The IRS Form 6252, also known as the Installment Sale Income, is a crucial document for individuals and businesses that have entered into an installment sale agreement. This form is used to report the income from the sale of property, such as real estate, securities, or other assets, that is received in installments over a period of time. Completing the IRS Form 6252 accurately and on time is essential to avoid any penalties or fines. In this article, we will guide you through the 7 essential steps to complete the IRS Form 6252.

Understanding the IRS Form 6252

Before we dive into the steps to complete the form, it's essential to understand what the IRS Form 6252 is and who needs to file it. The form is used to report the income from an installment sale, which is a sale of property where the buyer pays the seller in installments over a period of time. This type of sale is often used for real estate transactions, but it can also be used for other types of assets, such as securities or equipment.

Who Needs to File the IRS Form 6252?

Not everyone who enters into an installment sale agreement needs to file the IRS Form 6252. The form is typically required for individuals and businesses that have entered into an installment sale agreement and have received payments from the buyer. This includes:

- Individuals who have sold real estate or other assets using an installment sale agreement

- Businesses that have sold assets, such as equipment or securities, using an installment sale agreement

- Partnerships and S corporations that have entered into an installment sale agreement

Step 1: Gather Required Information

Before you start filling out the IRS Form 6252, you need to gather all the required information. This includes:

- The date of the sale

- The amount of the sale

- The number of installments

- The amount of each installment

- The interest rate, if applicable

- The buyer's name and address

Where to Find the Required Information

You can find the required information in the installment sale agreement, which should include the terms of the sale, such as the amount of the sale, the number of installments, and the interest rate. You can also find the required information in the payment records, which should show the amount of each payment and the date it was received.

Step 2: Determine the Gain on the Sale

To complete the IRS Form 6252, you need to determine the gain on the sale. The gain on the sale is the amount of profit you made from the sale, which is calculated by subtracting the cost basis of the property from the amount of the sale.

How to Calculate the Gain on the Sale

To calculate the gain on the sale, you need to know the cost basis of the property, which is the original purchase price of the property plus any improvements or expenses. You can find the cost basis of the property in the installment sale agreement or in your records.

Step 3: Calculate the Installment Sale Income

Once you have determined the gain on the sale, you need to calculate the installment sale income. The installment sale income is the amount of income you receive from the sale each year, which is calculated by multiplying the gain on the sale by the number of installments.

How to Calculate the Installment Sale Income

To calculate the installment sale income, you need to multiply the gain on the sale by the number of installments. For example, if you sold a property for $100,000 and the gain on the sale is $50,000, and the buyer pays you $20,000 per year for 5 years, the installment sale income would be $10,000 per year.

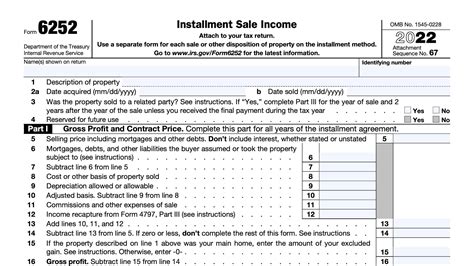

Step 4: Complete Part I of the IRS Form 6252

Part I of the IRS Form 6252 is used to report the gain on the sale and the installment sale income. You need to complete the following lines:

- Line 1: Date of sale

- Line 2: Amount of sale

- Line 3: Gain on the sale

- Line 4: Number of installments

- Line 5: Installment sale income

How to Complete Part I

To complete Part I, you need to enter the required information in the corresponding lines. For example, if you sold a property on January 1, 2022, for $100,000, and the gain on the sale is $50,000, and the buyer pays you $20,000 per year for 5 years, you would enter the following information:

- Line 1: January 1, 2022

- Line 2: $100,000

- Line 3: $50,000

- Line 4: 5

- Line 5: $10,000

Step 5: Complete Part II of the IRS Form 6252

Part II of the IRS Form 6252 is used to report the payments received from the buyer. You need to complete the following lines:

- Line 6: Payments received from buyer

- Line 7: Interest income from buyer

How to Complete Part II

To complete Part II, you need to enter the required information in the corresponding lines. For example, if you received $20,000 from the buyer in 2022, and $20,000 in 2023, you would enter the following information:

- Line 6: $20,000 (2022)

- Line 6: $20,000 (2023)

- Line 7: $0 (if there is no interest income)

Step 6: Calculate the Tax Liability

Once you have completed Part I and Part II of the IRS Form 6252, you need to calculate the tax liability. The tax liability is the amount of taxes you owe on the installment sale income.

How to Calculate the Tax Liability

To calculate the tax liability, you need to multiply the installment sale income by the tax rate. For example, if the installment sale income is $10,000, and the tax rate is 24%, the tax liability would be $2,400.

Step 7: File the IRS Form 6252

Finally, you need to file the IRS Form 6252 with the IRS. You can file the form electronically or by mail.

How to File the IRS Form 6252

To file the IRS Form 6252 electronically, you can use the IRS e-file system. To file the form by mail, you need to send it to the IRS address listed in the instructions.

What is the IRS Form 6252?

+The IRS Form 6252 is used to report the income from an installment sale agreement.

Who needs to file the IRS Form 6252?

+Individuals and businesses that have entered into an installment sale agreement and have received payments from the buyer need to file the IRS Form 6252.

What is the deadline to file the IRS Form 6252?

+The deadline to file the IRS Form 6252 is the same as the deadline to file your tax return.

In conclusion, completing the IRS Form 6252 requires careful attention to detail and a thorough understanding of the installment sale agreement. By following these 7 essential steps, you can ensure that you complete the form accurately and on time, avoiding any penalties or fines.