As a resident of Kentucky, understanding your tax obligations is crucial to avoid any penalties or fines. One of the essential tax forms you need to familiarize yourself with is the Kentucky Tax Form TC 96 182. This form is used for various tax-related purposes, and in this article, we will delve into its details, exploring what it is, how to fill it out, and its significance in the tax filing process.

What is Kentucky Tax Form TC 96 182?

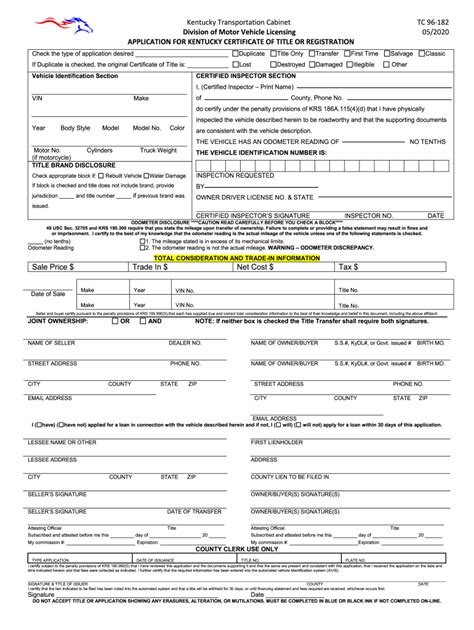

The Kentucky Tax Form TC 96 182 is a document used by the Kentucky Department of Revenue to report and pay various taxes, including withholding tax, sales tax, and use tax. This form is also known as the "Kentucky Withholding Tax Form" or "Kentucky Sales and Use Tax Form." Its primary purpose is to ensure that businesses and individuals comply with the state's tax laws and regulations.

Types of Taxes Reported on Form TC 96 182

There are several types of taxes that can be reported on Form TC 96 182, including:

- Withholding tax: This tax is withheld from employee wages and is reported on a quarterly basis.

- Sales tax: This tax is levied on the sale of tangible personal property and certain services.

- Use tax: This tax is imposed on the use or consumption of tangible personal property that is not subject to sales tax.

How to Fill Out Form TC 96 182

Filling out Form TC 96 182 requires careful attention to detail to ensure accuracy and avoid any errors. Here's a step-by-step guide to help you complete the form:

- Identification Information: Enter your business name, address, and federal employer identification number (FEIN) or social security number (SSN).

- Tax Type: Select the type of tax you are reporting (withholding tax, sales tax, or use tax).

- Tax Period: Enter the tax period for which you are reporting (quarterly or monthly).

- Tax Due: Calculate the total tax due and enter the amount.

- Payment: Enter the payment amount and method (check or electronic funds transfer).

- Certification: Sign and date the form to certify that the information is accurate and complete.

Additional Requirements

In addition to filling out Form TC 96 182, you may need to attach supporting documentation, such as:

- W-2 forms for employees

- 1099 forms for independent contractors

- Sales tax exemption certificates

- Use tax exemption certificates

When to File Form TC 96 182

The filing frequency for Form TC 96 182 depends on the type of tax you are reporting:

- Withholding tax: Quarterly (April 30, July 31, October 31, and January 31)

- Sales tax: Monthly (20th day of the following month)

- Use tax: Quarterly (April 30, July 31, October 31, and January 31)

Penalties for Late Filing or Non-Compliance

Failure to file Form TC 96 182 on time or failure to comply with the state's tax laws and regulations can result in penalties and fines. The Kentucky Department of Revenue may impose:

- Late filing penalty: 10% of the tax due

- Late payment penalty: 10% of the tax due

- Interest on unpaid tax: 6% per annum

Appealing a Penalty

If you receive a penalty notice, you can appeal the decision by filing a written protest with the Kentucky Department of Revenue. You must provide evidence to support your claim and explain why you believe the penalty was incorrect.

Conclusion

In conclusion, Kentucky Tax Form TC 96 182 is an essential document for businesses and individuals in Kentucky. Understanding how to fill out the form and meeting the filing deadlines can help you avoid penalties and fines. If you have any questions or concerns, you can contact the Kentucky Department of Revenue for assistance.

We hope this article has provided you with a comprehensive guide to Kentucky Tax Form TC 96 182. If you have any further questions or would like to share your experiences, please comment below.

What is the purpose of Kentucky Tax Form TC 96 182?

+The purpose of Kentucky Tax Form TC 96 182 is to report and pay various taxes, including withholding tax, sales tax, and use tax.

How often do I need to file Form TC 96 182?

+The filing frequency for Form TC 96 182 depends on the type of tax you are reporting. Withholding tax is filed quarterly, sales tax is filed monthly, and use tax is filed quarterly.

What are the penalties for late filing or non-compliance?

+The Kentucky Department of Revenue may impose penalties and fines for late filing or non-compliance, including a 10% late filing penalty, 10% late payment penalty, and interest on unpaid tax.