Kansas residents and businesses are fortunate to have access to various tax credits and deductions that can help reduce their tax liability. One of the primary forms used to claim these credits and deductions is the Kansas Form K-40. In this article, we will provide an in-depth guide to understanding the Kansas Form K-40, including its purpose, eligibility requirements, and the various tax credits and deductions that can be claimed.

Understanding the Kansas Form K-40

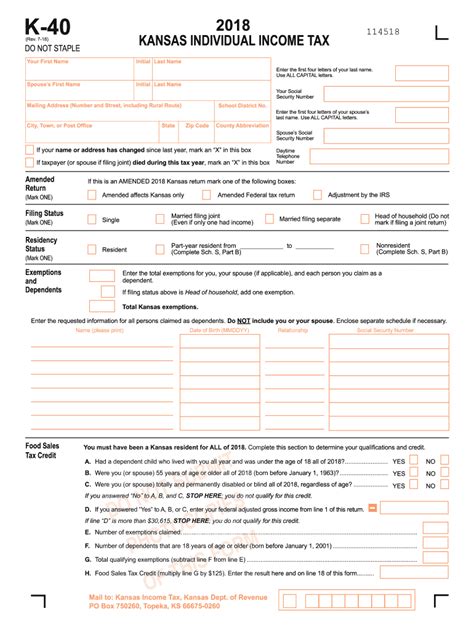

The Kansas Form K-40 is the primary form used by Kansas residents and businesses to report their state income tax liability. The form is used to calculate the taxpayer's total tax liability, as well as to claim any applicable tax credits and deductions. The Kansas Form K-40 is typically filed on an annual basis, with the deadline for filing typically being April 15th of each year.

Eligibility Requirements

To be eligible to file the Kansas Form K-40, taxpayers must meet certain requirements. These requirements include:

- Being a resident of Kansas for at least part of the tax year

- Having earned income from Kansas sources, such as wages, salaries, or self-employment income

- Having paid Kansas state income tax during the tax year

Types of Tax Credits and Deductions

The Kansas Form K-40 allows taxpayers to claim a variety of tax credits and deductions, including:

Tax Credits

Tax credits are dollar-for-dollar reductions in tax liability. Some common tax credits available on the Kansas Form K-40 include:

- Earned Income Tax Credit (EITC): A refundable tax credit available to low-income working individuals and families.

- Child Tax Credit: A non-refundable tax credit available to taxpayers with qualifying children.

- Education Tax Credit: A non-refundable tax credit available to taxpayers who have paid education expenses.

Tax Deductions

Tax deductions, on the other hand, reduce taxable income. Some common tax deductions available on the Kansas Form K-40 include:

- Standard Deduction: A fixed amount that can be deducted from taxable income.

- Itemized Deductions: A list of specific expenses that can be deducted from taxable income, such as mortgage interest, charitable donations, and medical expenses.

- Business Expenses: A list of expenses related to a taxpayer's business or self-employment income.

**Claiming Tax Credits and Deductions**

To claim tax credits and deductions on the Kansas Form K-40, taxpayers must complete the relevant sections of the form. This includes:

- Part 1: Income: Reporting all income earned during the tax year, including wages, salaries, and self-employment income.

- Part 2: Adjustments: Claiming any applicable adjustments to income, such as alimony payments or student loan interest.

- Part 3: Tax Credits: Claiming any applicable tax credits, such as the EITC or Child Tax Credit.

- Part 4: Tax Deductions: Claiming any applicable tax deductions, such as the standard deduction or itemized deductions.

Additional Tax Credits and Deductions

In addition to the tax credits and deductions listed above, there are several other credits and deductions available to Kansas taxpayers. These include:

Kansas State Tax Credits

- Kansas Earned Income Tax Credit: A state-specific version of the federal EITC.

- Kansas Child Tax Credit: A state-specific version of the federal Child Tax Credit.

- Kansas Education Tax Credit: A state-specific credit available to taxpayers who have paid education expenses.

Kansas State Tax Deductions

- Kansas Mortgage Interest Deduction: A deduction available to taxpayers who have paid mortgage interest on a primary residence.

- Kansas Charitable Donation Deduction: A deduction available to taxpayers who have made charitable donations.

- Kansas Medical Expense Deduction: A deduction available to taxpayers who have paid medical expenses.

**Tips for Filing the Kansas Form K-40**

To ensure accurate and timely filing of the Kansas Form K-40, taxpayers should keep the following tips in mind:

- File electronically: Filing electronically can help reduce errors and speed up processing time.

- Use tax preparation software: Tax preparation software can help taxpayers navigate the complex tax code and ensure accurate filing.

- Seek professional help: Taxpayers who are unsure about how to file the Kansas Form K-40 should seek help from a qualified tax professional.

Conclusion

The Kansas Form K-40 is a critical document for Kansas residents and businesses, providing access to various tax credits and deductions that can help reduce tax liability. By understanding the purpose and eligibility requirements of the form, as well as the various tax credits and deductions available, taxpayers can ensure accurate and timely filing. Remember to file electronically, use tax preparation software, and seek professional help if needed.

FAQ Section

What is the deadline for filing the Kansas Form K-40?

+The deadline for filing the Kansas Form K-40 is typically April 15th of each year.

What is the Earned Income Tax Credit (EITC)?

+The EITC is a refundable tax credit available to low-income working individuals and families.

Can I claim the standard deduction and itemized deductions on the same return?

+No, taxpayers can only claim one or the other, not both.