The Internal Revenue Service (IRS) requires businesses to file various forms to report their tax obligations and compliance. One such form is the IRS Form 3551, also known as the "Information Returns and Wage Statements". This form is used by employers to report wages, tips, and other compensation paid to employees, as well as to report taxes withheld and paid. However, filling out this form correctly can be a daunting task, especially for small businesses or those new to tax compliance.

Filling out IRS Form 3551 correctly is crucial to avoid errors, penalties, and delays in processing. In this article, we will provide you with 5 tips to help you fill out the form correctly and ensure that your business remains compliant with IRS regulations.

Understanding the Purpose of IRS Form 3551

Before we dive into the tips, it's essential to understand the purpose of IRS Form 3551. This form is used by employers to report the following:

- Wages, tips, and other compensation paid to employees

- Taxes withheld from employee wages, including federal income tax, Social Security tax, and Medicare tax

- Taxes paid by the employer, including federal unemployment tax (FUTA) and state unemployment tax

Employers are required to file this form annually, typically by January 31st of each year, for the previous tax year.

Tip 1: Gather All Necessary Information

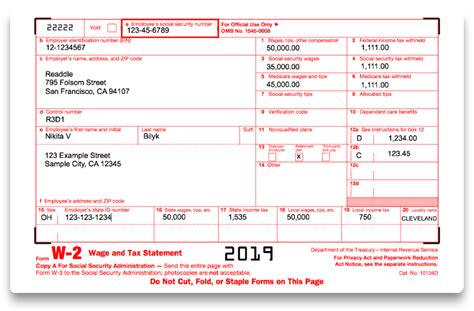

To fill out IRS Form 3551 correctly, you'll need to gather all necessary information about your employees, their compensation, and taxes withheld and paid. This includes:

- Employee identification information, such as name, address, and Social Security number

- Wage and compensation information, including gross wages, tips, and other compensation

- Tax withholding information, including federal income tax, Social Security tax, and Medicare tax

- Tax payment information, including FUTA and state unemployment tax

Make sure to have all this information readily available before starting to fill out the form.

Additional Requirements for Certain Employees

If you have employees who are subject to special tax rules, such as non-resident aliens or employees who receive tips, you'll need to provide additional information. For example, you may need to report tips received by employees and allocate them to the correct employees.

Tip 2: Use the Correct Form and Instructions

The IRS provides a separate instruction booklet for Form 3551, which includes detailed instructions on how to complete the form. Make sure to use the correct form and instructions for the tax year you're reporting.

Additionally, the IRS often updates the form and instructions, so ensure you're using the latest version. You can download the form and instructions from the IRS website or order them by phone or mail.

Tip 3: Report All Wages and Compensation Correctly

When reporting wages and compensation, make sure to include all types of compensation, including:

- Gross wages and salaries

- Tips and gratuities

- Bonuses and commissions

- Fringe benefits, such as health insurance and retirement plans

You'll also need to report any adjustments to wages, such as retroactive pay increases or decreases.

Special Reporting Requirements for Certain Types of Compensation

Certain types of compensation, such as non-cash fringe benefits or taxable benefits, may require special reporting. For example, you may need to report the value of employer-provided vehicles or other non-cash benefits.

Tip 4: Report Taxes Withheld and Paid Correctly

When reporting taxes withheld and paid, make sure to include all types of taxes, including:

- Federal income tax withheld

- Social Security tax withheld

- Medicare tax withheld

- FUTA and state unemployment tax paid

You'll also need to report any adjustments to taxes withheld or paid, such as corrections to prior-year returns.

Special Reporting Requirements for Certain Types of Taxes

Certain types of taxes, such as backup withholding or withholding on non-cash compensation, may require special reporting. For example, you may need to report backup withholding on non-cash compensation, such as stock options or restricted stock units.

Tip 5: Double-Check Your Math and Accuracy

Finally, double-check your math and accuracy before submitting the form. Errors or inaccuracies can delay processing, trigger penalties, and even lead to audits.

Make sure to review the form carefully, checking for errors in:

- Employee identification information

- Wage and compensation reporting

- Tax withholding and payment reporting

- Math calculations

Conclusion and Next Steps

Filling out IRS Form 3551 correctly is crucial to avoid errors, penalties, and delays in processing. By following these 5 tips, you can ensure that your business remains compliant with IRS regulations and avoids costly mistakes. Remember to gather all necessary information, use the correct form and instructions, report all wages and compensation correctly, report taxes withheld and paid correctly, and double-check your math and accuracy.

If you're unsure about any aspect of the form or need additional guidance, consider consulting with a tax professional or contacting the IRS directly.

What is the purpose of IRS Form 3551?

+IRS Form 3551 is used by employers to report wages, tips, and other compensation paid to employees, as well as to report taxes withheld and paid.

What types of compensation must be reported on Form 3551?

+All types of compensation must be reported, including gross wages and salaries, tips and gratuities, bonuses and commissions, and fringe benefits.

What types of taxes must be reported on Form 3551?

+All types of taxes must be reported, including federal income tax withheld, Social Security tax withheld, Medicare tax withheld, and FUTA and state unemployment tax paid.