourage you to share your experiences and feedback in the comments section below.

What is the purpose of the UNM payroll adjustment form?

+The UNM payroll adjustment form is used to correct errors in payroll, such as overpayments, underpayments, or incorrect benefits deductions.

What information is required to complete the UNM payroll adjustment form?

+The form requires employee information, payroll adjustment type, pay period information, payroll error details, corrected pay information, and certification and authorization.

What are the consequences of not completing the UNM payroll adjustment form correctly?

+Failure to complete the form correctly can result in delayed or incorrect payroll corrections, additional errors or complications, and increased risk of non-compliance with regulations.