Maryland Form 548, also known as the "Amended Income Tax Return" form, is a crucial document for individuals and businesses in Maryland who need to make changes to their previously filed income tax returns. Whether you're a resident, non-resident, or business owner in Maryland, understanding the ins and outs of this form is vital to ensure you're meeting your tax obligations. Here are six essential facts about Maryland Form 548 that you need to know.

Maryland Form 548 is used to amend a previously filed income tax return, which means it's used to correct errors, report additional income, or claim additional deductions and credits. This form is typically used when you need to make changes to your original return, such as correcting mathematical errors, reporting additional income, or claiming additional deductions and credits. By filing an amended return, you can ensure that your tax liability is accurate and up-to-date.

Eligibility to File Maryland Form 548

To be eligible to file Maryland Form 548, you must have previously filed a Maryland income tax return, either as an individual or a business. This includes residents, non-residents, and businesses that have filed a Maryland tax return in the past. Additionally, you must have a valid reason for filing an amended return, such as correcting an error or reporting additional income.

Reasons for Filing Maryland Form 548

There are several reasons why you may need to file Maryland Form 548. These include:

- Correcting mathematical errors or discrepancies on your original return

- Reporting additional income that was not included on your original return

- Claiming additional deductions and credits that you're eligible for

- Changing your filing status or dependents

- Reporting changes to your business income or expenses

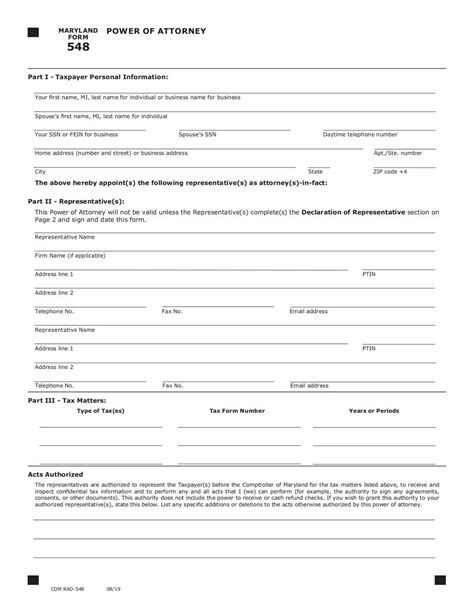

How to File Maryland Form 548

Filing Maryland Form 548 is a relatively straightforward process. Here are the steps you need to follow:

- Download and complete Maryland Form 548 from the Comptroller of Maryland's website or through a tax preparation software.

- Gather all necessary documentation, including your original tax return, supporting documentation for changes, and any additional forms or schedules.

- Complete the form, making sure to include all required information and supporting documentation.

- Submit the form to the Comptroller of Maryland, either by mail or electronically.

Deadlines for Filing Maryland Form 548

The deadline for filing Maryland Form 548 varies depending on your situation. Generally, you have three years from the original filing deadline to file an amended return. For example, if you filed your original return on April 15, 2022, you have until April 15, 2025, to file an amended return. However, if you're filing an amended return to claim a refund, you have two years from the original filing deadline.

Penalties for Not Filing Maryland Form 548

If you fail to file Maryland Form 548 when required, you may be subject to penalties and interest. These can include:

- Late-filing penalty: 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%

- Late-payment penalty: 0.5% of the unpaid tax for each month or part of a month, up to a maximum of 25%

- Interest on unpaid tax: calculated from the original filing deadline

Additional Resources

If you need help with filing Maryland Form 548, there are several resources available:

- Comptroller of Maryland's website: provides instructions, forms, and FAQs

- Tax preparation software: many software programs, such as TurboTax or H&R Block, offer guidance and support for filing amended returns

- Tax professionals: consider consulting a tax professional or accountant for personalized assistance

By understanding these essential facts about Maryland Form 548, you can ensure that you're meeting your tax obligations and avoiding potential penalties. Remember to file your amended return accurately and on time to avoid any issues.

If you have any further questions or concerns about Maryland Form 548, please don't hesitate to comment below. We'll do our best to provide additional guidance and support. Additionally, be sure to share this article with anyone who may benefit from this information.

What is Maryland Form 548 used for?

+Maryland Form 548 is used to amend a previously filed income tax return, which means it's used to correct errors, report additional income, or claim additional deductions and credits.

Who is eligible to file Maryland Form 548?

+To be eligible to file Maryland Form 548, you must have previously filed a Maryland income tax return, either as an individual or a business.

What are the deadlines for filing Maryland Form 548?

+The deadline for filing Maryland Form 548 varies depending on your situation. Generally, you have three years from the original filing deadline to file an amended return.