As a resident of Kentucky, filing your state tax form 740 can be a daunting task, especially if you're new to the process. With various deductions, credits, and forms to navigate, it's essential to ensure you're taking advantage of all the benefits available to you. In this article, we'll provide you with five valuable tips to help you file your Kentucky state tax form 740 with ease.

Understanding the Kentucky State Tax Form 740

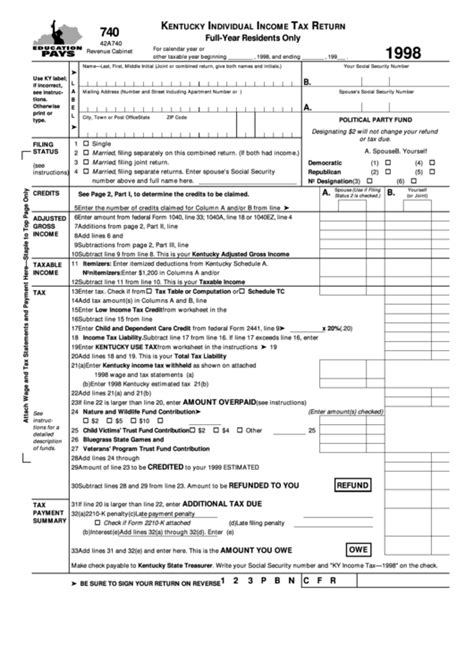

Before we dive into the tips, it's crucial to understand what the Kentucky state tax form 740 is and what it entails. The form 740 is the primary income tax form used by the Kentucky Department of Revenue to calculate the amount of taxes owed by individuals and businesses. It's a comprehensive form that requires you to report your income, deductions, and credits.

Tip 1: Gather All Necessary Documents

To ensure a smooth filing process, gather all necessary documents before starting your form 740. These documents may include:

- W-2 forms from your employer

- 1099 forms for freelance or contract work

- Interest statements from banks and investments

- Dividend statements from stocks and mutual funds

- Charitable donation receipts

- Medical expense receipts

Having all these documents readily available will save you time and reduce the likelihood of errors.

Tip 2: Take Advantage of Kentucky-Specific Deductions

Kentucky offers various deductions that can help reduce your tax liability. Some of these deductions include:

- Homestead Exemption: If you're a homeowner, you may be eligible for a homestead exemption, which can reduce your property taxes.

- Retirement Account Contributions: Contributions to a Kentucky state-sponsored retirement plan, such as the Kentucky Retirement Systems, may be deductible.

- Charitable Donations: Donations to qualified charitable organizations may be deductible.

Be sure to review the Kentucky Department of Revenue's website for a comprehensive list of available deductions.

Tip 3: Claim Kentucky Tax Credits

In addition to deductions, Kentucky offers various tax credits that can further reduce your tax liability. Some of these credits include:

- Earned Income Tax Credit (EITC): If you're a low-to-moderate-income individual, you may be eligible for the EITC.

- Child Care Assistance Program Credit: If you're a working parent, you may be eligible for a credit for child care expenses.

- Adoption Credit: If you've adopted a child, you may be eligible for a credit to offset adoption expenses.

Review the Kentucky Department of Revenue's website for a comprehensive list of available tax credits.

Tip 4: File Electronically

Filing electronically is a convenient and efficient way to submit your form 740. The Kentucky Department of Revenue offers various electronic filing options, including:

- Kentucky e-File: A free online filing system for individuals and businesses.

- Tax preparation software: Many tax preparation software programs, such as TurboTax and H&R Block, support electronic filing of Kentucky state tax returns.

Electronic filing can reduce errors, speed up processing times, and provide faster refunds.

Tip 5: Seek Professional Help if Needed

If you're unsure about any aspect of the filing process or need help with complex tax situations, consider seeking the help of a tax professional. A tax professional can guide you through the process, ensure accuracy, and help you take advantage of all available deductions and credits.

By following these five tips, you'll be well on your way to filing your Kentucky state tax form 740 with ease. Remember to stay organized, take advantage of available deductions and credits, and seek professional help if needed.

Stay Informed and Stay Ahead

We hope you found these tips helpful in navigating the Kentucky state tax form 740. Stay informed about changes to Kentucky tax laws and regulations by visiting the Kentucky Department of Revenue's website. By staying ahead of the curve, you can ensure a smooth and stress-free tax filing experience.

Share Your Thoughts

Have you filed your Kentucky state tax form 740? Share your experiences, tips, and questions in the comments below. We'd love to hear from you and help you navigate the world of Kentucky state taxes.

FAQs

What is the deadline for filing Kentucky state tax form 740?

+The deadline for filing Kentucky state tax form 740 is typically April 15th of each year.

Can I file my Kentucky state tax form 740 electronically?

+Yes, you can file your Kentucky state tax form 740 electronically through the Kentucky Department of Revenue's website or through tax preparation software.

What deductions are available on the Kentucky state tax form 740?

+Kentucky offers various deductions, including the homestead exemption, retirement account contributions, and charitable donations. Review the Kentucky Department of Revenue's website for a comprehensive list of available deductions.