Filing taxes can be a daunting task, but with the right guidance, it can be a breeze. If you're a Kentucky resident, you'll need to file Form 740, the Kentucky Individual Income Tax Return. Here are five tips to help you navigate the process and ensure you're taking advantage of all the deductions and credits available to you.

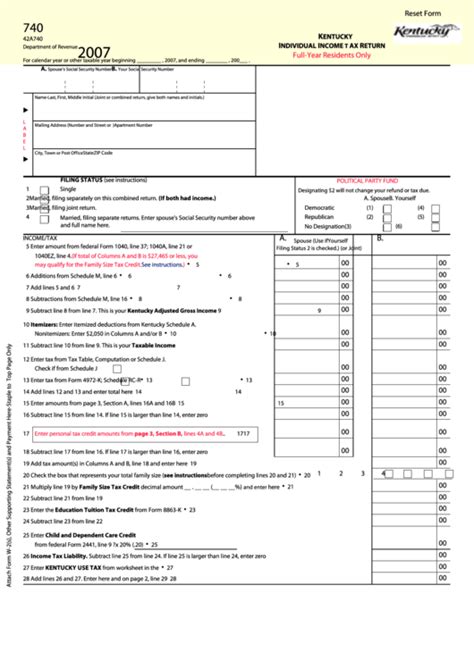

Understanding Kentucky Tax Form 740

Before we dive into the tips, let's take a brief look at what Form 740 entails. This form is used to report your income, claim deductions and credits, and calculate your tax liability. You'll need to file Form 740 if you're a Kentucky resident, or if you have Kentucky-source income and are not a resident.

Tip 1: Gather All Necessary Documents

To ensure a smooth filing process, gather all the necessary documents beforehand. These may include:

- Your W-2 forms from employers

- 1099 forms for freelance work or other income

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense receipts

- Mortgage interest statements

Having all these documents in one place will save you time and reduce stress when filling out Form 740.

**Kentucky Tax Credits and Deductions**

Kentucky offers various tax credits and deductions that can help reduce your tax liability. Let's explore some of the most common ones:

- Kentucky Earned Income Tax Credit (EITC): If you're eligible for the federal EITC, you may also be eligible for the Kentucky EITC.

- Kentucky Child and Dependent Care Credit: If you paid for childcare or adult care while working or looking for work, you may be eligible for this credit.

- Kentucky Education Savings Plan: Contributions to a Kentucky Education Savings Plan may be deductible.

- Kentucky Mortgage Interest Credit: If you're a homeowner, you may be eligible for a credit for mortgage interest paid.

**Understanding Kentucky Tax Rates**

Kentucky has a progressive tax system, with tax rates ranging from 2% to 6%. The tax rate you'll pay depends on your taxable income. Here's a breakdown of the tax rates:

- 2%: Taxable income up to $3,000

- 3%: Taxable income between $3,001 and $4,000

- 4%: Taxable income between $4,001 and $5,000

- 5%: Taxable income between $5,001 and $10,000

- 6%: Taxable income over $10,000

Tip 2: Claim All Eligible Credits and Deductions

To minimize your tax liability, make sure to claim all eligible credits and deductions. Review the credits and deductions mentioned earlier and ensure you're taking advantage of those you're eligible for.

Tip 3: File Electronically

Filing electronically is the fastest and most convenient way to file your Kentucky tax return. You can use tax software like TurboTax or H&R Block to guide you through the process. Electronic filing also reduces the risk of errors and ensures faster processing of your return.

Tip 4: Take Advantage of Kentucky's Volunteer Firefighter and Rescue Squad Tax Credit

If you're a volunteer firefighter or rescue squad member, you may be eligible for a tax credit of up to $1,000. This credit is designed to recognize the valuable contributions of volunteer emergency responders.

Tip 5: Seek Professional Help If Needed

If you're unsure about any aspect of filing Form 740, consider seeking professional help. A tax professional can guide you through the process, ensure you're taking advantage of all eligible credits and deductions, and help you avoid errors.

Wrapping Up

Filing Kentucky tax Form 740 can seem daunting, but by following these five tips, you'll be well on your way to a stress-free filing experience. Remember to gather all necessary documents, claim all eligible credits and deductions, file electronically, take advantage of the Volunteer Firefighter and Rescue Squad Tax Credit, and seek professional help if needed.

By taking the time to understand Kentucky's tax laws and regulations, you'll be able to navigate the filing process with confidence. Happy filing!

What is the deadline for filing Kentucky tax Form 740?

+The deadline for filing Kentucky tax Form 740 is typically April 15th of each year.

Can I file my Kentucky tax return electronically?

+Yes, you can file your Kentucky tax return electronically using tax software like TurboTax or H&R Block.

What is the Kentucky Earned Income Tax Credit (EITC)?

+The Kentucky EITC is a tax credit for low-to-moderate-income working individuals and families.