Setting up direct deposit is a great way to manage your finances more efficiently. Wells Fargo, one of the largest banks in the United States, offers a direct deposit service that allows you to have your paycheck, government benefits, or other payments deposited directly into your account. In this article, we will guide you through the process of filling out the Wells Fargo Direct Deposit Authorization Form.

What is the Wells Fargo Direct Deposit Authorization Form?

The Wells Fargo Direct Deposit Authorization Form is a document that you need to complete and submit to authorize the direct deposit of funds into your Wells Fargo account. The form is used to provide your employer, government agency, or other payers with the necessary information to set up direct deposit.

Benefits of Using the Wells Fargo Direct Deposit Authorization Form

Using the Wells Fargo Direct Deposit Authorization Form offers several benefits, including:

- Convenience: Direct deposit saves you time and effort by eliminating the need to physically deposit checks or cash.

- Security: Direct deposit reduces the risk of lost or stolen checks, and you can be sure that your funds are safe and secure.

- Timeliness: With direct deposit, you can access your funds on the same day they are deposited, eliminating the need to wait for checks to clear.

- Cost-effectiveness: Direct deposit can help you avoid fees associated with depositing checks or cash.

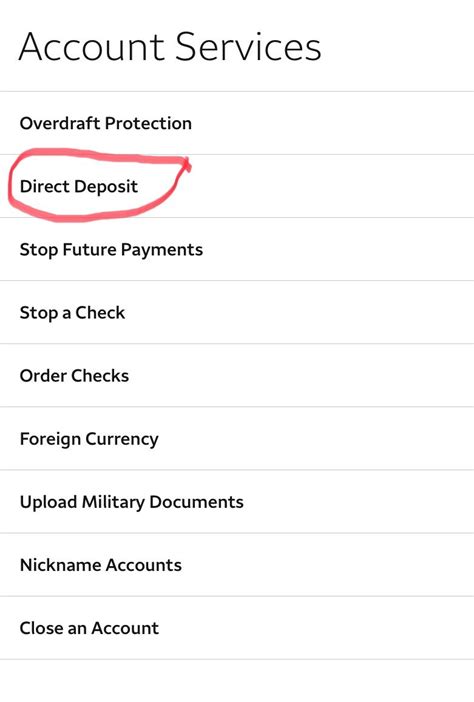

How to Fill Out the Wells Fargo Direct Deposit Authorization Form

To fill out the Wells Fargo Direct Deposit Authorization Form, follow these steps:

- Gather required information: Before you start filling out the form, make sure you have the following information:

- Your Wells Fargo account number

- Your Wells Fargo routing number (also known as the ABA number)

- Your employer's or payer's name and address

- The type of payment you want to receive via direct deposit (e.g., payroll, government benefits, etc.)

- Complete the form: Fill out the form accurately and completely, making sure to include all required information.

- Sign the form: Sign the form in the presence of a notary public, if required.

- Submit the form: Submit the completed form to your employer or payer, along with any required supporting documentation.

Wells Fargo Direct Deposit Authorization Form Requirements

To ensure that your direct deposit is set up correctly, make sure you meet the following requirements:

- Account requirements: You must have a valid Wells Fargo checking or savings account to receive direct deposit.

- Routing number: You must provide your Wells Fargo routing number, which can be found on the bottom of your checks or on the Wells Fargo website.

- Account number: You must provide your Wells Fargo account number, which can be found on your checks or on the Wells Fargo website.

- Payment type: You must specify the type of payment you want to receive via direct deposit.

Common Mistakes to Avoid When Filling Out the Form

When filling out the Wells Fargo Direct Deposit Authorization Form, avoid the following common mistakes:

- Inaccurate information: Make sure to provide accurate information, including your account number and routing number.

- Incomplete form: Complete the form fully and accurately, making sure to include all required information.

- Unsigned form: Sign the form in the presence of a notary public, if required.

Wells Fargo Direct Deposit FAQs

Here are some frequently asked questions about the Wells Fargo Direct Deposit Authorization Form:

- Q: How long does it take to set up direct deposit? A: The time it takes to set up direct deposit varies depending on the payer, but it typically takes 1-2 pay periods.

- Q: Can I use direct deposit for multiple payments? A: Yes, you can use direct deposit for multiple payments, including payroll, government benefits, and other types of payments.

- Q: Can I cancel direct deposit at any time? A: Yes, you can cancel direct deposit at any time by contacting your employer or payer.

What is the Wells Fargo Direct Deposit Authorization Form used for?

+The Wells Fargo Direct Deposit Authorization Form is used to authorize the direct deposit of funds into your Wells Fargo account.

How do I fill out the Wells Fargo Direct Deposit Authorization Form?

+To fill out the form, gather required information, complete the form accurately and completely, sign the form, and submit it to your employer or payer.

What are the benefits of using the Wells Fargo Direct Deposit Authorization Form?

+The benefits of using the form include convenience, security, timeliness, and cost-effectiveness.

In conclusion, filling out the Wells Fargo Direct Deposit Authorization Form is a straightforward process that can help you manage your finances more efficiently. By following the steps outlined in this article, you can ensure that your direct deposit is set up correctly and start enjoying the benefits of direct deposit.