Mortgage interest can be a significant expense for homeowners, but it can also provide a valuable tax benefit. The Mortgage Interest Credit, also known as the Homebuyer Tax Credit, is a non-refundable tax credit available to eligible homeowners who have a mortgage on their primary residence. In this article, we will delve into the details of the Mortgage Interest Credit, including how to claim it on IRS Form 8396.

What is the Mortgage Interest Credit?

The Mortgage Interest Credit is a tax credit designed to help low-to-moderate-income homebuyers purchase or refinance a home. The credit is calculated as a percentage of the mortgage interest paid on a primary residence, and it can be claimed in addition to the mortgage interest deduction.

Eligibility Requirements

To be eligible for the Mortgage Interest Credit, you must meet the following requirements:

- You must be a homeowner with a mortgage on your primary residence.

- Your income must not exceed the limit set by the state or local government that issued the mortgage credit certificate (MCC).

- You must have obtained an MCC from the state or local government that issued the certificate.

- The MCC must be for a mortgage on your primary residence.

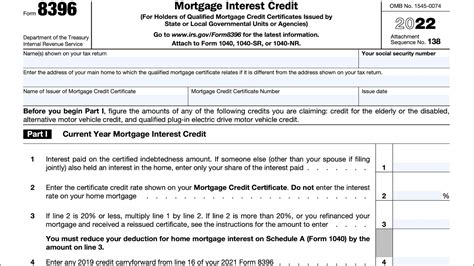

How to Claim the Mortgage Interest Credit on IRS Form 8396

To claim the Mortgage Interest Credit, you will need to complete IRS Form 8396, Mortgage Interest Credit. Here's a step-by-step guide to help you through the process:

- Gather required documents: You will need to gather the following documents:

- Your MCC (mortgage credit certificate)

- Your mortgage interest statement (Form 1098)

- Your tax return (Form 1040)

- Complete Form 8396: Complete Form 8396, making sure to enter the correct information from your MCC and mortgage interest statement.

- Calculate the credit: Calculate the credit using the instructions provided on Form 8396.

- Claim the credit: Claim the credit on your tax return (Form 1040) by reporting the credit amount on Line 54 of Schedule 3 (Form 1040).

Example of How to Calculate the Credit

Let's say you have a mortgage interest statement showing $10,000 in mortgage interest paid, and your MCC indicates that you are eligible for a 20% credit. Here's how you would calculate the credit:

- Multiply the mortgage interest paid by the credit percentage: $10,000 x 20% = $2,000

- Enter the credit amount on Form 8396: $2,000

- Claim the credit on your tax return: Report the credit amount on Line 54 of Schedule 3 (Form 1040)

Benefits of the Mortgage Interest Credit

The Mortgage Interest Credit provides several benefits to eligible homeowners, including:

- Increased tax savings: The credit can provide significant tax savings, especially for low-to-moderate-income homeowners.

- Reduced tax liability: The credit can reduce your tax liability, potentially resulting in a larger refund or lower tax bill.

- Increased purchasing power: The credit can increase your purchasing power by providing additional funds for a down payment or closing costs.

Common Mistakes to Avoid

When claiming the Mortgage Interest Credit, it's essential to avoid common mistakes that can delay or deny your credit. Here are some common mistakes to avoid:

- Incorrect MCC information: Make sure to enter the correct MCC information on Form 8396.

- Incorrect mortgage interest amount: Verify the mortgage interest amount on your mortgage interest statement (Form 1098).

- Failure to claim the credit: Don't forget to claim the credit on your tax return (Form 1040).

Conclusion

The Mortgage Interest Credit is a valuable tax benefit that can provide significant tax savings to eligible homeowners. By understanding the eligibility requirements, completing Form 8396 correctly, and avoiding common mistakes, you can claim the credit and reduce your tax liability.

We hope this article has provided you with a comprehensive understanding of the Mortgage Interest Credit and how to claim it on IRS Form 8396. If you have any questions or need further clarification, please don't hesitate to comment below.

What is the Mortgage Interest Credit?

+The Mortgage Interest Credit is a non-refundable tax credit available to eligible homeowners who have a mortgage on their primary residence.

How do I claim the Mortgage Interest Credit on IRS Form 8396?

+To claim the credit, complete Form 8396, making sure to enter the correct information from your MCC and mortgage interest statement. Then, claim the credit on your tax return (Form 1040) by reporting the credit amount on Line 54 of Schedule 3 (Form 1040).

What are the benefits of the Mortgage Interest Credit?

+The credit can provide significant tax savings, reduce tax liability, and increase purchasing power.