As a resident of Kentucky, understanding the state's tax filing requirements is essential to avoid any penalties or fines. The Kentucky Form 740 NP is a crucial document for non-residents and part-year residents who need to file their state income tax returns. In this article, we will delve into the filing requirements and instructions for Kentucky Form 740 NP, providing you with a comprehensive guide to ensure you meet the necessary obligations.

What is Kentucky Form 740 NP?

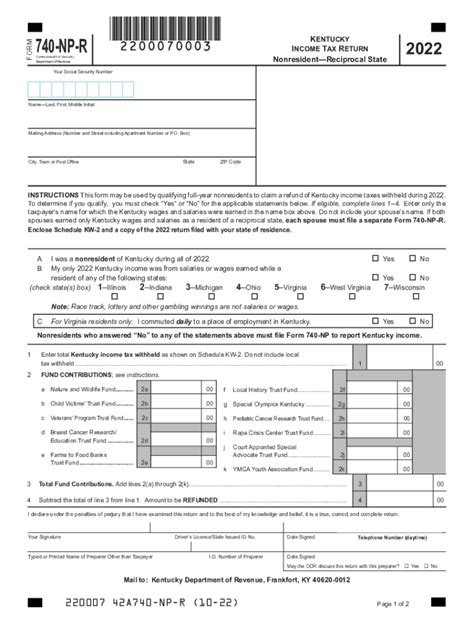

Kentucky Form 740 NP is the state's non-resident and part-year resident income tax return form. This form is used by individuals who are not residents of Kentucky but have earned income from sources within the state. Part-year residents, on the other hand, are those who have lived in Kentucky for only part of the tax year. The form is used to report and pay state income tax on earnings from Kentucky sources.

Who Needs to File Kentucky Form 740 NP?

The following individuals are required to file Kentucky Form 740 NP:

- Non-residents who have earned income from Kentucky sources, including but not limited to:

- Wages or salaries earned while working in Kentucky

- Income from a business or profession conducted in Kentucky

- Rent or royalty income from Kentucky properties

- Capital gains from the sale of Kentucky properties or assets

- Part-year residents who have lived in Kentucky for only part of the tax year

- Individuals who have earned income from a Kentucky-based business or profession, even if they do not live in the state

Filing Status and Residency Requirements

To determine your filing status and residency requirements, you must consider the following:

- Filing status: You can file as single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Residency: You are considered a resident of Kentucky if you have lived in the state for at least 183 days during the tax year.

What Income is Subject to Kentucky Tax?

The following types of income are subject to Kentucky tax:

- Wages or salaries earned in Kentucky

- Income from a business or profession conducted in Kentucky

- Rent or royalty income from Kentucky properties

- Capital gains from the sale of Kentucky properties or assets

- Interest and dividend income from Kentucky-based financial institutions

- Income from a Kentucky-based trust or estate

Exemptions and Deductions

You may be eligible for exemptions and deductions on your Kentucky Form 740 NP, including:

- Standard deduction: $2,460 for single filers, $4,920 for joint filers

- Personal exemption: $2,000 for each dependent

- Itemized deductions: Medical expenses, mortgage interest, property taxes, and charitable contributions

- Business expenses: Deductions for business-related expenses, such as travel and equipment

Filing Instructions and Deadlines

To file your Kentucky Form 740 NP, follow these steps:

- Gather all necessary documents, including your W-2 forms, 1099 forms, and any other relevant tax documents.

- Complete the form and calculate your tax liability.

- Pay any tax due by the filing deadline.

- File your return electronically or by mail.

The filing deadline for Kentucky Form 740 NP is April 15th of each year. If you need an extension, you can file Form 740EXT to request an automatic six-month extension.

Payment Options and Penalties

You can pay your Kentucky tax liability using the following options:

- Electronic funds transfer (EFT)

- Check or money order

- Credit or debit card

If you fail to pay your tax liability on time, you may be subject to penalties and interest. The penalty for late payment is 10% of the unpaid tax, plus interest at a rate of 12% per annum.

Audit and Appeal Process

If you are selected for an audit, you will receive a notice from the Kentucky Department of Revenue. You have the right to appeal any assessment or penalty imposed by the department.

To appeal, you must file a written protest within 30 days of the notice. The protest should include your name, address, and a detailed explanation of your dispute.

Conclusion and Next Steps

Filing your Kentucky Form 740 NP requires careful attention to detail and a thorough understanding of the state's tax laws and regulations. By following the instructions and guidelines outlined in this article, you can ensure a smooth and accurate filing process.

If you have any questions or concerns, you can contact the Kentucky Department of Revenue for assistance. Remember to stay organized, and don't hesitate to seek professional help if needed.

Take the next step and start preparing your Kentucky Form 740 NP today!

What is the deadline for filing Kentucky Form 740 NP?

+The filing deadline for Kentucky Form 740 NP is April 15th of each year.

What types of income are subject to Kentucky tax?

+Wages or salaries earned in Kentucky, income from a business or profession conducted in Kentucky, rent or royalty income from Kentucky properties, and capital gains from the sale of Kentucky properties or assets are all subject to Kentucky tax.

How do I pay my Kentucky tax liability?

+You can pay your Kentucky tax liability using electronic funds transfer (EFT), check or money order, or credit or debit card.