Completing IRS Form 8689 can be a daunting task, especially for those who are new to the process. However, with the right guidance, it can be a manageable and even straightforward process. In this article, we will provide you with 7 tips to help you complete IRS Form 8689 accurately and efficiently.

Tip 1: Understand the Purpose of IRS Form 8689

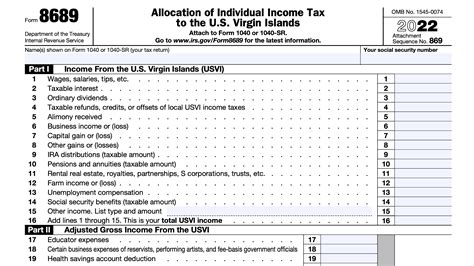

Before you start filling out IRS Form 8689, it's essential to understand its purpose. IRS Form 8689 is used to calculate and report the Allocation of Individual Income Tax to Guam or the Northern Mariana Islands. This form is typically used by individuals who have income from sources within Guam or the Northern Mariana Islands.

What You Need to Know

To complete IRS Form 8689, you will need to provide information about your income, deductions, and credits. You will also need to allocate your income between Guam or the Northern Mariana Islands and the United States.

Tip 2: Gather Required Documents

To complete IRS Form 8689 accurately, you will need to gather certain documents and information. These may include:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your address and phone number

- Information about your income, including wages, salaries, and tips

- Information about your deductions and credits, including charitable donations and mortgage interest

- Information about your allocation of income between Guam or the Northern Mariana Islands and the United States

Tip 3: Use the Correct Filing Status

Your filing status will determine which tax rates and deductions you are eligible for. When completing IRS Form 8689, make sure to use the correct filing status. Your filing status may be single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

How to Determine Your Filing Status

To determine your filing status, you will need to consider your marital status, age, and other factors. You can use the IRS's Filing Status tool to help you determine your filing status.

Tip 4: Report Income Accurately

Reporting income accurately is crucial when completing IRS Form 8689. Make sure to report all income from sources within Guam or the Northern Mariana Islands, including wages, salaries, and tips.

Tip 5: Claim Deductions and Credits

Claiming deductions and credits can help reduce your tax liability. When completing IRS Form 8689, make sure to claim all eligible deductions and credits, including charitable donations and mortgage interest.

Types of Deductions and Credits

There are several types of deductions and credits you may be eligible for, including:

- Standard deduction

- Itemized deductions

- Earned Income Tax Credit (EITC)

- Child Tax Credit

Tip 6: Allocate Income Correctly

Allocating income correctly is crucial when completing IRS Form 8689. Make sure to allocate your income between Guam or the Northern Mariana Islands and the United States accurately.

Tip 7: Review and Edit Carefully

Finally, review and edit your IRS Form 8689 carefully before submitting it. Make sure to check for errors and inaccuracies, and correct them as needed.

What to Check for

When reviewing and editing your IRS Form 8689, make sure to check for:

- Errors in math calculations

- Inaccurate or incomplete information

- Missing signatures or dates

By following these 7 tips, you can complete IRS Form 8689 accurately and efficiently. Remember to take your time, gather all required documents, and review and edit carefully before submitting.

What is IRS Form 8689 used for?

+IRS Form 8689 is used to calculate and report the Allocation of Individual Income Tax to Guam or the Northern Mariana Islands.

What documents do I need to complete IRS Form 8689?

+You will need to gather documents such as your Social Security number or ITIN, address and phone number, income information, and deduction and credit information.

How do I allocate income between Guam or the Northern Mariana Islands and the United States?

+You will need to use the correct allocation percentage for your income from sources within Guam or the Northern Mariana Islands and the United States.