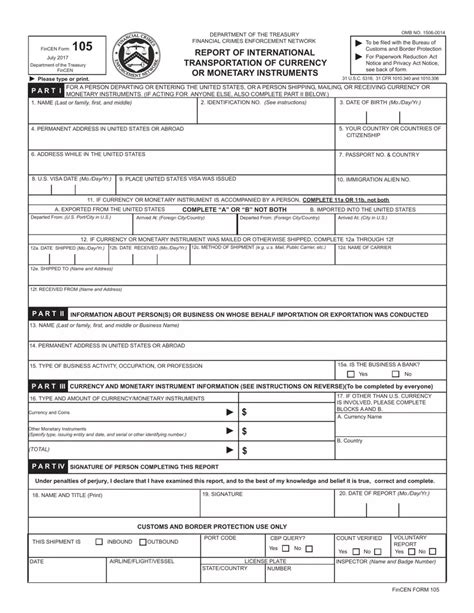

The Financial Crimes Enforcement Network (FinCEN) Form 105, also known as the Report of International Transportation of Currency or Monetary Instruments (CMIR), is a crucial document that affects your IRS report. As a traveler, it's essential to understand the implications of this form on your tax obligations. In this article, we'll explore three ways FinCEN Form 105 affects your IRS report.

What is FinCEN Form 105?

Before we dive into the effects of FinCEN Form 105 on your IRS report, let's briefly discuss what this form is. FinCEN Form 105 is a report required by the Bank Secrecy Act (BSA) for individuals who transport or ship currency or monetary instruments exceeding $10,000 into or out of the United States. This includes cash, traveler's checks, money orders, or other monetary instruments.

1. Reporting Requirements

The first way FinCEN Form 105 affects your IRS report is by requiring you to report certain transactions. If you transport or ship currency or monetary instruments exceeding $10,000, you must file FinCEN Form 105 with the U.S. Customs and Border Protection (CBP) within 15 days of the transaction. This report must include information about the transaction, such as the date, amount, and type of currency or monetary instruments involved.

Failure to file FinCEN Form 105 or providing false information can result in penalties and fines, which can negatively impact your IRS report.

1.1 Penalties for Non-Compliance

The penalties for non-compliance with FinCEN Form 105 reporting requirements can be severe. According to the BSA, failure to file the report or providing false information can result in a penalty of up to $250,000 or twice the value of the transaction, whichever is greater. In addition to the penalty, you may also face fines and even prosecution.

2. Cash Transaction Reporting

The second way FinCEN Form 105 affects your IRS report is through cash transaction reporting. When you file FinCEN Form 105, you're also required to report certain cash transactions to the IRS. This includes transactions exceeding $10,000 in a single transaction or multiple transactions within a 24-hour period.

2.1 Cash Transaction Types

The following types of cash transactions are reportable:

- Cash deposits or withdrawals exceeding $10,000

- Cash transactions involving foreign currencies exceeding $10,000

- Cash transactions involving monetary instruments exceeding $10,000

2.2 IRS Reporting Requirements

When you file FinCEN Form 105, you're also required to report these cash transactions to the IRS on Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business. Failure to report these transactions can result in penalties and fines, which can negatively impact your IRS report.

3. Tax Implications

The third way FinCEN Form 105 affects your IRS report is through tax implications. When you file FinCEN Form 105, you're required to report certain transactions that may have tax implications. For example, if you transport or ship currency or monetary instruments exceeding $10,000 into or out of the United States, you may be required to report this income on your tax return.

3.1 Income Reporting

If you receive income from a foreign source, you're required to report this income on your tax return. Failure to report this income can result in penalties and fines, which can negatively impact your IRS report.

3.2 Foreign Account Reporting

If you have a foreign bank account or other foreign financial assets, you're required to report these assets on Form 8938, Statement of Specified Foreign Financial Assets. Failure to report these assets can result in penalties and fines, which can negatively impact your IRS report.

In conclusion, FinCEN Form 105 has significant implications for your IRS report. It's essential to understand the reporting requirements, cash transaction reporting, and tax implications of this form to avoid penalties and fines.

If you have any questions or concerns about FinCEN Form 105 or its impact on your IRS report, please don't hesitate to comment below. We'd be happy to help you navigate the complexities of this form and ensure compliance with all applicable regulations.

Take Action

To ensure compliance with FinCEN Form 105 and its impact on your IRS report, take the following actions:

- Familiarize yourself with the reporting requirements and cash transaction reporting rules

- Consult with a tax professional or financial advisor to ensure compliance

- File FinCEN Form 105 and Form 8300, if required

- Report foreign income and assets on your tax return

By taking these actions, you can avoid penalties and fines and ensure compliance with all applicable regulations.

What is FinCEN Form 105?

+FinCEN Form 105 is a report required by the Bank Secrecy Act (BSA) for individuals who transport or ship currency or monetary instruments exceeding $10,000 into or out of the United States.

What are the penalties for non-compliance with FinCEN Form 105?

+The penalties for non-compliance with FinCEN Form 105 can be severe, including a penalty of up to $250,000 or twice the value of the transaction, whichever is greater.

How does FinCEN Form 105 affect my IRS report?

+FinCEN Form 105 affects your IRS report in three ways: reporting requirements, cash transaction reporting, and tax implications.