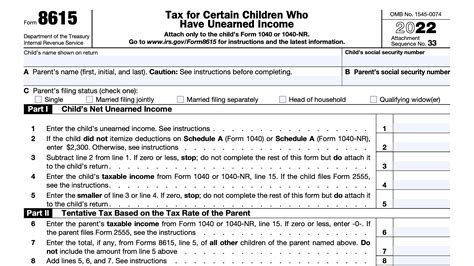

As a parent or guardian, ensuring your child's tax obligations are met is crucial. One form that may be required for your child's tax filing is IRS Form 8615, also known as the "Dependency Exemption and/or Child Tax Credit." This form is used to report the income of certain children under the age of 18, or under the age of 24 if a full-time student. The purpose of Form 8615 is to calculate the amount of tax owed on your child's unearned income, which includes dividends, capital gains, and interest.

Filling out Form 8615 can be a complex process, but with the right guidance, you can ensure your child's tax obligations are met accurately. In this article, we will provide you with five essential tips for filling out IRS Form 8615.

Tip 1: Determine if Your Child Needs to File Form 8615

Before you start filling out Form 8615, it's essential to determine if your child needs to file this form. Generally, if your child's unearned income exceeds $1,100, they will need to file Form 8615. However, there are some exceptions to this rule. For example, if your child's only income is from interest and dividends, and the total amount is less than $1,100, they may not need to file Form 8615.

To determine if your child needs to file Form 8615, you will need to calculate their net unearned income. This includes:

- Dividends

- Capital gains

- Interest

- Royalties

If your child's net unearned income exceeds $1,100, you will need to complete Form 8615.

What is Considered Unearned Income?

Unearned income includes income that is not earned through a job or self-employment. Examples of unearned income include:

- Dividends from stocks or mutual funds

- Capital gains from the sale of assets

- Interest from savings accounts or bonds

- Royalties from intellectual property

Tip 2: Gather All Required Documents

Before you start filling out Form 8615, it's essential to gather all the required documents. This includes:

- Your child's social security number or individual taxpayer identification number (ITIN)

- Your child's birthdate

- Your child's unearned income statements (e.g., 1099-DIV, 1099-INT)

- Your child's tax return (if they have one)

Having all the required documents will make it easier to complete Form 8615 accurately.

What if I Don't Have All the Required Documents?

If you don't have all the required documents, you can still file Form 8615. However, you will need to estimate your child's unearned income and provide an explanation for the missing documents. It's essential to note that estimating income can lead to errors, which may result in penalties or delays in processing your child's tax return.

Tip 3: Complete Form 8615 Accurately

Completing Form 8615 accurately is crucial to avoid errors and penalties. Here are some tips to help you complete Form 8615 accurately:

- Use the correct tax year and form number

- Enter your child's social security number or ITIN correctly

- Report all unearned income accurately

- Calculate the tax owed correctly

It's essential to note that Form 8615 has several schedules and worksheets that need to be completed accurately. If you're unsure about how to complete Form 8615, it's recommended that you seek the help of a tax professional.

What if I Make an Error on Form 8615?

If you make an error on Form 8615, you may be subject to penalties and interest. To avoid this, it's essential to review Form 8615 carefully before submitting it to the IRS. If you do make an error, you can amend Form 8615 by filing Form 1040X.

Tip 4: Attach Required Schedules and Worksheets

Form 8615 requires several schedules and worksheets to be attached. These include:

- Schedule 1: Unearned Income

- Schedule 2: Tax Computation

- Worksheet 1: Unearned Income Worksheet

- Worksheet 2: Tax Computation Worksheet

It's essential to attach all required schedules and worksheets to Form 8615 to avoid delays in processing your child's tax return.

What if I Don't Attach Required Schedules and Worksheets?

If you don't attach required schedules and worksheets, your child's tax return may be delayed or rejected. To avoid this, it's essential to review Form 8615 carefully and attach all required schedules and worksheets.

Tip 5: File Form 8615 on Time

Finally, it's essential to file Form 8615 on time. The deadline for filing Form 8615 is typically April 15th of each year. However, if your child's tax return is required to be filed by a different date, you should file Form 8615 by that date.

What if I Miss the Filing Deadline?

If you miss the filing deadline, you may be subject to penalties and interest. To avoid this, it's essential to file Form 8615 on time. If you're unable to file Form 8615 by the deadline, you can request an automatic six-month extension by filing Form 4868.

We hope these five essential tips for filling out IRS Form 8615 have been helpful. Remember to determine if your child needs to file Form 8615, gather all required documents, complete Form 8615 accurately, attach required schedules and worksheets, and file Form 8615 on time. By following these tips, you can ensure your child's tax obligations are met accurately and avoid errors and penalties.

What is IRS Form 8615?

+IRS Form 8615 is a tax form used to report the income of certain children under the age of 18, or under the age of 24 if a full-time student. The form is used to calculate the amount of tax owed on your child's unearned income, which includes dividends, capital gains, and interest.

Who needs to file Form 8615?

+Generally, if your child's unearned income exceeds $1,100, they will need to file Form 8615. However, there are some exceptions to this rule. For example, if your child's only income is from interest and dividends, and the total amount is less than $1,100, they may not need to file Form 8615.

What is considered unearned income?

+Unearned income includes income that is not earned through a job or self-employment. Examples of unearned income include dividends from stocks or mutual funds, capital gains from the sale of assets, interest from savings accounts or bonds, and royalties from intellectual property.