Jamaica, a tropical paradise known for its stunning beaches, lush mountains, and rich culture, is also a popular destination for tourists and businesses alike. As a business owner or individual looking to establish a presence in Jamaica, you may need to file a C5 Form with the Jamaican government. In this article, we will provide a comprehensive guide on how to file a Jamaica C5 Form, including the required documents, steps, and benefits of compliance.

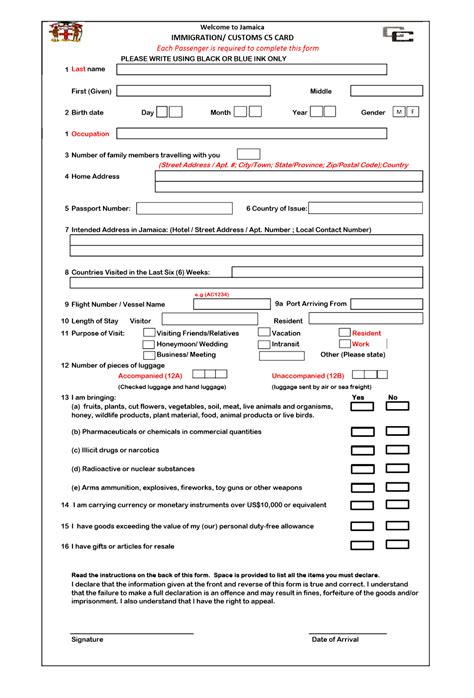

The C5 Form is a critical document required by the Jamaican government for businesses and individuals who want to engage in commercial activities on the island. It is a declaration form that outlines the details of the business or individual, including their name, address, and purpose of business. Filing a C5 Form is a mandatory step for anyone looking to establish a business presence in Jamaica, and failure to comply can result in penalties and fines.

Benefits of Filing a Jamaica C5 Form

Filing a C5 Form provides several benefits for businesses and individuals looking to establish a presence in Jamaica. Some of the key benefits include:

- Compliance with Jamaican law: Filing a C5 Form is a mandatory requirement for businesses and individuals who want to engage in commercial activities in Jamaica. By filing the form, you demonstrate your commitment to compliance and avoid potential penalties and fines.

- Tax benefits: By filing a C5 Form, you may be eligible for tax benefits and incentives offered by the Jamaican government.

- Business registration: Filing a C5 Form is a necessary step for registering your business with the Jamaican government.

- Access to government services: By filing a C5 Form, you may gain access to government services and resources, including trade licenses and permits.

Required Documents for Filing a Jamaica C5 Form

To file a C5 Form, you will need to provide the following documents:

- A copy of your passport or national ID

- Proof of business registration (e.g. articles of incorporation, business license)

- A copy of your tax identification number (TIN)

- A detailed description of your business activities

- A list of your business locations in Jamaica

Additional Requirements for Non-Residents

If you are a non-resident looking to file a C5 Form, you will need to provide additional documentation, including:

- A copy of your visa or work permit

- A letter of introduction from your Jamaican business partner or sponsor

- A copy of your tax returns from the previous year

Step-by-Step Guide to Filing a Jamaica C5 Form

Filing a C5 Form involves several steps, which are outlined below:

- Obtain a copy of the C5 Form: You can obtain a copy of the C5 Form from the Jamaican government website or from a local business registration office.

- Complete the C5 Form: Fill out the C5 Form in its entirety, providing all required information and documentation.

- Submit the C5 Form: Submit the completed C5 Form to the relevant authorities, along with all required documentation.

- Pay the filing fee: Pay the filing fee, which is currently JMD 5,000 (approximately USD 35).

- Wait for processing: Wait for the Jamaican government to process your C5 Form, which can take several weeks.

Common Mistakes to Avoid When Filing a Jamaica C5 Form

When filing a C5 Form, it is essential to avoid common mistakes that can delay or prevent processing. Some common mistakes to avoid include:

- Incomplete or inaccurate information

- Failure to provide required documentation

- Incorrect filing fee payment

- Late filing

By avoiding these common mistakes, you can ensure a smooth and efficient filing process.

Conclusion

Filing a Jamaica C5 Form is a critical step for businesses and individuals looking to establish a presence in Jamaica. By following the steps outlined in this guide, you can ensure compliance with Jamaican law and avoid potential penalties and fines. Remember to provide all required documentation and avoid common mistakes to ensure a smooth and efficient filing process.

We encourage you to share your experiences and ask questions in the comments below. Don't forget to share this article with your colleagues and friends who may be looking to establish a business presence in Jamaica.

What is the purpose of the C5 Form?

+The C5 Form is a declaration form required by the Jamaican government for businesses and individuals who want to engage in commercial activities on the island.

What documents are required to file a C5 Form?

+A copy of your passport or national ID, proof of business registration, a copy of your tax identification number, a detailed description of your business activities, and a list of your business locations in Jamaica.

How long does it take to process a C5 Form?

+The processing time for a C5 Form can take several weeks.