Filing taxes can be a daunting task, especially when it comes to state-specific forms like the Kentucky Form 740. As a resident of the Bluegrass State, it's essential to understand the filing instructions and tips to ensure you're taking advantage of all the credits and deductions available to you. In this article, we'll break down the Kentucky Form 740 filing instructions and provide valuable tips to help you navigate the process with ease.

Understanding the Kentucky Form 740

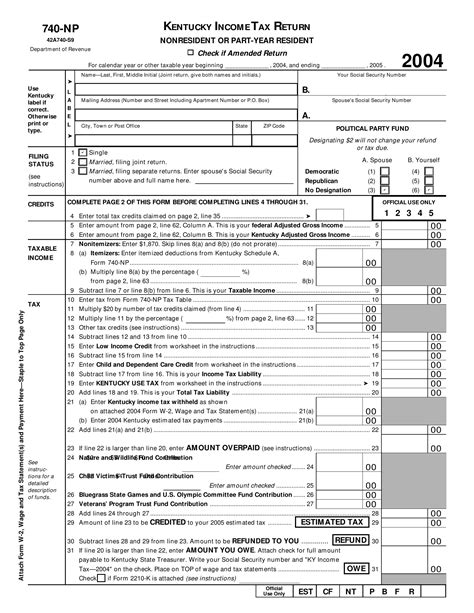

The Kentucky Form 740 is the state's individual income tax return form. It's used to report your income, claim credits and deductions, and calculate your state tax liability. The form is typically due on April 15th of each year, unless you're requesting an extension.

Filing Status and Residency

Before you start filling out the form, you'll need to determine your filing status and residency. Your filing status will determine which credits and deductions you're eligible for, while your residency will impact which forms you need to file.

- Filing Status: You can file as single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Residency: If you're a resident of Kentucky, you'll need to file the Form 740. If you're a non-resident or part-year resident, you may need to file a different form.

**Kentucky Form 740 Filing Instructions**

Now that you've determined your filing status and residency, let's dive into the filing instructions for the Kentucky Form 740.

Step 1: Gather Required Documents

Before you start filling out the form, make sure you have all the necessary documents, including:

- Your W-2 forms from all employers

- Your 1099 forms for freelance work or self-employment income

- Your interest statements from banks and investments

- Your dividend statements from stocks and investments

- Your charitable donation receipts

Step 2: Fill Out the Form

Once you have all your documents, start filling out the Form 740. Make sure to:

- Enter your name, address, and Social Security number correctly

- Report all your income from W-2 and 1099 forms

- Claim all eligible credits and deductions

- Calculate your state tax liability

Step 3: Claim Credits and Deductions

Kentucky offers several credits and deductions to help reduce your state tax liability. Some of the most common include:

- The Kentucky Earned Income Tax Credit (EITC)

- The Kentucky Child and Dependent Care Credit

- The Kentucky Education Savings Account Credit

- The Kentucky Mortgage Interest Credit

**Kentucky Tax Credits**

Kentucky offers several tax credits to help reduce your state tax liability. Some of the most common include:

- The Kentucky Earned Income Tax Credit (EITC): This credit is designed to help low-income working individuals and families.

- The Kentucky Child and Dependent Care Credit: This credit is designed to help working families with child care expenses.

- The Kentucky Education Savings Account Credit: This credit is designed to help families save for education expenses.

Step 4: File Your Return

Once you've completed the Form 740, you can file your return electronically or by mail.

- Electronic Filing: You can e-file your return through the Kentucky Department of Revenue's website or through a tax software provider.

- Mail Filing: You can mail your return to the Kentucky Department of Revenue.

Tips and Reminders

Here are a few tips and reminders to keep in mind when filing your Kentucky Form 740:

- Make sure to file your return on time to avoid penalties and interest.

- Take advantage of all eligible credits and deductions to reduce your state tax liability.

- Keep accurate records of your income and expenses in case of an audit.

- Consider consulting a tax professional if you're unsure about any part of the filing process.

**Common Mistakes to Avoid**

When filing your Kentucky Form 740, there are several common mistakes to avoid:

- Failing to report all income

- Failing to claim all eligible credits and deductions

- Failing to sign and date the return

- Failing to keep accurate records

Conclusion

Filing your Kentucky Form 740 can be a complex process, but by following these instructions and tips, you can ensure you're taking advantage of all the credits and deductions available to you. Remember to gather all required documents, fill out the form accurately, and claim all eligible credits and deductions. Don't hesitate to consult a tax professional if you're unsure about any part of the filing process.

What is the deadline for filing the Kentucky Form 740?

+The deadline for filing the Kentucky Form 740 is April 15th of each year, unless you're requesting an extension.

What credits and deductions are available on the Kentucky Form 740?

+Kentucky offers several credits and deductions, including the Kentucky Earned Income Tax Credit (EITC), the Kentucky Child and Dependent Care Credit, and the Kentucky Education Savings Account Credit.

Can I e-file my Kentucky Form 740?

+Yes, you can e-file your Kentucky Form 740 through the Kentucky Department of Revenue's website or through a tax software provider.