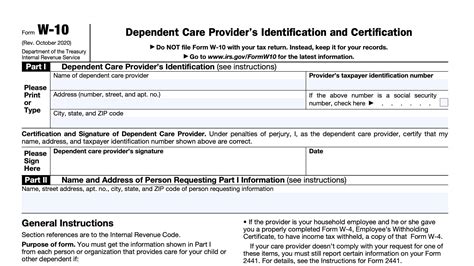

As a parent or guardian, taking care of your dependents is a top priority. However, finding reliable and trustworthy caregivers can be a daunting task. The IRS Form W-10, also known as the Dependent Care Provider Information form, is a crucial document that helps you report information about the caregivers who take care of your dependents. In this article, we will delve into the world of Form W-10, exploring its importance, benefits, and step-by-step instructions on how to complete it.

What is Form W-10?

Form W-10 is a document that provides information about the caregivers who take care of your dependents. The form is used to report the name, address, and taxpayer identification number (TIN) of the caregiver, as well as the amount of money paid to them for their services. The information reported on Form W-10 is used to determine whether you are eligible for the Child and Dependent Care Credit, a tax credit that helps offset the costs of childcare.

Why is Form W-10 important?

Form W-10 is essential for several reasons:

- Tax credit eligibility: By completing Form W-10, you can determine whether you are eligible for the Child and Dependent Care Credit. This credit can help reduce your tax liability, resulting in a lower tax bill or a larger refund.

- Record-keeping: Form W-10 serves as a record of the caregivers who have taken care of your dependents. This information can be useful for future reference, especially if you need to claim the Child and Dependent Care Credit in subsequent years.

- Compliance with IRS regulations: Failing to complete Form W-10 or providing inaccurate information can result in penalties and fines. By completing the form accurately and on time, you can avoid any potential issues with the IRS.

Benefits of Form W-10

Completing Form W-10 offers several benefits, including:

- Streamlined tax preparation: By having all the necessary information in one place, you can simplify your tax preparation process and reduce the risk of errors.

- Accurate tax credits: Form W-10 helps ensure that you receive the correct amount of tax credits, which can result in significant savings.

- Improved record-keeping: The form provides a centralized location for storing information about your caregivers, making it easier to track and manage your dependent care expenses.

Step-by-Step Instructions for Completing Form W-10

To complete Form W-10, follow these step-by-step instructions:

- Gather necessary information: Before starting the form, make sure you have the following information:

- Caregiver's name and address

- Caregiver's taxpayer identification number (TIN)

- Amount of money paid to the caregiver

- Download Form W-10: You can download Form W-10 from the IRS website or obtain a copy from your local IRS office.

- Complete the form: Fill out the form with the required information, making sure to include the caregiver's name, address, and TIN.

- Attach supporting documentation: Attach a copy of the caregiver's TIN and any other supporting documentation, such as payment receipts.

- Submit the form: Submit the completed form to the IRS, either electronically or by mail, depending on your preference.

Tips and Reminders

When completing Form W-10, keep the following tips and reminders in mind:

- Use accurate information: Make sure to use accurate and up-to-date information when completing the form.

- Keep records: Keep a copy of the completed form and supporting documentation for your records.

- Submit on time: Submit the form by the required deadline to avoid any potential penalties.

Common Mistakes to Avoid

When completing Form W-10, avoid the following common mistakes:

- Inaccurate information: Double-check the information you provide to ensure it is accurate and up-to-date.

- Missing documentation: Make sure to attach all required supporting documentation, such as payment receipts.

- Late submission: Submit the form by the required deadline to avoid any potential penalties.

Frequently Asked Questions

Q: What is the purpose of Form W-10?

A: Form W-10 is used to report information about the caregivers who take care of your dependents, including their name, address, and taxpayer identification number.

Q: Who needs to complete Form W-10?

A: Parents and guardians who pay for dependent care services need to complete Form W-10.

Q: What is the deadline for submitting Form W-10?

A: The deadline for submitting Form W-10 varies depending on your tax filing status. Check the IRS website for specific deadlines.

Q: Can I submit Form W-10 electronically?

A: Yes, you can submit Form W-10 electronically through the IRS website.

Conclusion

In conclusion, Form W-10 is a crucial document that helps you report information about the caregivers who take care of your dependents. By completing the form accurately and on time, you can determine whether you are eligible for the Child and Dependent Care Credit, simplify your tax preparation process, and ensure compliance with IRS regulations.