The IRS Form W-4V is a crucial document for individuals who receive certain government payments, such as social security benefits, unemployment compensation, and pensions. The form allows individuals to certify their eligibility for exempt or reduced rate of withholding on these payments. However, accessing and filling out the form can be a daunting task for many. In this article, we will explore five easy ways to access the IRS Form W-4V printable and provide a comprehensive guide on how to fill it out.

What is IRS Form W-4V?

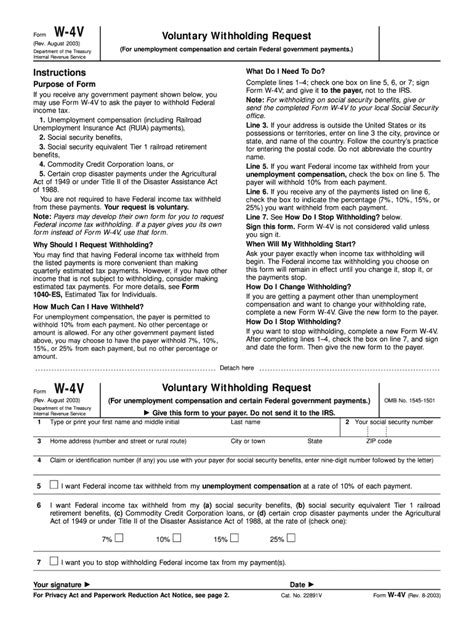

The IRS Form W-4V, also known as the Voluntary Withholding Request, is a form used by individuals to request that federal income tax be withheld from certain government payments. The form is typically used by individuals who receive social security benefits, unemployment compensation, and pensions. By filling out the form, individuals can choose to have federal income tax withheld from these payments, which can help reduce their tax liability at the end of the year.

5 Ways to Access IRS Form W-4V Printable

Accessing the IRS Form W-4V printable can be done in several ways. Here are five easy methods:

1. IRS Website

The most convenient way to access the IRS Form W-4V printable is through the official IRS website. Simply visit the IRS website at and search for "Form W-4V." You can download and print the form directly from the website.

2. IRS Phone

If you prefer to receive a physical copy of the form, you can call the IRS at 1-800-829-3676 (toll-free) and request that a copy be mailed to you.

3. Local IRS Office

You can also visit your local IRS office to obtain a copy of the form. Use the IRS Office Locator tool on the IRS website to find the nearest office to you.

4. Social Security Administration

If you are receiving social security benefits, you can also obtain a copy of the form from your local Social Security Administration office. Use the SSA Office Locator tool on the SSA website to find the nearest office to you.

5. Online Tax Preparation Software

Many online tax preparation software programs, such as TurboTax and H&R Block, offer access to the IRS Form W-4V printable. These programs can also guide you through the process of filling out the form and provide additional resources and support.

Filling Out IRS Form W-4V

Filling out the IRS Form W-4V is a relatively straightforward process. Here are the steps to follow:

- Certify your eligibility: Read and sign the certification statement on the form to confirm that you are eligible for exempt or reduced rate of withholding.

- Choose your withholding rate: Select the percentage of withholding you want to apply to your government payments. You can choose from 7%, 10%, 12%, or 22%.

- Provide your identification information: Enter your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Specify the type of payment: Identify the type of government payment you are receiving, such as social security benefits or unemployment compensation.

- Sign and date the form: Sign and date the form to confirm your certification and withholding rate.

Common Questions and Answers

Here are some common questions and answers about the IRS Form W-4V:

Q: What is the deadline for submitting Form W-4V? A: There is no specific deadline for submitting Form W-4V. However, it is recommended that you submit the form as soon as possible to ensure that withholding begins on your next payment.

Q: Can I submit Form W-4V electronically? A: No, Form W-4V must be submitted in paper form. You can mail or fax the form to the IRS or submit it in person at your local IRS office.

Q: Can I change my withholding rate after submitting Form W-4V? A: Yes, you can change your withholding rate at any time by submitting a new Form W-4V. However, the new rate will only apply to future payments.

Conclusion

Accessing and filling out the IRS Form W-4V printable can be a straightforward process. By following the steps outlined in this article, you can easily obtain and complete the form. Remember to choose the correct withholding rate and provide accurate identification information to ensure that your tax liability is accurately reflected. If you have any further questions or concerns, don't hesitate to reach out to the IRS or your local tax professional.What's your experience with IRS Form W-4V? Share your thoughts and questions in the comments below!

What is the purpose of IRS Form W-4V?

+The purpose of IRS Form W-4V is to certify an individual's eligibility for exempt or reduced rate of withholding on certain government payments, such as social security benefits and unemployment compensation.

How do I submit Form W-4V to the IRS?

+You can submit Form W-4V to the IRS by mail, fax, or in person at your local IRS office.

Can I change my withholding rate after submitting Form W-4V?

+Yes, you can change your withholding rate at any time by submitting a new Form W-4V.